Debate Assignment:

Should We Never Pay Down the National Deficit or Debt (even partly)?

Bob Jensen

at Trinity University

U.S. National Debt

Clock ---

http://www.usdebtclock.org/

Also see

http://www.brillig.com/debt_clock/

Question

Should we keep increasing the government spending deficit and the national debt

every year ad infinitum?

Answers

Although in these down economic times, the liberal's Keynesian hero and Nobel

Prize economist, Paul Krugman, thinks recovery is stalled because the government

is not massively increasing spending deficits. But he's not willing to commit

himself to never reducing deficits or never paying down some of the national

debt. Hence, he really does not answer the above question ---

http://www.nytimes.com/2012/01/02/opinion/krugman-nobody-understands-debt.html

So let's turn to a respected law professor who advocates increasing the

government spending deficit and the national debt every year ad infinitum?

"Why We Should Never Pay Down the National Debt (even partly)," by

Neil H. Buchanan George Washington University Law School), SSRN, 2012 ---

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2101811

Abstract:

Calls either to balance the federal budget on an annual basis, or to pay

down all or part of the national debt, are based on little more than

uninformed intuitions that there is something inherently bad about borrowing

money. We should not only ignore calls to balance the budget or to pay down

the national debt, but we should engage in a responsible plan to increase

the national debt each year. Only by issuing debt to lubricate the financial

system, and to support the economy’s healthy growth, can we guarantee a

prosperous future for current and future citizens of the United States.

Student Assignment

Since many of the most liberal economists are

not quite

willing to assert that "we should never pay down the national debt," what

questionable and unmentioned assumptions have been made by Neil H. Buchanan

that need to be addressed?

Are some of these assumptions unrealistic in any world

other than a utopian world?

Assumption 1

Debt We Owe to Ourselves is Not Debt --- Such Debt is Really an Asset

In addition, the federal government’s debt is

partly held internally, with some federal agencies holding Treasury bonds

on their books as assets. The most important of these agencies is the

Social Security Administration, which accounts for its accumulated annual

budget surpluses by holding Treasuries, thereby lending its annual surpluses

to the rest of the federal government.28 This means that the total federal

debt is only partly held by parties that are not part of the federal

government, creating a distinction between the total federal debt and the

“debt held by the public

Buchanan, Page 687

Jensen Comment

Did Professor Buchanan ever take an accounting course? Debt that you owe to

your self is not an asset. If it was an asset we

could create $200 trillion in the Social Security Trust Funds by giving it

$200 trillion worth of treasury bonds, thereby creating "assets" for no cost

or sacrifice to the government. The fact of the matter was that

at one point in time the Social Security Trust Funds held genuine assets

based on the contributions of employees and their employers (that FICA tax

sent to the government). But Congress in its own ignorance long ago raided

those real SS Trust Fund assets and replaced them with IOUs so it could

spend the FICA funds for other purposes. The IOUs are hardly the same type

of assets. Debt you owe yourself is not an asset and will one day have to be

replaced by genuine assets (e.g., tax increases) when the SS checks must be

sent to retirees and disabled persons.

It has, nonetheless, been argued that the

economic question is not whether the U.S. bonds held by Social Security

represent legal obligations that will be fulfilled but whether the Trust

Fund represents savings that help preclude a need to raise taxes in the

future even if current taxes collected cannot support the benefits paid.

This may not settle the economic question, however, since it has been

contended that if the government would have paid as much or more to

borrow from other sources were it not for the Fund, lower government

spending was not enabled and there was accordingly no economic

contribution to government savings. Complicating an analysis is the

point of view adopted (if the fund lends to the rest of government at a

below-market rate of interest, it represents a loss to future Social

Security beneficiaries under a narrow view, but possibly a gain under a

larger view since the government gains from the low cost funding and the

fiscal health of the government stands behind the ultimate solvency of

Social Security). Comparative borrowing assessments may also affected by

crowding out effects.

Was the money added to the fund in 1980, for

example, saved so that it could be spent on a retiring baby boomer in

2020 without a tax increase? If the only way for the federal government

to repay the bonds held by Social Security is by raising taxes in 2020,

this suggests that the excess money collected in 1980 was spent on other

government activities, not saved by Social Security. However, if bonds

are repaid by other borrowing, then the fund could be viewed as just one

of many potential lenders to the federal government. Using this point of

view, having to replace the Trust as a lender because it is recalling

its loan is not evidence that the money was simply spent, but rather

that lenders have shifted. If there are tax increases, those who believe

the trust fund is real might also note that tax increases could have

been even higher without the trust fund.

http://en.wikipedia.org/wiki/Social_Security_Trust_Fund#2011_activity_and_financial_status

Governmental accounting is mostly done with smoke and mirrors ---

http://www.trinity.edu/rjensen/Theory02.htm#GovernmentalAccounting

Lets just crank out trillions in assets for entitlement funds by

giving them unlimited treasury bonds.

Am I missing something here?

Assumption 2

Only Health Care Costs Present a Danger to the Sustainability of Economic

Prosperity Attainable Massive in Deficits and National Debt

Based on available forecasts of the federal

government’s likely spending and taxing levels, only health care costs pose

a serious danger of creating the kind of systemic crisis that could bring

down the economic system. The remainder of the federal government’s

finances, including Social Security payments during the retirement years of

the Baby Boom generation, is entirely under control, with no indication that

long-term borrowing needs would approach anything close to unsustainable

levels.

Buchanan, Page 690

Jensen Comment

Firstly, there's a huge assumption here that health care costs can be

"managed" while increasing the quality care and coverage provided to

virtually all residents of the United States. Buchanan admits there's a real

danger that real danger that rising health care costs will through a monkey

wrench into his entire thesis. And he offers no analysis of why this won't

come to pass.

Secondly, there's a huge assumption that all other government spending

will not spin out of control. But his arguments are superficial to a point

of being ludicrous. For example, to control serious inflation the Fed at

some point may have to double artificially low interest rates. Suppose that

the national debt stands at $50 trillion when interest rates averaging 3%.

If these interest rates must be doubled to 6% in an attempt to bring down

inflation, nearly all the $50 trillion will have to be rolled over at twice

the interest cost paid out to the government's creditors.

I would argue that there are many threats other than health care costs

that can spin out of control with interest on the national debt being one of

them..

