In 2017 my

Website was migrated to the clouds and reduced in size.

Hence some links below are broken.

Contact me at

rjensen@trinity.edu if you really need to file that is missing.

Greetings from the White Mountains on March

3, 2009

This morning it's down around zero with

slightly less than a foot of new snow.

Yesterday we had a blizzard with howling winds from the southeast that shifted

to the north.

When the winds shift north we watch our thermometer head south.

My mailbox generally looks like this in March.

Below is our Lafayette Road that leads down to Franconia

There was not quite as much snow when I took the picture below.

It's been a great winter for the ski resorts

up here.

I can watch tiny dots move down some of

Cannon Mountain's Ski Trails

I took the picture below zoomed and then took an unzoomed sunset picture.

Below is a picture pointed east showing the

lighting that sometimes takes place at sunset.

Lafayette is the highest mountain but the ski trails belong to Cannon Mountain.

Down the road a neighbor hauled in two

discarded ski ski gondolas from the Killington Ski Resort

To the right is the Sugar Hill Sampler and Museum

I previously featured two businesses in

Sugar Hill (Harman's General Store and Polly's Pancake Parlor)

Last but not least is the Sugar Hill Sampler and Museum about a half mile down

our road.

The Sampler is an old barn that is really a nice store inside as well as a

museum of our village.

Barbara Zarafini owns the Sampler.

Her family is one of the native families that once owned much land on Sunset Hill

where I live

Barbara and her family still own quite a lot of land up here, including some

great Lupine fields.

The picture below was taken before the gondolas were moved in.

In 2004

the temperature dropped as low as -40F while temperatures on the summit of Mt.

Washington that we view from our living room plummeted over -100F. The

Sampler's owner, Barbara Zarafini, down the way invited us to a dinner party.

In the course of the conversation Barbara mentioned out a maiden lady named Miss

Cornell (the granddaughter of the founder of Cornell University) used to live in

the Zarafini log house. What was memorable was how Mrs. Cornell's teeth were

occasionally frozen in the glass beside her bed. In the past two years it's not

been down to -40F. I guess that's global warming's fault.

The Sampler's Home Page is at

http://www.sugarhillsampler.com/

The Sugar Hill Sampler is a unique shopping experience & family

museum in one, thoughtfully displayed in an historic barn built by the first

permanent settler to this site c.1790. Visitors come from far and wide each

year to browse, visit our museum, sample our homemade products and enjoy the

famous mountain view. The museum is in the back of the barn and in the

basement. The Sampler is closed for a few winter months.

How frustrating it is to watch newspaper after

newspaper stop the presses and terminate the news reporters and foreign

correspondents. It is said that the newspapers have an outdated business model

now that we have the Internet and millions of blogs for the news. But most

bloggers like myself don't caution out to dangerous streets, sit through boring

town meetings, watch court trials in action, or wearily track down original

sources. We rely on the newspaper reporters, many of whom are now standing in unemployment

lines. Thriving television stations have very few reporters relative to the many

failing newspapers in this land.

Who will report the news on the streets and

expose the thieves in our 51

main legislatures?

Tidbits on March 3, 2009

Bob Jensen

For earlier editions of Tidbits go to

http://faculty.trinity.edu/rjensen/TidbitsDirectory.htm

For earlier editions of New Bookmarks go to

http://faculty.trinity.edu/rjensen/bookurl.htm

Click here to search Bob Jensen's web site if you have key words to enter ---

Search Site.

For example if you want to know what Jensen documents have the term "Enron"

enter the phrase Jensen AND Enron. Another search engine that covers Trinity and

other universities is at

http://www.searchedu.com/.

Bob Jensen's past presentations and lectures

---

http://faculty.trinity.edu/rjensen/resume.htm#Presentations

Bob Jensen's Threads ---

http://faculty.trinity.edu/rjensen/threads.htm

Bob Jensen's Home Page is at

http://faculty.trinity.edu/rjensen/

CPA

Examination ---

http://en.wikipedia.org/wiki/Cpa_examination

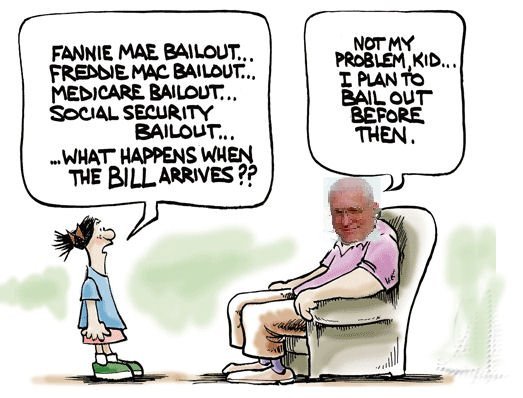

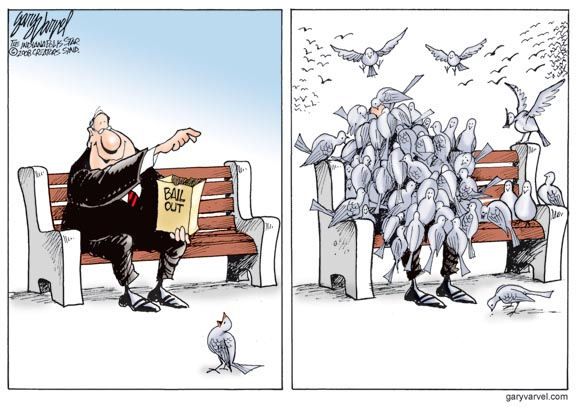

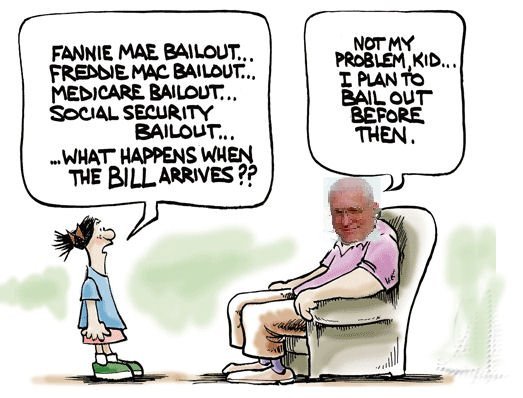

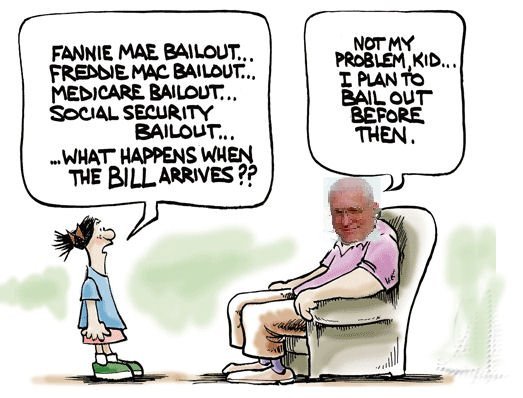

Bob Jensen's essay on the financial crisis bailout's aftermath and an alphabet soup of

appendices can be found at

http://faculty.trinity.edu/rjensen/2008Bailout.htm

On May 14, 2006 I retired from Trinity University after a long

and wonderful career as an accounting professor in four universities. I was

generously granted "Emeritus" status by the Trustees of Trinity University. My

wife and I now live in a cottage in the White Mountains of New Hampshire ---

http://faculty.trinity.edu/rjensen/NHcottage/NHcottage.htm

Bob Jensen's blogs and various threads on many topics ---

http://faculty.trinity.edu/rjensen/threads.htm

(Also scroll down to the table at

http://faculty.trinity.edu/rjensen/ )

Global Incident Map ---

http://www.globalincidentmap.com/home.php

Set up free conference calls at

http://www.freeconference.com/

Also see

http://www.yackpack.com/uc/

U.S. Social Security Retirement

Benefit Calculators ---

http://www.socialsecurity.gov/estimator/

After 2017 what we would really like is a choice between our full social

security benefits or 18 Euros each month ---

http://faculty.trinity.edu/rjensen/Entitlements.htm

Free Online Tutorials in Multiple Disciplines ---

http://faculty.trinity.edu/rjensen/Bookbob2.htm#Tutorials

Chronicle of Higher Education's 2008-2009

Almanac ---

http://chronicle.com/free/almanac/2008/?utm_source=at&utm_medium=en

Bob Jensen's threads on higher education controversies ---

http://faculty.trinity.edu/rjensen/HigherEdControversies.htm

Bob Jensen's threads on economic and social statistics ---

http://faculty.trinity.edu/rjensen/Bookbob1.htm#EconStatistics

World Clock ---

http://www.peterussell.com/Odds/WorldClock.php

Tips on computer and networking

security ---

http://faculty.trinity.edu/rjensen/ecommerce/000start.htm

Many useful accounting sites (scroll down) ---

http://www.iasplus.com/links/links.htm

If you want to help our badly injured troops, please check out

Valour-IT: Voice-Activated Laptops for Our Injured Troops ---

http://www.valour-it.blogspot.com/

Free Online Textbooks, Videos, and Tutorials ---

http://faculty.trinity.edu/rjensen/ElectronicLiterature.htm#Textbooks

Free Tutorials in Various Disciplines ---

http://faculty.trinity.edu/rjensen/Bookbob2.htm#Tutorials

Edutainment and Learning Games ---

http://faculty.trinity.edu/rjensen/000aaa/thetools.htm#Edutainment

Open Sharing Courses ---

http://faculty.trinity.edu/rjensen/000aaa/updateee.htm#OKI

Online Video, Slide Shows, and Audio

In the past I've provided links to various types of music and video available

free on the Web.

I created a page that summarizes those various links ---

http://faculty.trinity.edu/rjensen/music.htm

Born Again in America ---

http://www.bornagainamerican.org/

The T-Mobile Dance in a London Train

Station ---

http://www.youtube.com/watch?v=VQ3d3KigPQM

Hulu TV and Movies ---

http://www.hulu.com/

Church Anniversary Dance ---

http://www.blackbottom.com/watch.php?v=BdXxuqt6rtt

American Cinema (video) ---

http://www.learner.org/resources/series67.html

2009 AICPA Video on Career Opportunities for CPAs ---

http://link.brightcove.com/services/player/bcpid1716442239

Expo 67 (world's fairs) ---

http://www.collectionscanada.gc.ca/expo/index-e.html

National Marine Sanctuaries Media Library ---

https://marinelife.noaa.gov/media_lib/index.aspx

Women Deans of Business Schools ---

http://www.businessweek.com/bschools/content/feb2009/bs20090220_540066.htm

Vatican City State ---

http://www.vaticanstate.va/EN/homepage.htm

Celebrate Diversity with Dream in Color

---

http://www.scholastic.com/dreamincolor/africanamericanheritage/index.htm

The Whisperers:

Private Life in Stalin's Russia ---

http://www.orlandofiges.com/

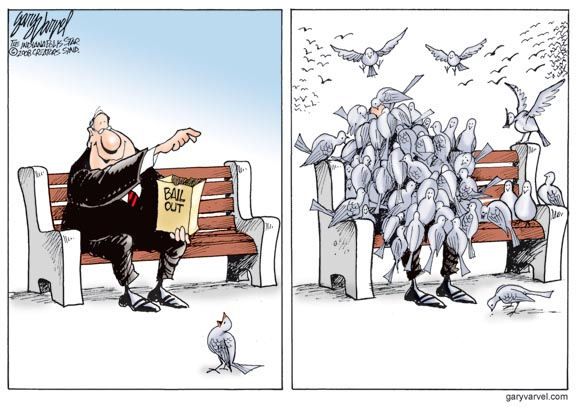

Rep. Manzullo Questions Bailout Czar Neel Kashkari (Watch a

Butt Get Chewed Out) ---

http://www.youtube.com/watch?v=UP73cK3GXdo

Bob Jensen's threads on outrageous executive compensation ---

http://faculty.trinity.edu/rjensen/FraudConclusion.htm#OutrageousCompensation

Jane Fonda's Broadcasts on Radio Hanoi (audio) ---

http://www.wintersoldier.com/index.php?topic=FondaHanoi

Free music downloads ---

http://faculty.trinity.edu/rjensen/music.htm

Music and the Brain [iTunes]

http://www.loc.gov/podcasts/musicandthebrain/index.html

Ben Kweller's Country Makeover, In Performance

---

http://www.npr.org/templates/story/story.php?storyId=101302481

Monk At Town Hall: Five Decades Of Jazz Lore

---

http://www.npr.org/templates/story/story.php?storyId=101247362

TheRadio (my favorite commercial-free

online music site) ---

http://www.theradio.com/

Slacker (my second-favorite commercial-free online music site) ---

http://www.slacker.com/

Gerald Trites likes this

international radio site ---

http://www.e-radio.gr/

Songza:

Search for a song or band and play the selection ---

http://songza.com/

Also try Jango ---

http://www.jango.com/?r=342376581

Sometimes this old guy prefers the jukebox era (just let it play through) ---

http://www.tropicalglen.com/

And I listen quite often to Soldiers Radio Live ---

http://www.army.mil/fieldband/pages/listening/bandstand.html

Also note U.S. Army Band recordings

---

http://bands.army.mil/music/default.asp

Bob Jensen listens to music free online (and no commercials)

---

http://www.slacker.com/

Photographs and Art

Elements of Architecture ---

http://exhibits.slpl.org/steedman/elements.asp

World Architecture Community ---

http://www.worldarchitecture.org/main/

America's Favorite Architecture ---

http://www.favoritearchitecture.org/

The Alfred Whital Stern Collection of Lincolniana

---

http://memory.loc.gov/ammem/collections/stern-lincoln/

Becoming Edvard Munch: Influence, Anxiety, and

Myth ---

http://www.artic.edu/aic/collections/exhibitions/Munch/index

Museum of Biblical Art (video) ---

http://www.mobia.org/index.php

Eisenhower National Historic Site ---

http://www.nps.gov/history/museum/exhibits/eise/index.html

Umbrella 1978-2005 (art Journal) ---

http://indiamond6.ulib.iupui.edu/umbrella/

Captured Emotions: Baroque Painting in Bologna,

1575-1725 ---

http://www.getty.edu/art/exhibitions/captured_emotions/

Was he pointing it at the Catholic Church? ---

Click Here

The digit will be part of a landmark exhibition marking the 400th anniversary of

his first observations of the skies.

The finger – the middle digit from Galileo's right hand – is mounted on a marble

base and encased in a crystal jar.

Online Books, Poems, References, and Other Literature

In the past I've provided links to various

types electronic literature available free on the Web.

I created a page that summarizes those various links ---

http://faculty.trinity.edu/rjensen/ElectronicLiterature.htm

Cotsen Children's Library: Virtual Children's Books Exhibits

---

http://library.princeton.edu/libraries/cotsen/exhibitions/index.html

One More Story is an interactive online library for children

---

http://www.onemorestory.com/

Public.Resource.Org ---

http://public.resource.org/

Charles Olson's Melville Project ---

http://charlesolson.uconn.edu/Works_in_the_Collection/Melville_Project/index.htm

The Nuclear Vault: U.S. Nuclear Detection and

Counterterrorism, 1998- 2009 ---

http://www.gwu.edu/~nsarchiv/nukevault/ebb270/index.htm

Folger Shakespeare Library ---

http://folger.edu/index.cfm

Shakespeare's Staging ---

http://shakespeare.berkeley.edu/

Arden: World of William Shakespeare ---

http://swi.indiana.edu/arden/gi_specs.shtml

SOURCETEXT.com (with much emphasis on Shakespeare)

A home for specialized, reason-provoking texts that appeal to the

eternally curious and to those who value wit and character ---

http://www.sourcetext.com/

Literary Locales (from the English Department at

San Jose State University) ---

http://www2.sjsu.edu/depts/english/places.htm

National Yiddish Book Center ---

http://www.yiddishbookcenter.org/

Free Online Textbooks, Videos, and Tutorials ---

http://faculty.trinity.edu/rjensen/ElectronicLiterature.htm#Textbooks

Free Tutorials in Various Disciplines ---

http://faculty.trinity.edu/rjensen/Bookbob2.htm#Tutorials

Edutainment and Learning Games ---

http://faculty.trinity.edu/rjensen/000aaa/thetools.htm#Edutainment

Open Sharing Courses ---

http://faculty.trinity.edu/rjensen/000aaa/updateee.htm#OKI

Message from Bob Jensen on March 3, 2009

Hi Robin,

Tom Selling is correct. I’m sorry I forwarded this banking crisis explanation

depicting the failing homeowners as alcoholics in Heidi's Bar. It’s very bitter

and equates the people behind on their mortgages to alcoholics intent on

screwing taxpayers. Most were merely sober hopefuls at the racetrack.

Certainly there were many borrowers who conspired with crooked brokers when

refinancing their houses for far more than the house would ever be worth. A

typical scam was Marvene’s scam in Arizona. Marvene’s been in a few bars and has

an income of about $3,000 a month from welfare programs, food stamps and

disability payments related to a back injury. Marvene got in with a crooked

lender called “Integrity” that loaded her up on credit of $75,500 knowing full

well that Marvene could never repay. Marvene got her big luxury truck, her new

electronics, and financed the drug habit of her son. Marvene knew she could

never repay Integrity from her monthly income.