And this is only one type of government expenditure that can spin out of

control

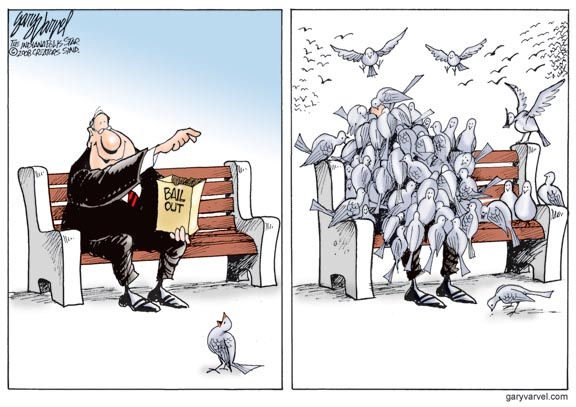

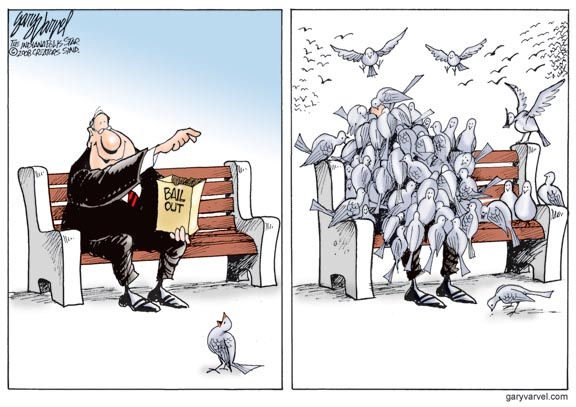

Professor Buchanan ignores that Congressional spending is heavily

impacted by lobbying interests, each of which wants more subsidies and few

of which will probably spend this money for a net increase in the GDP.

An example of how the government hands out subsidies for political rather

than economic reasons are the billions given to corn ethanol producers to

produce product that is totally unviable from an economic perspective. Even

environmentalist Al Gore admits that corn ethanol subsidies are politically

motivated disasters.

I had almost zero respect for Nobel Prize winner Al Gore's persistent

advocacy of corn ethanol that takes more energy to produce than is gained.

Also ethanol purportedly generates

twice as much

ozone as gasoline in traditional combustion engines and is absurdly

expensive to transport.

I had more respect for Al Gore after he admitted that he supported corn

ethanol subsidies for political reasons rather than either economic or

environmental reasons.

"Al Gore's Ethanol Epiphany: He concedes the industry he promoted

serves no useful purpose" The Wall Street Journal, November 22,

2010 ---

http://online.wsj.com/article/SB10001424052748703572404575634753486416076.html?mod=djemEditorialPage_t

Anyone who opposes ethanol subsidies, as these

columns have for decades, comes to appreciate the wisdom of St. Jude.

But now that a modern-day patron saint—St. Al of Green—has come out

against the fuel made from corn and your tax dollars, maybe this isn't

such a lost cause.

Welcome to the college of converts, Mr. Vice

President. "It is not a good policy to

have these massive subsidies for first-generation ethanol," Al Gore told

a gathering of clean energy financiers in Greece this week. The benefits

of ethanol are "trivial," he added, but "It's hard once such a program

is put in place to deal with the lobbies that keep it going."

No kidding, and Mr. Gore said he knows from

experience: "One of the reasons I made that mistake is that I paid

particular attention to the farmers in my home state of Tennessee, and I

had a certain fondness for the farmers in the state of Iowa because I

was about to run for President."

Mr. Gore's mea culpa underscores the degree to

which ethanol has become a purely political machine: It serves no

purpose other than re-electing incumbents and transferring wealth to

farm states and ethanol producers. Nothing proves this better than the

coincident trajectories of ethanol and Mr. Gore's career.

Continued in article

But even in these 2012 times of severe drought in the corn belt when at

last we have good reason to stop these absurd subsidies to corn ethanol

producers, we have a huge example of how hard it is to shut down a wasteful

industry that should be shut down entirely. It's just not politically

feasible to end wasteful subsidies that millions of voters have become

dependent upon over the years.

The undesirable tobacco industry is not only protected by politics it

still received government subsidies. It's virtually impossible to shut a

government subsidy program down not matter how undesirable or inefficient it

becomes.

Assumption 3

Those few instances where the government can utilize economic resources more

efficiently (than private industry) are not offset where government massively

burns up economic resources due to waste, inefficiency, and fraud.

It is important to remember, however, that the

government can sometimes use economic resources in more productive ways than

those resources would have been used by private businesses. When the

government engages in productive investment, such as building the

infrastructure that allows private commerce to flourish, that spending more

than pays for itself. For example, the best recent economic research

indicates that each dollar spent to prevent students from dropping out of

school before receiving their high school diplomas results in a return to

the government of between $1.45 to $3.55, saving approximately $90 billion

for each year that the government succeeds in halving dropout rates from

current levels.

Buchanan, pp. 691-692

Jensen Comment

Perhaps there are instances where the government can be more productive than

private industry, but private industry generally faces a market discipline

that government does not face, thereby leading to countless areas where the

government squanders resources in ways that are unimaginable in private

industry. For example, the Pentagon has no idea how much total inventory it

has or how many hundreds of billions of this inventory is lost, stolen, or

outdated. The GAO says some enormous government agencies are unauditable,

including the Pentagon and the IRS. And hence these agencies operate without

audits that make the agencies accountable for lost resources.

Thus those rare instances where the government is more productive in

terms of resources are massively overcome by instances where the government

spending is out of control A good example, is the Medicare

reimbursements to clever thieves bill the system over and over again with

phony claims such as claims for equipment and medication that never existed.

Another example, is the lifetime disability and Medicare coverage awarded to

millions of people who are not truly disabled. Still another example, is the

billions of tax refunds given to crooks with phony IDs.

And that $90 billion return arising from preventing school dropouts is

predicated on the assumption that there is a legitimate economic opportunity

for those drop outs and a great desire on their parts to be productive. Many

of those dropouts are not and never will have the aptitude or motivation or

opportunity to become anything more than they would have been without high

school diplomas that in most instances are now given out to anybody who

shows up regularly for class. That of course does not mean we should

encourage dropping out in order to be more efficient with school budgets.

I'm not saying this at all. But it's not clear that we should spend a

million dollars of government funding on each and every potential dropout.

Assumption 4

If the government were to adopt the Golden Rule in its budgeting every trillion

dollars added to the deficit will return more than a trillion dollars

With these considerations in mind, economists

have devised a budget rule that maximizes long-term economic growth, dubbing

it the “Golden Rule.” Under the Golden Rule, the federal government would

borrow money to finance its spending on productive investments, and it would

collect enough taxes to cover its other spending, including interest

payments on the debt, on a cyclically-adjusted basis—that is, after allowing

for increased deficits during economic downturns.

Buchanan, pp. 692-693

Jensen Comment

This all hinges on the assumption that there are opportunities for such

trillion dollar returns and that the government can implement this level of

spending efficiently and effectively to achieve such long-term returns. The

evidence, however, is just the opposite. Instead the government is coaxed by

hucksters to invest in enterprises only to discover, belatedly, that other

nations in the global economy are more effective and efficient in those

enterprises. An example from above are the massive subsidies given to corn

ethanol producers when in fact the sugar cane ethanol producers in Brazil

produce a sugar cane ethanol product that is much more cost effective

because sugar cane ethanol is much more chemically superior to corn ethanol.