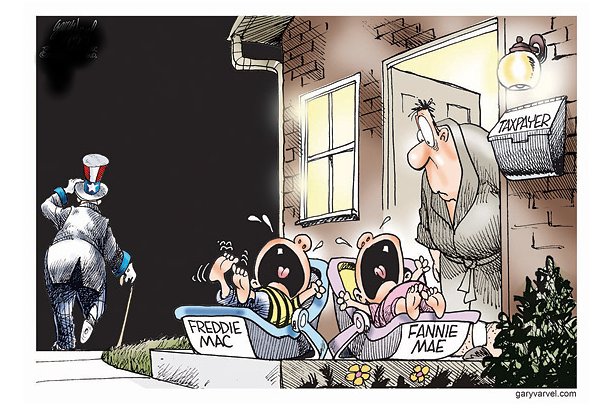

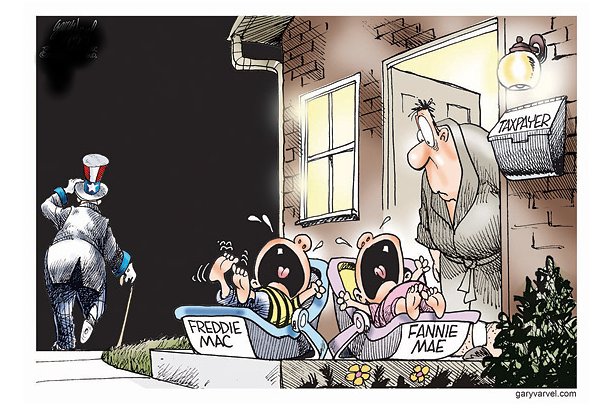

Integrity’s CEO Barry Rybicki and his loan officer, however, had a plan from the

start. They never laid eyes on Marvene’s shack but brokered a $103,000 mortgage

on her shack that neighbors ultimately bought in foreclosure for $10,000 and

tore down because it was such an eyesore. The 107 mortgages that Integrity sold

for $47 million included Marvene’s adjustable rate mortgage. Fannie Mae and

Freddie Mack were forced by Rep. Barney Frank and Sen. Chris Dodd to buy up

mortgages of poor people like Marvene. Of course Integrity, Fannie, and Freddie

knew full well that mortgages like these would never be repaid --- but that was

the big game in town in the subprime era.

You can read about Marvene’s case and see pictures at

http://faculty.trinity.edu/rjensen/FraudMarvene.htm

At the time her shack was still for sale for $15,000 in foreclosure.

Marvene is not an innocent. She’s dumb like a fox in playing the games (read

that government) offered to her in life.

What was wrong about the credit crisis story below is that it equates the credit

crisis with the Marvenes of this world. Sure there were over a million of

Marvenes. But there were also millions of Nelson families (if

you’re old enough you remember little Rick Nelson and his mother Harriet on

television) of middle or upper class means that were conned by unscrupulous

mortgage brokers to get spendable cash by refinancing with subprime adjustable

rate mortgages on homes valued at $200,000 or more. Often it was the mortgage

brokers who lied about their incomes and home values in order to get them to

sign huge mortgages. The Nelsons were honest and law abiding citizens. They were

good family folks that we call yuppies who really believed that their incomes

would increase in time to pay the eventual kick-up in mortgage rates. If their

incomes were not sufficient increased to pay the eventual increase in mortgage

payments, they just assumed real estate values always went up such that they

could sell their home for well above their loan balance and still come out

ahead.

But the real estate market bubble burst!

Harriet Nelson and Marvene are not at all alike.

Harriet Nelson and her loving husband Ozzie defaulted on their subprime

mortgage just like millions of other Nelson-like church-going families defaulted

on their mortgages. These were not alcoholics sitting in bars drinking up

taxpayer money.

Now we move up the ladder of shame. I honestly believe that Rep. Barney Frank

and Sen. Chris Dodd never suspected the real estate bubble would burst. They

were not as street smart as they like to pretend and did not anticipate that

Main Street mortgage brokers would cheat so drastically when submitting lies

about borrower incomes and home values. More importantly, Frank and Dodd, like

the Nelson family, assumed that the odds were 100% that the real estate boom

would never burst.

And those investment banks on Wall Street and other banks made the same

assumption that real estate was better than gold since they had watched their

own homes go up as much as ten times what they paid for them only a few years

back. Sure they knew that there are always loan foreclosures and the odds of

foreclosure were higher with subprime mortgages. But they assumed that they

could diversify this foreclosure risk in

Markowitz-based mathematical models that diversified risk. They let Fannie

and Freddie get stuck with the hopeless Marvene-type mortgages. But they bought

up Nelson-type mortgage cookies and then crumbled the cookies into CDO bonds in

anticipation that a few spoiled crumbs in a CDO bond would not make the entire

bond toxic. And they would’ve been correct if the real estate bubble had not

burst!

The legal and moral issues here concern intention of fraud. Barry Rybicki at

Integrity is an outright crook! Marvene is a willing cheat when given a chance.

The Nelsons simply took what looked like a pretty good gamble. The Harvard and

Wharton graduates at Lehman Brothers and other Wall Street firms violated their

responsibilities to their companies and shareholders by creating trillions upon

trillions of CDO cookie crumble bonds that they probably knew were building up

into too much risk in one type of business. But they badly wanted their

commissions and bonuses and fees that they got for each new CDO bag of crumbles

they sold.

Hence, Robin, the only people sitting Heidi’s bar were Marvene, Barry Rybicki,

and some greedy Harvard and Wharton alumni willing to drink up shareholder

value. The millions of Nelson families, Barney Frank, Chris Dodd, and even some

bank CEOs made what they thought were good bets that were totally wiped out when

the real estate market imploded. They were not in Heidi’s bar at the time. They

were at the racetrack.

The Economic Crisis Created a Perfect Storm for Progressives in Congress

Speaking of race tracks, we at last come to the U.S. Congress after the 2008

election. Democrats have monopoly power and most of them are progressives with

good intentions. They reason that if the U.S. could afford to wage war in Iraq

it can afford free education, training, and health care for over 300 million

U.S. citizens and unknown millions of pretenders living in the United States.

The banking crisis along with the economic crash (I still don’t think it’s an

economic depression) afford the monopolist progressives an excuse to more than

double the booked National Debt of $10 trillion today to about $20 trillion by

2012. Worse the unbooked entitlements OBSF of about $60 trillion today will jump

to about $100 trillion by 2012.

What's great about the Recovery Act and the trillions that will be spent in

ensuing deficit budgets is that hundreds of millions of people in the U.S. will

eventually get free education, training, and health care. Housing will be a

whole lot cheaper and the government will pay out trillions of dollars to keep

homeowners from losing their homes. If it sounds too good to be true, it

probably is too good to be true.

The new healthy graduates with their free training and education will be like

dead atheists in open coffins. They’ll be all dressed up with no place to go.

Congress is creating public works job opportunities while destroying career

opportunities. The reason is that the progressives, with all their good

intentions, will have placed trillions of stimulus money into part-time laboring

jobs like road building that are physically demanding and not at all suited for

people with career aspirations. Only so many can work in the health care and

education fields, and careers there will become pretty low paying due to the

need to minimize the cost of free health and education services and rationing.

Prosperous businesses create career opportunity growth. Congress at present is

destroying business opportunity. It is only creating government work

opportunity. Paul Williams cringes at thinking of his university as a socialist

organization owned and operated by government. By whatever name it’s owned and

managed by the government and it’s principle service graduates students into the

working world. I would like this to be a business world with career

opportunities. Yes I know that he will counter this by saying that for the past

four decades business has depended upon government in one way or another for its

prosperity, often with subsidies in one form or another. But until George W.

Bush went to war and could not say no to Congress on progressive spending

programs like the Medicare Drug Plan, the National Debt was only $6 trillion and

entitlements were perhaps around $30 trillion. Virtually all college graduates

had career hopes and most of these were hopes for careers in some type of

business or profession.

Compare this with a National Debt load of $20 trillion and unbooked OBSF

entitlements of $100 trillion. There’s no hope of carrying such booked and

unbooked debt without resorting to the Abraham Lincoln School of Finance (see

Honest Abe’s quote below). Career aspirations in most disciplines are shrinking

to near nothing.

A democracy cannot exist as a

permanent form of government. It can only exist until the voters discover that

they can vote themselves largesse from the public treasury. From that moment on,

the majority always votes for the candidates promising the most benefits from

the public treasury, with the result that a democracy always collapses over

loose fiscal policy, always followed by a dictatorship.

Alexander Tyler. 1787 - Tyler was a Scottish history professor that had

this to say about 2000 years after "The Fall of the Athenian Republic" and about

the time our original 13 states adopted their new constitution.

As quoted at

http://www.babylontoday.com/national_debt_clock.htm (where the debt clock in

real time is a few months behind)

The National Debt Amount This Instant (Refresh

your browser for updates by the second) ---

http://www.brillig.com/debt_clock/

America, what is happening to you?

“One thing seems probable to me,” said Peer

Steinbrück, the German finance minister, in September 2008....“the United States

will lose its status as the superpower of the global financial system.” You

don’t have to strain too hard to see the financial crisis as the death knell for

a debt-ridden, overconsuming, and underproducing American empire . . .

Richard Florida,

"How the Crash Will Reshape America," The Atlantic, March 2009 ---

http://www.theatlantic.com/doc/200903/meltdown-geography

The inherent vice of capitalism is the unequal

sharing of the blessings. The inherent blessing of socialism is the equal

sharing of misery.

Winston Churchill

(Good thing Obama sent Churchill's bust back to the U.K. from the Oval Office

and replaced it with a bust of Lincoln who wrote that Government should print

all the money it needs without borrowing)

From the Abraham Lincoln School of Finance

The government should create, issue, and circulate all the currency and credits

needed to satisfy the spending power of the government and the buying power of

consumers. By adoption of these principles, the taxpayers will be saved immense

sums of interest. Money will cease to be master and become the servant of

humanity.

Abraham Lincoln

(I wonder why this just does not work in Zimbabwe where Robert Mugabe adopted

Lincoln's fiscal policy?)

Bob Jensen

From:

AECM, Accounting Education using Computers and Multimedia [mailto:AECM@LISTSERV.LOYOLA.EDU]

On Behalf Of Alexander Robin A

Sent: Monday, March 02, 2009 8:30 PM

To: AECM@LISTSERV.LOYOLA.EDU

Subject: Re: Bank Crisis explained

Ok,

please elaborate.

Robin A

From:

Tom Selling

Sent: Sun 3/1/2009 6:19 PM

To: AECM@LISTSERV.LOYOLA.EDU

Subject: Re: Bank Crisis explained

This is not

a “simple” explanation; it is dangerously simplistic, and obviously written

by someone with an ax to grind. I would feel sorry for the students who

were fed this CRAP.

Tom Selling

From:

AECM, Accounting Education using Computers and Multimedia [mailto:AECM@LISTSERV.LOYOLA.EDU]

On Behalf Of Jensen, Robert

Sent: Sunday, March 01, 2009 4:11 AM

To: AECM@LISTSERV.LOYOLA.EDU

Subject: FW: Bank Crisis explained

Forwarded by a close friend.

They

keep trying to make it sound complicated but it's really very simple!

Even your students will understand now.

Bank Crisis in Terms Understood

Heidi

is the proprietor of a bar in Washington, DC. In order to increase sales and

comply with CRAP (Community Reinvestment Act Program reinforced by

Socialist Progressive Congressmen),

she decides to allow her loyal customers - most of whom are unemployed

alcoholics - to drink now but pay later. She keeps track of the drinks

consumed on a ledger (thereby granting the customers loans).

Word gets around and as a result increasing numbers of customers flood into

Heidi's bar.

Taking advantage of her customers' freedom from immediate payment

constraints, Heidi increases her prices for wine and beer, the most-consumed

beverages. Her sales volume increases massively.

A young and dynamic customer service consultant at the local bank recognizes

these customer debts as valuable future assets and increases Heidi's

borrowing limit.

He sees no reason for undue concern since he has the debts of the alcoholics

as collateral.

At the bank's corporate headquarters, expert bankers transform these

customer assets into DRINKBONDS, ALKBONDS and PUKEBONDS. These securities

are then traded on markets worldwide. No one really understands what these

abbreviations mean and how the securities are guaranteed. Nevertheless, as

their prices continuously climb, the securities become top-selling items.

One day, although the prices are still climbing, a risk manager

(subsequently of course fired due his negativity) of the bank decides that

slowly the time has come to demand payment of the debts incurred by the

drinkers at Heidi's bar.

However they cannot pay back the debts.

Heidi cannot fulfill her loan obligations and claims bankruptcy.

DRINKBOND and ALKBOND drop in price by 95 %. PUKEBOND performs better,

stabilizing in price after dropping by 90 %.

The suppliers of Heidi's bar, having granted her generous payment due dates

and having invested in the securities are faced with a new situation. Her

wine supplier claims bankruptcy, her beer supplier is taken over by a

competitor.

The bank is saved by the Government following dramatic round-the-clock

consultations by leaders from the governing political parties.

The funds required for this purpose are obtained by a tax levied on the

non-drinkers.

Finally an explanation I understand...

Charles B. Reed, chancellor of the California State

University system, explains why he wants the federal government to provide

billions of dollars in direct aid to four-year colleges, based on the number of

students they enroll who are eligible for Pell Grants or who are from

underrepresented minority groups.

"To Reach Obama's Goal, Colleges Should Get Billions From U.S., Cal State Chief

(Video)," Chronicle of Higher Education, March 2009 ---

http://chronicle.com/media/audio/v55/i26/reed/?utm_source=at&utm_medium=en

Jensen Comment

The new graduates with their free training and education will be like dead

atheists in open coffins. They’ll be all dressed up with no place to go.

Congress is creating public works job opportunities while destroying career

opportunities. The reason is that the progressives, with all their good

intentions, will have placed trillions of stimulus money into part-time laboring

jobs like road building that are physically demanding and not at all suited for

people with career aspirations. Only so many can work in the health care and

education fields, and careers there will become pretty low paying due to the

need to minimize the cost of free health and education services and rationing.

"Graduation is what President

Obama is all about," says Charles B. Reed in the above video

Jensen Comment

Prosperous businesses create career opportunity growth. Congress at present is

destroying business opportunity. It is only creating government work

opportunity. Paul Williams cringes at thinking of his university as a socialist

organization owned and operated by government. By whatever name it’s owned and

managed by the government and it’s principle service graduates students into the

working world. I would like this to be a business world with career

opportunities. Yes I know that he will counter this by saying that for the past

four decades business has depended upon government in one way or another for its

prosperity, often with subsidies in one form or another. But until George W.

Bush went to war and could not say no to Congress on progressive spending

programs like the Medicare Drug Plan, the National Debt was only $6 trillion and

entitlements were perhaps around $30 trillion. Virtually all college graduates

had career hopes and most of these were hopes for careers in some type of

business or profession.

Wouldn’t it be fantastic if progressives could

provide free education and training and health care to about 400 million U.S.

residents without destroying their career hopes in the process? Somehow

progressives have to provide more incentives to businesses, especially small

businesses, to create 400 million career opportunities. Many of those new

graduates would start up new businesses if they were not discouraged by

prospects that their success will be confiscated to pay for social programs.

Critics of Congressional earmarks harshly attacked

President Obama and members of his administration Monday, accusing the White

House of ignoring the president's campaign promise to end the use of

lawmaker-directed projects as a way of allocating precious federal funds. But

it's unlikely that many of those complaints will be coming from colleges, which

stand to benefit -- to the tune of hundreds of millions of dollars -- from the

pork barrel-laden fiscal 2009 spending bill that is prompting the outcry . . .

Shhhh, Stop Complaining!

"Plenty of Pork," Inside Higher Ed, March 3, 2009 ---

http://www.insidehighered.com/news/2009/03/03/pork

Jensen

I'm complaining, but nobody is listening since everybody wants on the gravy

train.

Bob

Jensen’s threads on the

bailout and stimulus mess are at

http://faculty.trinity.edu/rjensen/2008Bailout.htm

Question

How do you feel about having ACORN conduct the U.S. Census?

The group discussed ACORN’s track record of election

fraud, which is concerning considering the group is the largest grass roots

organization in America with 170 affiliated organizations. Despite a series of

complaints of voter registration fraud by ACORN representatives, however, the

mainstream media is reluctant to report on the group’s transgressions, RNLA

officials say . . . “But liberals constantly deny that voter fraud exists. When

prosecutions are started, they try everything they can to stop them. They also

stop states from taking any steps through legislation or regulation that will

prevent it.” Ken Blackwell of the Family Research Council, who also is a leading

conservative and former Ohio Secretary of State,

also warned of the dangers of the White House taking over

the census.

Rick Pedraza, "Lawyers: ACORN

Destroying American Elections," Newsmax, February 27, 2009 ---

http://www.newsmax.com/insidecover/acord_destroys_US_vote/2009/02/27/186512.html

A democracy cannot exist as a permanent form of

government. It can only exist until the voters discover that they can vote

themselves largesse from the public treasury. From that moment on, the majority

always votes for the candidates promising the most benefits from the public

treasury, with the result that a democracy always collapses over loose fiscal

policy, always followed by a dictatorship.