Professor Buchanan also ignores time value of money when he throws out

the phrase "long-term." For example, investing trillions to colonize Mars or

the moon may commence to yield returns in 200 years, but in the meantime

annual interest is paid on the debt over 200 years to fund this "long-term

productive investment."

What Professor Buchanan fails to mention is that government funding often

is necessary when there are externalities that make the investments good

things for uneconomic reasons. For example, spending $1 billion per child to

develop a drug to save the lives of 100 children over a 10-year horizon may

have ethical and humane benefits but certainly not economic benefits.

The government is intended to provide funding for many good things that

would not be profitable to produce in the business world.

Professor Buchanan downplays austerity in favor of deficit financing. but

he never mentions California or the PIGS nations in Europe that have with

massive debt that has reached or nearly-reached junk status. Governments

that are not allowed to inflate their way out of debt default by printing

currency have little choice other than austerity unless they are saved by

other governments. In order to inflate its way out of default Greece, for

example, will have to withdraw from the Euro Zone and California will have

to withdraw from the Dollar Zone so they can print unlimited amounts of

their own currencies.

Professor Buchanan assumes that the National Debt of the United States

has no limits such that its possible to have no austerity and unlimited

trillions of National Debt without having to fear junk status of U.S.

Treasury bonds. I don't know any respected economist that supports this

assumption. The Fed has already purchased over $2 trillion in U.S.

Treasury bonds, which is tantamount to printing greenbacks to spend rather

than tax or borrow. Even though the government in the 1990s redefined

inflation (by throwing out food and fuel price increases) while keeping in

the depressed housing costs so as to hide how bad inflation is growing, the

economic recovery so slow that inflation has not really jumped like it will

if the Fed continues to print money when recovery finally arrives.

Assumption 5

If deficits threatening the rollover of National Debt as sustainable rates of

interest, the threat can be averted by raising taxes on the wealthy

Moreover, if the worst-case forecasts of

spiraling health care costs turn out to be true, there is nothing that could

be done elsewhere in the budget to avert catastrophe. The best long-term

path would include increased taxes on the wealthiest Americans, which would

allow the government to finance the rest of its operations (other than

health care) easily for decades to come.

Buchanan, pp. 690-691

This is the typical assumption of the liberals that the wealthy people

are a piñata that when, banked with a taxation stick, will shower down all

the money that 's needed to restore prosperity in dire times. This might've

been somewhat the case when the deficits of the U.S. were under $1

trillion. But in Buchanan's scenario that deficits can keep rising by

trillions upon trillions, it's not at all clear that confiscating the entire

incomes of high income taxpayers would even cover increased interest costs

on the debt.

At present we're already sticking it to the rich.

"CBO: The wealthy pay 70 percent of taxes," by Stephen Dinan, The

Washington Times, July 10, 2012 ---

http://www.washingtontimes.com/news/2012/jul/10/cbo-rich-pay-outsized-share-taxes/

And most other nations are finding that lowering their highest marginal

tax rates increased GDP.

Marginal Tax Rate Declines in the Rest of the World ---

http://www.econlib.org/library/Enc/MarginalTaxRates.html

Table 1 Maximum Marginal Tax

Rates on Individual Income

|

*. Hong Kong�s maximum tax (the �standard rate�) has

normally been 15 percent, effectively capping the marginal

rate at high income levels (in exchange for no personal

exemptions). |

|

**. The highest U.S. tax rate of 39.6 percent after 1993

was reduced to 38.6 percent in 2002 and to 35 percent in

2003. |

|

| |

1979 |

1990 |

2002 |

| Argentina |

45 |

30 |

35 |

| Australia |

62 |

48 |

47 |

| Austria |

62 |

50 |

50 |

| Belgium |

76 |

55 |

52 |

| Bolivia |

48 |

10 |

13 |

| Botswana |

75 |

50 |

25 |

| Brazil |

55 |

25 |

28 |

| Canada (Ontario) |

58 |

47 |

46 |

| Chile |

60 |

50 |

43 |

| Colombia |

56 |

30 |

35 |

| Denmark |

73 |

68 |

59 |

| Egypt |

80 |

65 |

40 |

| Finland |

71 |

43 |

37 |

| France |

60 |

52 |

50 |

| Germany |

56 |

53 |

49 |

| Greece |

60 |

50 |

40 |

| Guatemala |

40 |

34 |

31 |

| Hong Kong |

25* |

25 |

16 |

| Hungary |

60 |

50 |

40 |

| India |

60 |

50 |

30 |

| Indonesia |

50 |

35 |

35 |

| Iran |

90 |

75 |

35 |

| Ireland |

65 |

56 |

42 |

| Israel |

66 |

48 |

50 |

| Italy |

72 |

50 |

52 |

| Jamaica |

58 |

33 |

25 |

| Japan |

75 |

50 |

50 |

| South Korea |

89 |

50 |

36 |

| Malaysia |

60 |

45 |

28 |

| Mauritius |

50 |

35 |

25 |

| Mexico |

55 |

35 |

40 |

| Netherlands |

72 |

60 |

52 |

| New Zealand |

60 |

33 |

39 |

| Norway |

75 |

54 |

48 |

| Pakistan |

55 |

45 |

35 |

| Philippines |

70 |

35 |

32 |

| Portugal |

84 |

40 |

40 |

| Puerto Rico |

79 |

43 |

33 |

| Russia |

NA |

60 |

13 |

| Singapore |

55 |

33 |

26 |

| Spain |

66 |

56 |

48 |

| Sweden |

87 |

65 |

56 |

| Thailand |

60 |

55 |

37 |

| Trinidad and Tobago |

70 |

35 |

35 |

| Turkey |

75 |

50 |

45 |

| United Kingdom |

83 |

40 |

40 |

| United States |

70 |

33 |

39** |

|

| Source:

PricewaterhouseCoopers; International Bureau of Fiscal

Documentation. |

Jensen Conclusion

It's easy to understand why Professor Buchanan is a law school professor and not

a professor of economics. I don't know of a single economist who advocates never

running (at least in part) the national debt.

"Why 'New York Times' Economist Paul Krugman Is Partly Right But Mostly Wrong,"

by Michael T. Snyder, Seeking Alpha, May 3, 2012 ---

http://seekingalpha.com/article/556041-why-new-york-times-economist-paul-krugman-is-partly-right-but-mostly-wrong

In recent days, New York Times economist Paul

Krugman has been doing a whole bunch of interviews in which he has declared

that the solution to our economic problems is very easy. Krugman says that

all we need to do to get the global economy going again is for the

governments of the world to start spending a lot more money.

Krugman believes that austerity is only going to

cause the economies of the industrialized world to slow down even further

and therefore he says that it is the wrong approach. And you know what?

Krugman is partly right about all of this. The false prosperity that the

United States and Europe have been enjoying has been fueled by unprecedented

amounts of debt, and in order to maintain that level of false prosperity we

are going to need even larger amounts of debt. But there are several reasons

why Krugman is mostly wrong.