Alexander Tyler. 1787 - Tyler was a Scottish history professor that had

this to say about 2000 years after "The Fall of the Athenian Republic" and about

the time our original 13 states adopted their new constitution.

As quoted at

http://www.babylontoday.com/national_debt_clock.htm (where the debt clock in

real time is a few months behind)

The National Debt Amount This Instant (Refresh your browser for

updates by the second) ---

http://www.brillig.com/debt_clock/

America, what is happening to you?

“One thing seems probable to me,” said Peer Steinbrück,

the German finance minister, in September 2008....“the United States will lose

its status as the superpower of the global financial system.” You don’t have to

strain too hard to see the financial crisis as the death knell for a

debt-ridden, overconsuming, and underproducing American empire . . .

Richard Florida, "How the Crash Will

Reshape America," The Atlantic, March 2009 ---

http://www.theatlantic.com/doc/200903/meltdown-geography

The inherent vice of capitalism is the unequal sharing of the blessings. The

inherent blessing of socialism is the equal sharing of misery.

Winston Churchill (Good thing

Obama sent Churchill's bust back to the U.K. from the Oval Office and replaced

it with a bust of Lincoln who wrote that Government should print all the money

it needs without borrowing)

The government should create, issue, and circulate

all the currency and credits needed to satisfy the spending power of the

government and the buying power of consumers. By adoption of these principles,

the taxpayers will be saved immense sums of interest. Money will cease to be

master and become the servant of humanity.

Abraham Lincoln (I wonder why this

just does not work in Zimbabwe where Robert Mugabe adopted Lincoln's fiscal

policy?)

It's very clear now the Democrats controlling

Washington are living in a parallel universe – one where up is down, left is

right, dark is light, fairness is unfairness and responsibility is

irresponsibility. But is it really necessary for Obama to insult our

intelligence (claiming

fiscal responsibility for the sake of our grandchildren while doubling unfunded

social entitlements trillions upon trillions of dollars)

like this? His supporters have already demonstrated a

complete, abject inability to comprehend the simplest economic principle. He

doesn't need to fool them. They fool themselves.

Joseph Farah, "'Living

within our means'," WorldNetDaily, February 28, 2009 ---

http://www.worldnetdaily.com/index.php?fa=PAGE.view&pageId=90236

'

"We Can't Tax Our Way Out of the

Entitlement Crisis," by R. Glenn Hubbard, The Wall Street Journal, August

21, 2008; Page A13 ---

http://online.wsj.com/article/SB121927694295558513.html

We can also secure a

firm financial footing for Social Security (and Medicare) without

choking off economic growth or curtailing our flexibility to pursue

other spending priorities. Three actions are essential: (1) reduce

entitlement spending growth through some form of means testing; (2)

eliminate all nonessential spending in the rest of the budget; and

(3) adopt policies that promote economic growth. This 180-degree

difference from Mr. Obama's fiscal plan forms the basis of Sen.

McCain's priorities for spending, taxes and health care.

The problem with Mr.

Obama's fiscal plans is not that that they lack vision. On the

contrary, the vision is plain enough: a larger welfare state paid

for by higher taxes. The problem is not even that they imply change.

The problem is that his plans are statist.

While the candidate

is sending a fiscal "Ich bin ein Berliner" message to Americans,

European critics of his call for greater spending on defense are the

canary in the coal mine for what lies ahead with his vision for the

United States.

Professor R. Glenn Hubbard is

Dean of the College of Business at Columbia University and a member

of the President's Council of Economic Advisors.

Bob Jensen's threads on the

"Entitlement Crisis" are at

http://faculty.trinity.edu/rjensen/entitlements.htm

The US government is on a “burning platform” of

unsustainable policies and practices with fiscal deficits, chronic healthcare

underfunding, immigration and overseas military commitments threatening a crisis

if action is not taken soon.

David M. Walker, Former Chief

Accountant of the United States ---

http://www.financialsense.com/editorials/quinn/2009/0218.html

Also see his dire warnings on CBS Sixty Minutes on the unbooked national debt

for entitlements (over five times the booked national debt and soaring with new

entitlements) ---

http://faculty.trinity.edu/rjensen/entitlements.htm

Question

What caused the credit crisis and why can't credit be unlocked after throwing

over $1 trillion at the big banks?

Great answers on Video --- this is a

must-see video for you, your family, and your students who want to understand

these banking failures

The Short and Simple Video About What Caused the Credit Crisis ---

http://vimeo.com/3261363

Also at

http://www.youtube.com/watch?v=Q0zEXdDO5JU

Ed Scribner forwarded the above links

Question

Who more than anybody else is at fault for wiping out shareholders in AIG, Bear

Stearns, Merrill Lynch, CitiBank, Bank of America, Washington Mutual, Fannie

Mae, Freddie Mack, etc.

Answers

I primarily blame the CPA auditors, internal auditors, and credit rating

agencies that failed to disclose the off-balance-sheet risks that fee-loving

bankers had created. The auditors and credit rating agencies have a fiduciary

and professional responsibility to disclose to investors the extent of looming

uncollectable investments. For many years auditors have been knowingly

understating banks' bad debt risks and failing to warn investors about such

banking risks. I also think auditors, along with credit rating agencies, knew

full well about the financial risks of their huge clients but were afraid to

jeopardize their fees by blowing whistles.

Question

What more than anything else saved United Airlines and who is primarily at fault

for wiping out the shareholders of United Airlines in 2002?

Answer

In December 2002 United Airlines filed Chapter 11 Bankruptcy. In order to get

United's airplanes back in the air, the single most important saving device was

to have Uncle Sam's taxpayers take over the lifetime retirement obligations to

be paid to United's retired pilots, flight attendants, mechanics, passenger

agents, and ground crews. This saved United Airlines with the help of some major

wage concessions of existing employees who decided that keeping their jobs was

the most important thing to them.

Once again the auditors are primarily at fault for not warning investors soon

enough that United Airlines was not a viable going concern and would not be able

to meet its unbooked liabilities called Off-Balance-Sheet-Financing (OBSF) by

accountants. If investors had been warned years earlier, the stock market

would've forced United Airlines to become more serious about pricing and funding

of retirement obligations. But since investors were not forewarned by the

auditors and credit rating agencies, the equity holders (many of them United

Airlines employees) got wiped out by the 2002 declaration of bankruptcy.

Question

What more than anything else will save General Motors in 2009 and who is

primarily at fault for wiping out the shareholders of General Motors?

GM is now losing $85 million per day on average.

In 2009 or 2010 filed General Motors will most likely declare Chapter 11

Bankruptcy. It will be Deja Vu United Airlines. In order to get GM's vehicles

back on the road, the single most important saving device was to have Uncle

Sam's taxpayers take over the retirement obligations (pensions and health care

obligations) to be paid to GM's retired management and factory workers and GMAC

retired employees as well. This will save GM with the help of some major wage

concessions of existing GM employees who eventually decide that keeping their

jobs was the most important thing to them.

Once again the auditors are primarily at fault for not warning investors soon

enough that General Motors was not a viable going concern and would not be able

to meet its unbooked liabilities called Off-Balance-Sheet-Financing (OBSF). If

investors had been warned years earlier, the stock market would've forced

General Motors to become more serious about pricing and funding of retirement

obligations. But since investors were not forewarned by the auditors and credit

rating agencies, the equity holders (many of them being huge investment funds)

got wiped out by the forthcoming 2009 declaration of bankruptcy.

In fairness, the accountants did give more warning about OBSF unfunded

retirement obligations in GM's case relative the United Airlines. Accountants

did disclose some years ago that about $1,500 of each new vehicle sold went

toward current funding of for retirement and health care of GM's retired

workers. It's been widely known for some time that GM's retirement obligations

were badly underfunded. What made it especially difficult for GM is that it's

major foreign competitors were making longer-lasting vehicles that beat GM

prices. The reason Toyota, Subaru, Nissan, etc. could undercut GM prices is that

these foreign automakers did not have the serious unbooked OBSF obligations that

GM carried on its back.

Question

What are the two secret numbers that you will never hear mentioned by Uncle

Sam's current leaders like President Obama, House Speaker Pelosi, and Senate

Leader Reid?

Answer

They will never mention the extent of Uncle Sam's unbooked OBSF liabilities.

Accountants have no accurate estimates of these liabilities, but the former

Chief Accountant of the United States, David Walker, estimates that these are

about $60 trillion at the moment. They may well be $100 trillion in four years

if Congress is successful in legislating tens of trillions of dollars in new

entitlements for education, energy, welfare, and health care.

Uncle Sam's leaders are now focusing our attention on problems with the annual

spending deficit (which may well approach $ trillion at the end of 2009) and the

booked National Debt (which may well approach $12 trillion by the end of 2009).