First of all, we have not seen any real "austerity"

yet. Even though there have been some significant spending cuts and tax

increases over in Europe, the truth is that nearly every European government

is still piling up more debt at a frightening pace. Here in the United

States, the federal government continues to spend more than a trillion

dollars a year more than it brings in. If the United States were to go to a

balanced federal budget, that would be austerity.

What we have now is wild spending by the federal

government beyond anything that John Maynard Keynes ever dreamed of.

Secondly, Krugman focuses all of his attention on making things more

comfortable for all of us in the short-term without even mentioning what we

might be doing to future generations. Yes, more government debt would give

us a short-term economic boost, but it would also make the long-term

financial problems that we are passing on to our children even worse.

It is important to understand that Paul Krugman is

a hardcore Keynesian. He believes that national governments can solve most

economic problems simply by spending more money. His prescription for the

U.S. economy in 2012 was summarized in a recent

Rolling Stone article:

The basic issue, says Krugman, is a lack of

demand. American consumers and businesses, aren't spending enough, and

efforts to get them to open their wallets have gone nowhere. Krugman's

solution: The federal government needs to step in and spend. A lot. On

debt relief for struggling homeowners; on infrastructure projects; on

aid to states and localities; on safety-net programs. Call it "stimulus"

if you like. Call it Keynesian economics, after the great economic

thinker (and Krugman idol) John Maynard Keynes, who first championed the

idea that government has an essential role in saving the free market

from its own excesses.

So, is Krugman right? Would the U.S. economy

improve if the federal government borrowed and spent an extra half a

trillion dollars this year for example? Yes, it would. But it would also get

us half a trillion dollars closer to bankruptcy as a nation.

Krugman claims that "austerity" has failed, but the

truth is that we have not even seen any real "austerity" yet. When a

government spends more than it brings in, that is not real austerity. People

talk about the "austerity" that we have seen in places such as Greece and

Spain, but the truth is that both nations are still piling up huge amounts

of new debt. So let's not pretend that the western world is serious about

austerity.

The goal for most European nations at this point is

to get their debts down to "sustainable" levels. But for economists such as

Krugman, this is a very bad idea. Krugman insists that cutting government

spending during a recession is a very stupid thing to do. The following is

from one of his recent articles

in the New York Times:

For the past two years most policy makers in

Europe and many politicians and pundits in America have been in thrall

to a destructive economic doctrine. According to this doctrine,

governments should respond to a severely depressed economy not the way

the textbooks say they should — by spending more to offset falling

private demand — but with fiscal austerity, slashing spending in an

effort to balance their budgets.

Critics warned from the beginning that

austerity in the face of depression would only make that depression

worse. But the “austerians” insisted that the reverse would happen. Why?

Confidence! “Confidence-inspiring policies will foster and not hamper

economic recovery,” declared Jean-Claude Trichet, the former president

of the European Central Bank — a claim echoed by Republicans in Congress

here. Or as I put it way back when, the idea was that the confidence

fairy would come in and reward policy makers for their fiscal virtue.

Yes, Krugman is correct that government austerity

measures will only make a recession worse. Just look at what has happened in

Greece. Wave after wave of austerity measures has pushed Greece into an

economic depression. If you want to see what austerity has done to the

unemployment rate in Greece, just check out

this chart.

As other nations across Europe have taken measures

to get debt under control, we have seen similar economic results all across

the continent. The overall unemployment rate in the eurozone has hit

10.9 percent which is a new all-time high, and

youth unemployment rates throughout Europe are

absolutely skyrocketing.

Right now there are already

12 countries in Europe that are officially in a

recession, and in many European nations manufacturing activity

is slowing down dramatically. So, yes, austerity

is not helping short-term economic conditions in Europe.

But what are the nations of the western world

supposed to do? According to Krugman, they are supposed to run up gigantic

amounts of new debt indefinitely. And that is what the United States is

doing right now. But at some point the clock strikes midnight and all of a

sudden you have become the "next Greece". U.S. government debt is already

rising much, much faster than U.S. GDP is.

Between 2007 and 2010, U.S. GDP grew by only 4.26

percent, but the U.S. national debt soared

by 61 percent during that same time period. Today,

the U.S. national debt is equivalent to

101.5 percent of U.S. GDP. But Paul Krugman does

not consider this to be a major problem.

The Obama administration is currently stealing

approximately

150 million dollars from our children and our

grandchildren every single hour to finance our reckless spending, but for

Paul Krugman that is not nearly good enough. To Krugman, the only thing that

is important is what is happening right now. Apparently the future can be

thrown into the toilet as far as he is concerned.

The founder of PIMCO, Bill Gross, told CNBC on

Tuesday that the U.S. government is likely to be hit with

another credit rating downgrade this year if

something is not done about our exploding debt.

The United States already has more government debt

per capita than Greece, Portugal, Italy, Ireland

or Spain does. But Krugman insists that the solution to our economic

problems is even more debt and even more spending.

In a previous article, I detailed how

we are doomed if the U.S. government keeps

spending money wildly like this and

we are doomed if the

U.S. governments stops spending money wildly like this.

If we keep running trillion dollar deficits every

year, at some point our financial system will collapse, the U.S. dollar

will fail, and we

will essentially be facing national bankruptcy.

But if the federal government stops borrowing and

spending money like this, our debt-fueled prosperity will rapidly disappear,

unemployment will shoot well up into double digits, and we will soon have

mass rioting in major U.S. cities.

The truth is that we have already been following

Paul Krugman's economic prescription for the nation for decades. Our

15 trillion dollar party has funded a standard of

living unlike anything the world has ever seen, but the party is coming to

an end.

The Federal Reserve is trying to keep the party

going by buying up huge amounts of government debt. The Fed actually

purchased approximately

61 percent of all government debt issued by the

U.S. Treasury Department in 2011.

It is a shell game that cannot go on for too much

longer. The

national debt crisis can be delayed for a while,

but at some point the house of cards is going to come crashing down on top

of us all.

"Pending Collapse of the United

States" ---

http://www.trinity.edu/rjensen/entitleme

"TOP TEN MYTHS OF MEDICARE," by Richard L. Kaplan, The Elder Law Journal,

Vol. 20, No.1, 2012 ---

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2111535

In the context of changing demographics, the

increasing cost of health care services, and continuing federal budgetary

pressures, Medicare has become one of the most controversial federal

programs. To facilitate an informed debate about the future of this

important public initiative, this article examines and debunks the following

ten myths surrounding Medicare: (1) there is one Medicare program, (2)

Medicare is going bankrupt, (3) Medicare is government health care, (4)

Medicare covers all medical cost for its beneficiaries, (5) Medicare pays

for long-term care expenses, (6) the program is immune to budgetary

reduction, (7) it wastes much of its money on futile care, (8) Medicare is

less efficient than private health insurance, (9) Medicare is not

means-tested, and (10) increased longevity will sink Medicare.

Jensen Comment

I don't agree with every conclusion in this paper, but it is one of the best

summaries of Medicare that I can recommend.