But these booked items will not break the back of Uncle Sam. What will break the

back of Uncle Sam is what broke the back of United Airlines and General Motors.

It's the unbooked OBSF debt which the companies, auditors, and credit rating

agencies tried to keep secret.

Uncle

Sam saved United Airlines by taking over United's OBSF retirement debt. Uncle

Sam will probably do the same for GM, Ford, and Chrysler unfunded OBSF debt. But

who will save Uncle Sam from its $60-$100 trillion of unfunded and unbooked OBSF

debt?

Answer

Only the Abraham Lincoln School of Finance (see Lincoln’s quote below) will save

Uncle Sam from its unsustainable OBSF

You,

your family, and your students may learn a great deal from the links to David

Walker's warning videos and the most worrisome CBS Sixty Minutes module ever

produced ---

http://faculty.trinity.edu/rjensen/entitlements.htm

In his address to a joint session of Congress on Tuesday, President Barack

Obama called for every American to pursue some form of education beyond high

school.

Maybe we should get them out of K-12 before thinking about throwing college

entitlement money at them

It's an ambitious goal — some might say impossible.

Currently, only two of every five American adults have a two- or four-year

college degree. Millions of Americans struggle even to complete high school,

with one in four dropping out. And even a high school degree is no guarantee a

student is ready for college . . . First, we must get serious about high

schools. Instead of preparing some for college and others for the jailhouse, we

need to help high schools prepare every student for college. Second, we have to

dramatically improve results for low-income and minority students, now more than

half of our youth. Increasing their success is the only way to ensure our

national success.

"College for all: Is Obama’s goal attainable? Education experts

share thoughts on what it would take," MSNBC, February 28, 2009 ---

http://www.msnbc.msn.com/id/29445201/

The US government is on a “burning platform” of unsustainable

policies and practices with fiscal deficits, chronic healthcare underfunding,

immigration and overseas military commitments threatening a crisis if action is

not taken soon.

David M. Walker,

Former Chief Accountant of the United States ---

http://www.financialsense.com/editorials/quinn/2009/0218.html

Also see his dire warnings on CBS Sixty Minutes on the unbooked national debt

for entitlements (over five times the booked national debt and soaring with new

entitlements) ---

http://faculty.trinity.edu/rjensen/entitlements.htm

A democracy cannot exist as a permanent form of government. It can only exist

until the voters discover that they can vote themselves largesse from the public

treasury. From that moment on, the majority always votes for the candidates

promising the most benefits from the public treasury, with the result that a

democracy always collapses over loose fiscal policy, always followed by a

dictatorship.

Alexander Tyler. 1787 - Tyler was a Scottish history professor that had

this to say about 2000 years after "The Fall of the Athenian Republic" and about

the time our original 13 states adopted their new constitution.

As quoted at

http://www.babylontoday.com/national_debt_clock.htm

(where the debt clock in real time is a few months behind)

The National Debt Amount This Instant (Refresh your browser for updates by the

second) ---

http://www.brillig.com/debt_clock/

America,

what is happening to you?

“One thing seems probable to me,” said Peer

Steinbrück, the German finance minister, in September 2008....“the United States

will lose its status as the superpower of the global financial system.” You

don’t have to strain too hard to see the financial crisis as the death knell for

a debt-ridden, overconsuming, and underproducing American empire . . .

Richard Florida,

"How the Crash Will Reshape America," The Atlantic, March 2009 ---

http://www.theatlantic.com/doc/200903/meltdown-geography

The inherent vice of capitalism is the unequal sharing of the blessings. The

inherent blessing of socialism is the equal sharing of misery.

Winston Churchill

(Good thing Obama sent Churchill's bust back to the U.K. from the Oval Office

and replaced it with a bust of Lincoln who wrote that Government should print

all the money it needs without borrowing)

From the Abraham Lincoln School of Finance

The government should create, issue, and circulate all the currency and credits

needed to satisfy the spending power of the government and the buying power of

consumers. By adoption of these principles, the taxpayers will be saved immense

sums of interest. Money will cease to be master and become the servant of

humanity.

Abraham Lincoln

(I wonder why this just does not work in Zimbabwe where Robert Mugabe adopted

Lincoln's fiscal policy?)

For

the sake of future America, we’d better hope that Lincoln was correct. But

Lincoln’s fiscal policy sure did not work for Zimbabwe.

Zimbabwe's central bank will introduce a 100 trillion

Zimbabwe dollar banknote, worth about $33 on the black market, to try to ease

desperate cash shortages, state-run media said on Friday.

KyivPost, January 16, 2009 ---

http://www.kyivpost.com/world/33522

Jensen Comment

This is a direct result of raising money by simply printing it, and the U.S.

should take note since this is how our Federal government has decided to pay for

anticipated trillion-dollar budget deficits ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#NationalDebt

Bob

Jensen’s threads on this entire bailout/stimulus mess are at

http://faculty.trinity.edu/rjensen/2008Bailout.htm

Due to recent budget cuts and the rising cost of

electricity, gas, and oil,

The Light at the End of the Tunnel has been turned off.

We apologize for any inconvenience.

Forwarded by Paula

This especially applies to the light on the Manhattan side of the Manhattan

Tunnels.

A democracy cannot exist as a permanent form of

government. It can only exist until the voters discover that they can vote

themselves largesse from the public treasury. From that moment on, the majority

always votes for the candidates promising the most benefits from the public

treasury, with the result that a democracy always collapses over loose fiscal

policy, always followed by a dictatorship.

Alexander Tyler. 1787 - Tyler was a Scottish history professor that had

this to say about 2000 years after "The Fall of the Athenian Republic" and about

the time our original 13 states adopted their new constitution.

As quoted at

http://www.babylontoday.com/national_debt_clock.htm (where the debt clock in

real time is a few months behind)

The National Debt Amount This Instant (Refresh your browser for

updates by the second) ---

http://www.brillig.com/debt_clock/

America, what is happening to you?

“One thing seems probable to me,” said Peer Steinbrück,

the German finance minister, in September 2008....“the United States will lose

its status as the superpower of the global financial system.” You don’t have to

strain too hard to see the financial crisis as the death knell for a

debt-ridden, overconsuming, and underproducing American empire . . .

Richard Florida, "How the Crash Will

Reshape America," The Atlantic, March 2009 ---

http://www.theatlantic.com/doc/200903/meltdown-geography

The US government is on a “burning platform” of

unsustainable policies and practices with fiscal deficits, chronic healthcare

underfunding, immigration and overseas military commitments threatening a crisis

if action is not taken soon.

David M. Walker, Former Chief

Accountant of the United States ---

http://www.financialsense.com/editorials/quinn/2009/0218.html

Also see his dire warnings on CBS Sixty Minutes on the unbooked national debt

for entitlements (over five times the booked national debt and soaring with new

entitlements) ---

http://faculty.trinity.edu/rjensen/entitlements.htm

Delay is preferable to error.

Thomas Jefferson

Obama Needs a 'Not To Do' List

Holman W. Jenkins Jr.

America Bought a Pig in a Poke

It's like going on a spending binge

at the Titanic's passenger store just after hitting the iceberg

Alas, that opportunity was squandered. Mr Obama

ceded control of the stimulus to the fractious congressional Democrats, allowing

a plan that should have had broad support from both parties to become a divisive

partisan battle. More serious still was Mr Geithner’s financial-rescue blueprint

which, though touted as a bold departure from the incrementalism and uncertainty

that had plagued the Bush administration’s Wall Street fixes, in fact looked

depressingly like his predecessors’ efforts: timid, incomplete and short on

detail. Despite talk of trillion-dollar sums, stockmarkets tumbled. Far from

boosting confidence, Mr Obama seems at sea.

. . . Mr Obama’s team must recognise this or they, like their predecessors, will

come to be seen as part of the problem, not the solution.

"The Obama Rescue," The Economist, February 14, 2008, Page

13 ---

http://www.economist.com/opinion/displaystory.cfm?story_id=13108724&CFID=45050187&CFTOKEN=28690481

Barack Obama promised to get the economy's mojo working

again with the passage of an almost $800 billion stimulus package. Wall Street

responded with a Bronx Cheer and a 300 drop in the Dow Jones Industrial Average.

What gives? . . . It is unclear how many more boondoggles will be uncovered in

the 1000+ page bill. People are still pouring through its mass of pages. Few, if

any, members of Congress read the bill before it was passed. Scare tactics well

known to every salesman were used to facilitate its passage. The President

proclaimed the sky was falling. An economic catastrophe was just around the

corner. Congress had to do "something" immediately to forestall disaster. There

was no time to read the fine print or to deliberate in a thoughtful manner. And

in lemming like fashion, the Democrats poured over the cliff. It was their

prerogative they claimed. After all, as Mr. Obama declared, "We won the

election."