Waste, Fraud, and Abuse: The gap between

payments and payees in Medicare makes it a criminal's piñata

It should be emphasized at the outset that this

contention is not about the ever-present specter of “waste, fraud, and

abuse” that haunts governmental programs generally. That Medicare is

targeted by scammers and schemers of all sorts is both indisputable and

hardly surprising. As the famed bank robber, Willie Sutton, reportedly

replied when asked why he robbed banks: “That’s where the money is.”101

Indeed, Medicare is where the money is—specifically $509 billion in fiscal

year 2010 alone.102 Any program that pays out this amount of money to a wide

variety of service providers in literally every county in America will be

very difficult to police. That reality notwithstanding, such violations of

the public trust as are encapsulated in the phrase “waste, fraud, and abuse”

should be ferreted out whenever possible and eliminated. No one excuses

these leakages, just as no one has a sure-fire solution to stem them once

and for all.

Kaplan, Page 19

One thing to think about is why

Medicare may be losing hundreds of billions of dollars relative to the national

health care plans of Canada, Europe, etc. The obvious thing to pick on is that

Medicare is a third party payment system where medical services, medications,

equipment such as battery-powered scooters and home hospital beds, and medical

care centers are not directly managed by the government. This opens the

door to millions of fraudulent claims, often by extremely clever criminals,

unscrupulous physicians, etc. The gap between payments and payees in Medicare

makes it more vulnerable to abuse and waste.

This and other articles make a

big deal about how administrative costs of Medicare are significantly less that

the administrative costs of private insurance carriers like Blue Cross. However,

what this article and related articles almost always fail to mention is that the

major component of administrative cost to companies like Blue Cross lies in

operating controls to prevent waste, fraud, and abuse.

National plans like those in

Canada have both lower administrative costs and less waste, fraud, and abuse

because the government provides most of the services directly without the moral

hazards that arise from the gap between funding and delivery of services.

Personally, I favor national plans. Of course, in some nations like Germany

there are premium alternatives where people that can afford it can pay for

premium services not covered in the national plans.

http://www.trinity.edu/rjensen/Health.htm

Futile Care Waste: My

former University of Maine colleague was given thirty days to live (because of

Stage Four bone cancer) received two new hips but never walked again and died in

less than two weeks

But the issue of “futile care” is very different

from “waste, fraud, and abuse.” The claim that Medicare should not pay for

pointless medical interventions presumes that funds were indeed spent on

actual medical procedures. The issue is whether those procedures should not

have been done for reasons of inefficacy or insufficient “bang for the

buck.” It is certainly true that Medicare spends a disproportionate amount

of its budget on treatments in the final months of its beneficiaries’ lives.

Some twenty-eight percent of the entire Medicare budget is spent on medical

care in enrollees’ final year of life,103 and nearly forty percent of that

amount is spent during a patient’s last month. The critical issue, of

course, is whether these expenditures are pointless.

In one respect, it is not surprising that the cost

of a person’s final medical episode is unusually expensive. That person’s

presenting condition must have been especially severe because he or she did

in fact die during or shortly after treatment. Moreover, when circumstances

are particularly bleak, more intensive and often much more expensive

procedures, tests, and interventions seem appropriate. After all, the

patient was literally fighting off death at that point, so medical personnel

try everything in their armamentarium to win what was ultimately the

patient’s final battle. Only after the fact does one know that the battle in

question was indeed the patient’s last episode. Does that mean that the

effort expended, and the attendant costs, were wasted?

This question is more difficult than some might

suspect. A recent study of Medicare claims data examined the association

between inpatient spending and the likelihood of death within thirty days of

a patient’s being admitted to a hospital.It found that for most of the

medical conditions examined, including surgery, congestive heart failure,

stroke, and gastrointestinal bleeding, a ten percent increase in inpatient

spending was associated with a decrease in mortality within thirty days of

3.1 to 11.3%, depending upon the specific medical condition in question.

Only for patients who presented with acute myocardial infarction was there

no association of increased inpatient spending and improved outcomes. Thus,

the authors concluded, “the amount [of waste] may not be as large as

commonly believed, at least for hospitalized Medicare patients.” To be sure,

the results might not be as encouraging in non-hospital settings, but

Medicare does not cover the cost of nursing home patients who are lingering

at death’s door while receiving “custodial care.”In any case, hospital costs

represent the single largest component of Medicare’s expenditures— fully

twenty-seven percent in the most recent year for which such data are

available.

That is not to say that some of Medicare’s

expenditures near the end of beneficiaries’ lives provide insufficient

benefit to justify their cost. But the tough questions are how to determine

those wasteful expenditures in advance and who should make that

determination. Such considerations are beyond the scope of this Article,but

suffice it to note that end-of-life care discussions are extraordinarily

contentious and easily demagogued. After all, former Vice Presidential

candidate Sarah Palin effectively scuttled a rather benign effort to include

payment for end-of-life counseling in Medicare’s newly provided “annual

wellness visit[s]” by contending that such counseling was a first step to

rationing health care by “death panels” run by government bureaucrats. Thus,

while patients can individually indicate in advance how much treatment they

want at the end of their lives, any comprehensive effort to root out

Medicare’s wasteful expenditures on “futile care” might face serious

political opposition.

In any case, an authoritative analysis published in

The New England Journal of Medicine concluded that “the hope of

cutting the amount of money spent on life-sustaining interventions for the

dying in order to reduce overall health care costs is probably vain.” The

authors noted that “there are no reliable ways to identify the patients who

will die” and that “it is not possible to say accurately months, weeks, or

even days before death which patients will benefit from intensive

interventions and which ones will receive ‘wasted’ care.” That leaves

age-based rationing of care or more precisely, denial of medical services on

the basis of chronological age, as the only easily implemented pathway to

eliminate what some might regard as inefficacious expenditures of medical

resources. Such age-based rationing of health care is practiced in other

national health care systems, even though studies of prognostic models have

demonstrated that “age alone is not a good predictor of whether treatment

will be success ful.” In any case, polls of Americans have shown little

support and significant opposition to the concept. One survey undertaken in

late 1989 sought agreement with the following statement: “Lifeextending

medical care should be withheld from older patients to save money to help

pay for the medical care of younger patients.” Only 5.7% of respondents

under age sixty-five strongly agreed with this statement while 38.3% of that

group strongly disagreed with it.120 Interestingly, among respondents who

were themselves age sixty-five and older, the gap between these opposing

viewpoints was narrower: 8.8% strongly agreed with the statement in question

while 35.4% strongly disagreed.

Whether results would be substantially different

today when the range of medical interventions has increased significantly

and when the nation’s budgetary situation has worsened considerably is an

open question. Yet, when the 2010 health care reform legislation created an

Independent Payment Advisory Board to reduce Medicare’s expenses, the

enabling statute was explicit that this Board may not make proposals that

would “ration health care.” Clearly, the prospect of eliminating Medicare

expenditures that are medically futile will not be an easy task to

accomplish.

Kaplan, pp. 19-22

Jensen Comment

My former University of Maine

colleague on Medicare was given thirty days to live (because of Stage Four bone

cancer) received two new hips but never walked again and died in less than two

weeks. I don't think he would've received those two useless and very expensive

hips on any of the national plans of Canada or Europe.

Where Did Medicare Go So Wrong?

Medicare is a much larger and much more complicated entitlement burden relative

to Social Security by a ratio of about six to one or even more. The Medicare

Medical Insurance Fund was established under President Johnson in1965.

Note that Medicare, like Social Security in general, was intended to be

insurance funded by workers over their careers. If premiums paid by workers and

employers was properly invested and then paid out after workers reached

retirement age most of the trillions of unfunded debt would not be precariously

threatening the future of the United States. The funds greatly benefit when

workers die before retirement because all that was paid in by these workers and

their employers are added to the fund benefits paid out to living retirees.

The first huge threat to sustainability arose beginning in 1968 when medical

coverage payments payments to surge way above the Medicare premiums collected

from workers and employers. Costs of medical care exploded relative to most

other living expenses. Worker and employer premiums were not sufficiently

increased for rapid growth in health care costs as hospital stays surged from

less than $100 per day to over $1,000 per day.

A second threat to the sustainability comes from families no longer concerned

about paying up to $25,000 per day to keep dying loved ones hopelessly alive in

intensive care units (ICUs) when it is 100% certain that they will not leave

those ICUs alive. Families do not make economic choices in such hopeless cases

where the government is footing the bill. In other nations these families are

not given such choices to hopelessly prolong life at such high costs. I had a

close friend in Maine who became a quadriplegic in a high school football game.

Four decades later Medicare paid millions of dollars to keep him alive in an ICU

unit when there was zero chance he would ever leave that ICU alive.

On November 22, 2009 CBS Sixty Minutes aired a video featuring experts

(including physicians) explaining how the single largest drain on the Medicare

insurance fund is keeping dying people hopelessly alive who could otherwise be

allowed to die quicker and painlessly without artificially prolonging life on

ICU machines.

"The Cost of Dying," CBS Sixty Minutes Video, November 22, 2009

---

http://www.cbsnews.com/stories/2009/11/19/60minutes/main5711689.shtml?tag=mncol;lst;1

What is really sad is the way Republicans are standing in the way of making

rational cost-benefit decisions about dying by exploiting the "Kill Granny"

political strategy aimed at killing a government option in health care reform.

See the "Kill Granny" strategy at ---

www.defendyourhealthcare.us

The third huge threat to the economy commenced in when disabled persons

(including newborns) tapped into the Social Security and Medicare insurance

funds. Disabled persons should receive monthly benefits and medical coverage

in this great land. But Congress should've found a better way to fund disabled

persons with something other than the Social Security and Medicare insurance

funds. But politics being what it is, Congress slipped this gigantic

entitlement through without having to debate and legislate separate funding for

disabled persons. And hence we are now at a crossroads where the Social Security

and Medicare Insurance Funds are virtually broke for all practical persons.

Most of the problem lies is Congressional failure to sufficiently increase

Social Security deductions (for the big hit in monthly payments to disabled

persons of all ages) and the accompanying Medicare coverage (to disabled people

of all ages). The disability coverage also suffers from widespread fraud.

Other program costs were also added to the Social Security and Medicare

insurance funds such as the education costs of children of veterans who are

killed in wartime. Once again this is a worthy cause that should be funded. But

it should've been separately funded rather than simply added into the Social

Security and Medicare insurance funds that had not factored such added costs

into premiums collected from workers and employers.

The fourth problem is that most military retirees are afforded full lifetime

medical coverage for themselves and their spouses. Although they can use

Veterans Administration doctors and hospitals, most of these retirees opted for

the underfunded

TRICARE plan the pushed most of the hospital and physician costs onto the

Medicare Fund. The VA manages to push most of its disabled veterans onto the

Medicare Fund without having paid nearly enough into the fund to cover the

disability medical costs. Military personnel do have Medicare deductions from

their pay while they are on full-time duty, but those deductions fall way short

of the cost of disability and retiree medical coverage.

The fifth threat to sustainability came when actuaries failed to factor in

the impact of advances in medicine for extending lives. This coupled with the

what became the biggest cost of Medicare, the cost of dying, clobbered the

insurance funds. Surpluses in premiums paid by workers and employers disappeared

much quicker than expected.

A sixth threat to Medicare especially has been widespread and usually

undetected fraud such as providing equipment like motorized wheel chairs to

people who really don't need them or charging Medicare for equipment not even

delivered. There are also widespread charges for unneeded medical tests or for

tests that were never really administered. Medicare became a cash cow for

crooks. Many doctors and hospitals overbill Medicare and only a small proportion

of the theft is detected and punished.

The seventh threat to sustainability commenced in 2007 when the costly

Medicare drug benefit entitlement entitlement was added by President George W.

Bush. This was a costly addition, because it added enormous drains on the fund

by retired people like me and my wife who did not have the cost of the drug

benefits factored into our payments into the Medicare Fund while we were still

working. It thus became and unfunded benefit that we're now collecting big time.

In any case we are at a crossroads in the history of funding medical care in

the United States that now pays a lot more than any other nation per capita and

is getting less per dollar spent than many nations with nationalized health care

plans. I'm really not against Obamacare legislation. I'm only against the lies

and deceits being thrown about by both sides in the abomination of the current

proposed legislation.

Democrats are missing the boat here when they truly have the power, for now

at least, in the House and Senate to pass a relatively efficient nationalized

health plan. But instead they're giving birth to entitlements legislation that

threatens the sustainability of the United States as a nation.

In any case, The New York Times presents a nice history of other

events that I left out above ---

http://www.nytimes.com/interactive/2009/07/19/us/politics/20090717_HEALTH_TIMELINE.html

"THE HEALTH CARE DEBATE: What Went Wrong? How the Health Care Campaign

Collapsed --

A special report.; For Health Care, Times Was A Killer," by Adam Clymer, Robert

Pear and Robin Toner, The New York Times, August 29,

1994 ---

Click Here

http://www.nytimes.com/1994/08/29/us/health-care-debate-what-went-wrong-health-care-campaign-collapsed-special-report.html

November 22, 2009 reply from Richard.Sansing

[Richard.C.Sansing@TUCK.DARTMOUTH.EDU]

The electorate's inability to debate trade-offs in

a sensible manner is the biggest problem, in my view. See

http://www.washingtonpost.com/wp-dyn/content/article/2009/11/19/AR2009111904053.html?referrer=emailarticle

Richard Sansing

The New York Times Timeline History of Health Care Reform in the

United States ---

http://www.nytimes.com/interactive/2009/07/19/us/politics/20090717_HEALTH_TIMELINE.html

Click the arrow button on the right side of the page. The biggest problem with

"reform" is that it added entitlements benefits without current funding such

that with each reform piece of legislation the burdens upon future generations

has hit a point of probably not being sustainable.