Ken Connor, "Pork and Pitchforks ,"

Townhall, February 22, 2009 ---

http://townhall.com/columnists/KenConnor/2009/02/22/pork_and_pitchforks

Henry Waxman, representing Beverly Hills. lied about banning millionaires

from free Medicaid health care

But for the new entitlements, there was a massive

loophole. Because the bill explicitly prohibited income or asset tests from

being applied to people receiving the new health care entitlements, anyone who

recently lost their job—including the former CEOs who Mr. Waxman said last fall

“walked away with millions”—could receive free or subsidized health care

courtesy of federal taxpayers. At a time when all Americans are struggling to

make ends meet, I viewed these uncapped subsidies as a poor use of taxpayers’

hard-earned money—and an unnecessary expansion of government to boot. So when

our Committee met to consider the “stimulus” legislation, I offered an amendment

to the legislation to make sure that individuals with income over $1 million who

elected continuation coverage from their former employers would not receive

federal subsidies to pay for that coverage. Chairman Waxman accepted my

amendment, and said he would “try to find a way to structure” the subsidies so

that wealthy executives wouldn’t be eligible for subsidies they really shouldn’t

need. (but this promise was an outright lie).

Cliff Stearns, "Medicaid for

Millionaires," Townhall, February 23, 2009 ---

http://townhall.com/columnists/CliffStearns/2009/02/23/medicaid_for_millionaires

Harvard professor says economists are a huge part of the problem ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#LiquidityBubble

Stephen A. Marglin is a professor of economics at Harvard

University. His latest book is The Dismal Science: How Thinking Like an

Economist Undermines Community (Harvard University Press, 2007).

Paul Williams Comment

Of course they are. All the pundits in the media talk about proximate

causes, but the cause no one wants to face is the one of faith that there

actually are "laws" of

economics (there aren't, only laws of nature).. Allen Greenspan made a most

bazaar statement on NBC news last night about human nature being "flawed." A

nature can't be flawed because it's a NATURE. Is the nature of an oak tree

flawed? Is the nature of a salmon flawed? Human nature isn't flawed; it is what

evolution has made it (Quiz: On which day did God create Markets?). What's

flawed are the institutions we have constructed that are ill-designed to our

nature. Ah, those economists. The problem is never the model; it's the flawed

human beings that simply refuse to behave the way they are supposed to.

Econonmists have taken one minimal aspect of our nature -- we swap things with

other humans -- and have elevated it into the singular defining characteristic

of what we are. Smith, the great free-trader, spoke of trade among nations

(thus, An Inquiry into the Nature and Causes of the Wealth of NATIONS). Not

individuals or enterprises, but nations. In the lexical order of human traits

and behaviors community precedes trade and commerce (The Theory of Moral

Sentiments). Economists have a lot to answer for, but they won't. Instead, they

will blame it all on us flawed human beings, not good enough to occupy the

imagninary world created so they can continue to be paid higher salaries for

being applied mathematicians than they could be paid for being real

mathematicians.

Why auditors are a huge part of the problem ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#AuditFirms

But fair value, mark-to-market, accounting is being inappropriately blamed ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#FairValueAccounting

Remember those Earmarks Pelosi and Obama Promised to Curtail

House Speaker Nancy Pelosi, California Democrat,

defended the spending blueprint that is needed to fund more than a dozen Cabinet

departments for the final seven months of the federal fiscal year. She said the

increases were needed to fund programs and policies starved for dollars under

President George W. Bush. It is a $30 billion, or 8 percent, increase over

comparable budgets for the same departments in fiscal 2008.

David R. Sands and Christina Bellantoni,

"Spending bill (another porker above and beyond the Stimulus Act porker)

tuffed with earmarks," The Washington Times, February 24, 2009 ---

http://washingtontimes.com/news/2009/feb/24/obama-pleads-for-fiscal-responsibility/

Jensen Comment

The proposed bill has a record-high set of over 9,000 earmarks as Congress

tightens its belt (yeah right) do to the economic crisis.

Yet, in drawing up the budget, the White House

assumed the economy would expand by a robust 3.2 percent in 2010, with growth

accelerating to 4 percent over the next three years. “It’s a hope, a wing and a

prayer,” Mr. Sinai said. “It’s a return to a sanguine view of the economy

that is simply not justified. . . .

If, as is widely anticipated, the economy grows more

slowly than the White House assumes, revenue will be lower, forcing the

government to cut spending, raise taxes or run larger deficits. Economists also

criticized as unrealistically hopeful the assumptions by the Federal Reserve as

it began so-called stress tests to gauge the health of the nation’s largest

banks. In testimony, Ben S. Bernanke, the Fed chairman, said that the nation’s

unemployment rate would most likely reach 8.8 percent next year.

Peter S. Goodman, "Sharper Downturn

Clouds Obama Spending Plans," The New York Times, February 27, 2009 ---

http://www.nytimes.com/2009/02/28/business/economy/28recession.html?hp

Winning the Lotto jackpot has become a key factor in

my retirement plan.

New Yorker Cartoon

"Two billion more bourgeois," The Economist, February 14, 2009, Page

18 ---

http://www.economist.com/opinion/displaystory.cfm?story_id=13109687&CFID=45050187&CFTOKEN=28690481

PEOPLE love to mock the middle class. Its

narrow-mindedness, complacency and conformism are the mother lode of

material for sitcom writers and novelists. But Marx thought “the

bourgeoisie…has played a most revolutionary part” in history. And although

The Economist rarely sees eye to eye with the father of communism,

on this Marx was right.

During the past 15 years a new middle

class has sprung up in emerging markets, producing a silent revolution in

human affairs—a revolution of wealth-creation and new aspirations. The

change has been silent because its beneficiaries have gone about

transforming countries unobtrusively while enjoying the fruits of success.

But that success has been a product of growth. As growth collapses, the way

the new middle class reacts to the thwarting of its expectations could

change history in a direction that is still impossible to foresee.

The new middle consists of people with

about a third of their income left for discretionary spending after

providing basic food and shelter. They are neither rich, inheriting enough

to escape the struggle for existence, nor poor, living from hand to mouth,

or season to season. One of their most important characteristics is variety:

middle-class people vary hugely by background, profession and income. As our

special report in this week’s issue argues, their numbers do not grow

gently, shadowing economic growth and rising 2%, or 5%, or 10% a year. At

some point, they surge. That happened in China about ten years ago. It is

happening in India now. In emerging markets as a whole, it has propelled the

middle class from a third of the developing world’s population in 1990 to

over half today. The developing world is no longer simply poor.

As people emerge into the middle class,

they do not merely create a new market. They think and behave differently.

They are more open-minded, more concerned about their children’s future,

more influenced by abstract values than traditional mores. In the words of

David Riesman, an American sociologist, their minds work like radar, taking

in signals from near and far, not like a gyroscope, pivoting on a point.

Ideologically they lean towards free markets and democracy, which tend to be

better than other systems at balancing out varied and conflicting interests.

A poll we commissioned for our special report on the middle class in the

developing world finds that such people are happier, more optimistic and

more supportive of democracy than are the poor.

These attitudes transform countries and

economies. The middle class is more likely to invest in new products and new

technologies than the rich, who tend to defend their existing assets. It is

better able than the poor to leap barriers to entry into business and can

therefore set up companies big enough to generate jobs. With its aspirations

and capacity for delayed gratification, the middle class is more likely to

invest in education and other sources of human capital, which are vital to

prosperity. For years, policymakers have tied economic success to the rich

(“trickle-down economics”) and to the poor (“inclusive growth”). But it is

the middle class that is the real motor of economic growth.

Now the middle class everywhere is under a

great threat. Its members have flourished in places and countries that have

opened up to the world economy—the eastern seaboard of China, southern

India, metropolitan Brazil. They are products of globalisation, and as

globalisation goes into reverse they may well be hit harder than the rich or

poor. They work in export industries, so their jobs are unsafe. They have

started to borrow, so are hurt by the credit crunch. They have houses and

shares, so their wealth is diminished by falling asset prices.

What will they do when the music stops?

Those at the bottom of the ladder do not have far to fall. But what happens

if you have clambered up a few rungs, joined the new middle class and now

face the prospect of slipping back into poverty? History suggests

middle-class people can behave in radically different ways. The rising

middle class of 19th-century Britain agitated peacefully for the vote; in

Latin America in the 1990s the same sorts of people backed democracy. Yet

the middle class also supported fascist governments in Europe in the 1930s

and initially backed military juntas in Latin America in the 1980s.

Nobody can be sure what direction today’s

new bourgeoisie of some 2.5 billion people will take if its aspirations are

dashed. If the downturn lasts only a year or two the attitudes of such

people may survive the pain of retrenchment. But a prolonged crash might

well undo much of the progress the developing world has lately made towards

democracy and political stability. It is hard to imagine the stakes being

higher.

Winning the Lotto jackpot has become a key factor in

my retirement plan.

New Yorker Cartoon

U.S. Secretary of State Hillary Clinton urged China

to continue buying U.S. Treasury bonds to help finance President Barack Obama's

stimulus plan, saying "we are truly going to rise or fall together." "Our

economies are so intertwined," Clinton said in an interview today in Beijing

with Shanghai-based Dragon Television. "It would not be in China's interest" if

the U.S. were unable to finance deficit spending to stimulate its stalled

economy. The U.S. is the single largest buyer of the exports that drive growth

in China, the world's third-largest economy. China in turn invests surplus

earnings from shipments of goods such as toys, clothing, and steel primarily in

Treasury securities, making it the world's largest holder of U.S. government

debt at the end of last year with $696.2 billion. China's leaders understand

that "the United States has to take some very drastic measures with the stimulus

package, which means we have to incur debt," Clinton said. The Chinese are

"making a very smart decision by continuing to invest in Treasury bonds," which

she called a "safe investment," because a speedy U.S. recovery will fuel China's

growth as well. China boosted purchases of U.S. debt by 46 percent last year to

a record. The Chinese government said last week it plans to keep buying

Treasuries, adding that future purchases will depend on the preservation of

their value and the safety of the investment. China's currency reserves of $1.95

trillion are about 29 percent of the world total.

Indira A.R. Lakshmanan "Clinton

Urges China to Keep Buying Treasuries," Bloomberg News, February 22, 2009

---

http://www.gata.org/node/7190

Jensen Comment

I discussed this concern in my Hidden Agenda" in Appendix Y at

http://faculty.trinity.edu/rjensen/2008Bailout.htm#HiddenAgendaDetails

President Obama's fiscal sustainability summit at

the White House Monday apparently wasn't all that stimulating. The Financial

Times is reporting that Larry Summers, head of Obama's National Economic

Council, actually fell asleep at the podium. This is the same event where John

McCain ranted about the cost of upgrading the presidential helicopter. "Although

Lawrence Summers, head of the National Economic Council, fell asleep on the

podium, most attendees, including Republicans, appear to have appreciated the

exercise. There was even some light-heartedness."

Liza Porteus Viana, "Larry Summers

Falls Asleep During Economic Summit," AOL News, February 24, 2009 ---

http://news.aol.com/political-machine/2009/02/24/larry-summers-falls-asleep-during-economic-summit/

Jensen Comment

This provides a clue as to why Professor Summers got out of podium

teaching and became an administrator (i.e., President of Harvard until the

feminists booted him out). Perhaps Summers was happily dreaming about reducing

the budget deficit --- a pure fantasy dream.

Having just spent another morning of my life reading

the most boring details of other people's mornings, I've realized how very

little things like Twitter, FaceBook, or FriendFeed actually contribute to one's

life: it's more like sitting in a room full of over-caffeinated narcissistic

Tourette's patients with ADHD who are all trying to be the most entertaining.

And, really, what's so social about a monologue?

Katherine Berry as quoted by Mark

Shapiro at

http://irascibleprofessor.com/comments-02-25-09.htm

India, what is happening to you?

Faced with a slowdown in growth, an exodus of foreign

investors, a huge corporate accounting scandal at a top , and a make-or-break

election, India's government has been struggling to find ways to rev up the

economy. First came an $8 billion stimulus package in December. Then, on Jan. 2,

as the country digested the news that exports had fallen for the first time in

nearly 15 years, the central bank cut interest rates and allowed state

governments to borrow another $6 billion. And last week, Prime Minister Manmohan

Singh's coalition government slashed taxes. Now comes the slap on the wrist. On

Feb. 24, Standard & Poor's sniffed at all the extra borrowing, which has raised

India's total deficit to about 12% of its gross domestic product, and revised

the country's outlook downward to negative from stable. While S&P reaffirmed its

BBB- rating, Takahira Ogawa, the analyst who recommended the change, says the

ratings agency (which, like BusinessWeek, is owned by The McGraw-Hill Cos.

(MHP)) would be watching India's fiscal condition closely for the next few

months. "We see more possibility for a downgrade later on down the line," he

says. "In a sense, this is a warning."

Mehul Srivastava, "India's Deficit

Threatens 'Junk' Rating: Standard & Poor's warns India of further

downgrades as the country's exports sink and extra borrowing raises its deficit

to 12% of GDP,The Wall Street Journal, " February 25, 2009 ---

http://www.businessweek.com/globalbiz/content/feb2009/gb20090225_145994.htm?link_position=link12

And next year they can be on non-ending welfare like the other end of the

spectrum

But let's not stop at a 42% top (tax) rate; as a

thought experiment, let's go all the way. A tax policy that confiscated 100% of

the taxable income of everyone in America earning over $500,000 in 2006 would

only have given Congress an extra $1.3 trillion in revenue. That's less than

half the 2006 federal budget of $2.7 trillion and looks tiny compared to the

more than $4 trillion Congress will spend in fiscal 2010. Even taking every

taxable "dime" of everyone earning more than $75,000 in 2006 would have barely

yielded enough to cover that $4 trillion.

"The 2% Illusion Take everything they earn, and it still won't be

enough," The Wall Street Journal, February 27, 2009 ---

http://online.wsj.com/article/SB123561551065378405.html?mod=djemEditorialPage

Jensen Comment

It would be sweet revenge to see actors Clooney, Hanks, Penn, and Streisand

standing in long Hollywood bread lines. How about Michael Moore scrubbing pots

and pans in a soup kitchen? Alas they're too smart to pay such high taxes.

Eventually all the Hollywood liberals will probably move to Ireland, a tax

haven for actors and artists and writers.

While

Frank Portnoy was fighting for more financial markets regulation, guess who

was fighting against it tooth and nail?

Few remember that Bill Clinton's administration, along with Greenspan and

Levitt, fought successfully against regulation of financial markets.

It's now Deja vu Larry Summers who is the liberal Keynesian scholar behind

President Obama's economic recovery and budget spending.

People remember Larry Summers as Harvard President who was forced out of office

by feminists.

But few remember that he was also Deputy Treasury Secretary during the presidency of

Bill Clinton.

Even fewer remember him as a virulent opponent of

financial markets regulation.

In 1997, Brooksley Born warned in congressional

testimony that unregulated trading in derivatives could "threaten our regulated

markets or, indeed, our economy without any federal agency knowing about it."

Born called for greater transparency--disclosure of trades and reserves as a

buffer against losses. Instead of heeding this oracle's warnings, Greenspan,

Rubin & Summers rushed to silence her. As the Times story reveals, Born's wise

warnings "incited fierce opposition" from Greenspan and Rubin who "concluded

that merely discussing new rules threatened the derivatives market." Greenspan

deployed condescension and told Born she didn't know what she doing and she'd

cause a financial crisis . . . In early 1998, according to the Times story, one

of the guys, Larry Summers, called Born to "chastise her for taking steps he

said would lead to a financial crisis. But Born kept at it, unwilling to let

arrogant men undermine her good judgment. But it got tougher out there. In June

1998, Greenspan, Rubin and the then head of the SEC, Arthur Levitt, Jr., called

on Congress "to prevent Ms. Born from acting until more senior regulators

developed their own recommendations." (Levitt now says he regrets that

decision.) Months later, the huge hedge fund Long Term Capital Management nearly

collapsed--confirming some of Born's warnings. (Bets on derivatives were a key

reason.) "Despite that event," the Times reports, " Congress (apparently as a

result of Greenspan & Summer's urging, influence-peddling and pressure) "froze"

Born's Commissions' regulatory authority. The next year, Born left as head of

the Commission.Born did not talk to the Times for their article. What emerges is

a story of reckless, willful and arrogant action and behaviour designed to

undermine a wise woman's good judgment. The three marketeers' disdain for modest

regulation of new and risky financial instruments reveals a faith-based

fundamentalist approach to the management of markets and risk. If there is any

accountability left in our system, Greenspan, Rubin and Summers should not be

telling anyone how to run anything. Instead, Barack Obama might do well to bring

back Brooksley Born and promote to his team economists who haven't contributed

to the ugly mess we're in.

Katrina vanden Heuvel, "The Woman

Greenspan, Rubin & Summers Silenced," The Nation, October 9, 2008 ---

http://www.thenation.com/blogs/edcut/370925/the_woman_greenspan_rubin_summers_silenced

Link forwarded by Jagdish Gangolly