Call it the fatal arithmetic of imperial decline.

Without radical fiscal reform, it could apply to America next.

Niall Ferguson, "An Empire at Risk: How Great Powers Fail," Newsweek

Magazine Cover Story, November 26, 2009 ---

http://www.newsweek.com/id/224694/page/1

. . .

In other words, there is no end in sight to the

borrowing binge. Unless entitlements are cut or taxes are raised, there will

never be another balanced budget. Let's assume I live another 30 years and

follow my grandfathers to the grave at about 75. By 2039, when I shuffle off

this mortal coil, the federal debt held by the public will have reached 91

percent of GDP, according to the CBO's extended baseline projections.

Nothing to worry about, retort -deficit-loving economists like Paul Krugman.

. . .

Another way of doing this kind of exercise is to

calculate the net present value of the unfunded liabilities of the Social

Security and Medicare systems. One recent estimate puts them at about

$104 trillion, 10

times the stated federal debt.

Continued in article

This is now President Obama's problem with or without new Obamacare

entitlements that are a mere drop in the bucket compared to the entitlement

obligations that President Obama inherited from every President of the United

States since FDR in the 1930s. The problem has been compounded under both

Democrat and Republican regimes, both of which have burdened future generations

with entitlements not originally of their doing.

Professor Niall Ferguson and David Walker are now warning us that by year

2050 the American Dream will become an American Nightmare in which Americans

seek every which way to leave this fallen nation for a BRIC nation offering some

hope of a job, health care, education, and the BRIC Dream.

Bob Jensen's threads on health care ---

http://www.trinity.edu/rjensen/Health.htm

Bob Jensen's threads on entitlements ---

http://www.trinity.edu/rjensen/entitlements.htm

Debt ---

http://en.wikipedia.org/wiki/Debt

History of Money and Debt ---

http://en.wikipedia.org/wiki/History_of_money

Debt (booked by accountants) versus Entitlements (promises made that are not

yet booked) ---

http://en.wikipedia.org/wiki/Entitlement

"We've Always Been Deadbeats Debt is not a new American way," by Scott

Reynolds Nelson, Chronicle of Higher Education, September 10, 2012 ---

http://chronicle.com/article/Borrowed-Dreams/134146/

My father was a repo man. He did not look the part,

which made him all the more effective. He alternately wore a long mustache

or a shaggy beard and owned bell-bottoms in black, blue, and cherry red. His

imitation-silk shirts were festooned with city maps, cartoon characters, or

sailing ships. Dad sang in the car, at the top of his lungs, mostly obscure

show tunes. His white Dodge Dart had Mach 1 racing stripes that he had

lifted from a souped-up Ford Mustang. The "deadbeats" saw him coming, that's

for sure, but they did not understand his profession until he walked into

their homes and took away their televisions.

Dad worked for Woolco, a company that lent

appliances on an installment plan. When borrowers failed to pay, ignored the

letters and phone calls, my father would come by. He often posed as a meter

reader or someone with a broken-down car. If he saw a random object lying

abandoned in the yard, he would pick it up and bring it to the door as if he

were returning it. He was warm and funny, charming, but pushy. He did not

carry a gun, but he was fearless under pressure and impervious to verbal

abuse. If the door opened, he was inside; if he was inside, he shortly had

his hands on the appliance; the rest was bookkeeping.

. . .

In each case, lenders had created complex financial

instruments to protect themselves from defaulters like the ones I watched

from the car. And in each case, the very complexity of the chain of

institutions linking borrowers and lenders made it impossible for those

lenders to distinguish good loans from bad.

In 1837, for example, banks in the north of England

discovered that the unpaid "cotton bills of exchange" in their vaults made

them the indirect owners of slaves in Mississippi. In 2007, shareholders in

DBS, the largest bank in Singapore, found themselves part owners of homes

facing foreclosure in California, Florida, and Nevada. In both cases,

efficient foreclosure proved impossible.

In those crashes in America's past, perhaps a repo

man in a Dodge Dart with a million gallons of gas could have visited every

debtor, edged his way in, and decided who was good for it. (My dad did

accept cash or money orders for Woolco's goods.) But big lenders have

neither the time nor the capacity to act with the diligence of a repo man.

Instead, such lenders (let's agree to call them all banks) try to unload

debts, hide from their own creditors, go into bankruptcy, and call on state

and federal institutions for relief. Banks have also routinely overestimated

the collateral—the underlying asset—for the loans they hold. When those

debts go unpaid or appear unpayable, banks quickly withdraw lending; the

teller's window slams shut. A crisis on Wall Street becomes a crisis on Main

Street. Money is tight. Loans are impossible: Crash.

***

Scholarship on these financial downturns has its

own long and checkered past.

From the 1880s to the 1950s, scholars told the

history of the nation's economic downturns as the history of banks. Such an

approach was not entirely wrong, but it tended to focus on big personalities

like J.P. Morgan or New York institutions; it tended to ignore the farmers,

artisans, slaveholders, and shopkeepers whose borrowing had fed the booms

and busts.

Then, in the 1960s and 1970s, the so-called new

economic historians (or cliometricians) came along with a different story.

Using state and federal data, they tried to build mathematical models of the

nation's financial health. Moving beyond banks, they emphasized what they

termed the "real economy," by which they meant measurable indices of growth

and profit. Taking the nation's health like a simple temperature reading,

they used gross domestic product, gross income, or collective return on

investment. Of course, none of those figures had been measured directly

before the 1930s, and so the prognoses tended to vary widely.

Such economic models of financial health, however

scientific they looked, tended to be abstract representations of an economy

that was, in fact, more complex and more interconnected than they pictured.

The models, for example, often assumed that old banks were like modern

banks, sharing common accounting principles, or that because banks first

issued credit cards in the 1960s, they offered no consumer credit before

then. Drilling into historical documents for seemingly relevant numbers,

then plugging those numbers into a model of a world they understood rather

than the economy they sought to describe, the cliometricians often produced

ahistorical work. Hence, one economic historian assumed that American

barrels of flour sent to New Orleans were consumed in the South, though most

were bound for re-export to the Caribbean. Another calculated that railroads

played little role in America's economic booms by modeling a scenario in

which canals could have (somehow) crossed the arid plains into the Sierra

Nevada mountains.

Bear in mind, that same kind of intellectual hubris

about models of economic behavior had awful effects in the recent past.

Around 2000, Barclays Bank borrowed a simple diffusion model from physics

(called the "Gaussian copula function") to suggest that foreclosures would

have a relatively small effect on nearby property values. Economists tested

it with two years of foreclosure and price data and agreed. Billions of

investment in real-estate followed, often in indirect markets like

real-estate derivatives and collateralized debt obligations. By 2008 the

model proved shockingly inaccurate.

If some historians focused on the temperature of

the "real economy," economists were becoming obsessed with the money supply

as the single factor explaining most American panics. Again, a certain kind

of blindness to the history of debt and deadbeats ensued. The most important

book here was Milton Friedman and Anna Jacobson Schwartz's seminal A

Monetary History of the United States, 1867-1960 (1963). It urged economists

to steer away from stories of speculation spun out by Keynesians like John

Kenneth Galbraith.

How, according to Friedman and Schwartz, can we

separate speculation and investment? All loans are risky. The riskier they

are, the higher the return. Some investments will fail. Markets need to

clear, and those buyers who come along to sweep up bargains are not ruthless

profiteers but simply maximizers who make markets work. Thus, the pair

steered economists away from problems of risk and toward the problems of

state intervention. They were the prophets of financial deregulation.

Their story about past financial panics had the

advantage of suggesting simple solutions: Use the Federal Reserve to inflate

or deflate the currency. For them, financial crises were mostly monetary.

Thus, the 1929 downturn started with a financial shock and then was

prolonged by an overly tight monetary policy. After A Monetary History

became gospel, economics textbooks dropped their numerous chapters on

financial panics because the policy solution became so clear; economists

trained after 1965 know little about financial downturns before the Great

Depression.

Yet a tripling of the money supply has still not

fully pulled the United States and the rest of the world out of our current

financial crisis—suggesting that our problems, and all the previous ones,

were not just monetary. My dad would have pointed out that economists have

misunderstood the problem. Crises are mostly about productive assets—the

promises in his trunk.

Social historians (and I count myself among them)

tell a very different story about financial panics, but we have our own

blind spots. Since the late 1960s, we have often discussed the American

economy as if farmers were coherent families of self-sufficient yeomen

surprised by the market economy. That story of a sudden revolution misses

the early and intimate relationship between Americans and credit. It

overlooks how American stores provided consumer credit to farmers,

plantations owners, and renters who settled the West.

Thus, American social historians have used the term

"market revolution" to describe the period after the 1819 panic. Accordingly

market forces rushed in as repo men like my dad became vanguards of a new

capitalist order. The financial jeremiads of Jacksonian Democrats of the

1820s and 30s against bankers and paper money became the natural outgrowth

of frontier farmers' anger at a capitalism they had never seen before. But

the store system of Andrew Jackson's day borrowed practices from the

colonial store system that goes back to the 17th century, if not earlier. It

was how the fur-trading and East and West India companies prospered. John

Jacob Astor and Andrew Jackson were cut from the same cloth. They made their

fortunes from their stores, and their store system made settlement possible.

Part of the reason we overlook the importance of

credit in American history is our continued attachment to Marx's divide

between precapitalist and capitalist forms of agriculture. That misses the

relationship between farming and credit for most of the people who settled

America. The more I study panics, the more I am persuaded that the pioneer

American institution of the 18th and early 19th centuries was not the

homestead or the trapper's shack but the store, an institution that sold

foreign goods to farmers on credit, taking payment in easily movable settler

products like furs, potash, barrel hoops, and butter.

Rather than imagining some golden age of

subsistence, scholars in the Marxist tradition should look more closely at

anticapitalist movements in the wake of panics. I include here not just the

utopian and religious communities like Quakers, Shakers, and Oneidans but

also the early Mormons, the Grangers, and the Populists. Those people

understood what it meant for banks, and then railroads, to extend credit

through stores. Often regarding capital as a collective inheritance, they

built their own associations to replace such institutions of credit (and the

railroad was an institution of credit) with locally managed cooperatives

that distributed agricultural benefits in a way that served the broader

community. The temple, the elevator, and the cooperative were attempts to

break the chain of debt without demonizing capital.

From the perspective of business history, Joseph A.

Schumpeter argued that business-cycle downturns came from periods of

"creative destruction" in which new technologies undermined old ones.

Outdated technologies, with millions invested in them, became instantly

obsolete, leading to financial failures that cascaded to other industries.

While Schumpeter, who died in 1950, once persuaded me, I think there is a

mechanistic fallacy in the argument. Railroads, for example, have taken the

blame for the 1857, 1873 and 1893 downturns. While there may be something

there, the whole account seems reductive and technologically determinist.

For example, canals, the Bessemer process, fractional distillation of oil,

and washing machines are all revolutionary technologies that flourished

during the American panics, not before them. They did sweep away older

technologies, but rather than causing panics those technologies benefited by

the uncertainty that panic created.

In a very different camp, neo-Marxists like

Giovanni Arrighi and David Harvey betray a similar kind of reductive

history, a latter-day Schumpeterianism. Their work posits a "spatial fix," a

center of capitalism that then organizes and draws tribute from the rest of

the world. For the late Arrighi, it was a kind of pump that sucked assets

from elsewhere as states were forming throughout the sweep of centuries. For

Harvey it is an investment in a capital city (Amsterdam, London, New York)

and a new communication technology (telegraph, telephone, the Internet) that

drew higher profits from everywhere else. Dutch and British hegemony became

American hegemony after World War II. That suggests that these scholars have

not really considered the tremendous influence of the U.S. Federal Reserve

in reorienting international trade between 1913 and the 1920s. Their story

seems more or less political to me: American empire comes when Americans

claim victory in World War II. The economic material seems to be used in the

service of a story about the rise and decline of empires.

If we follow the money, the American empire emerged

during World War I, when the international flow of debt changed drastically.

For Arrighi and Harvey, the International Monetary Fund and the World Bank

are the pathbreakers of financial empire. But it is worth remembering that

those institutions were explicitly designed to restrain the dirty tricks of

financial empires of the 1920s and 1930s: No more American banks using

gunboat diplomacy in Peru; no more Germans sending tanks into Poland to

collect unpaid debts.

***

As a historian, I have learned the most about

financial disasters from long-dead historians whose work blended primary,

secondary, and quantitative material. Rosa Luxemburg, William Graham Sumner,

Frank W. Taussig, and Charles Kindleberger would never have agreed about

anything. Luxemburg, a renegade Marxist who read in five languages,

described how the dangerous mix of a hierarchical production process with

the anarchy of international trade could lead manufacturers to block free

trade and embrace higher prices for their raw materials in the wake of a

panic. Sumner, a laissez-faire Social Darwinist who argued that income

inequality benefited society, carefully explained how drastic economic

changes could follow from tiny changes in international trade deals. Put in

a room together, each would have retreated to a corner to begin throwing

furniture. But they and the others were storytellers who used a mixture of

sources. Telling a story by looking through the trunk of assets and watching

the damage afterward makes more sense to me than simple models of financial

contagion, money supply, technological watersheds, or global fixes.

My father died before I started writing about

financial panics, but my thoughts have grown out of our 30-year-long

argument about financial downturns. Not surprisingly, he disliked

"deadbeats," seeing them as the people whose false promises weakened our

country. He probably had a point, and no doubt the executives of Woolco

would agree. But I find much in them to admire, for defaulters are often

dreamers. Viewing America's financial panics through the lens of numerous

unfulfilled and forgotten debts that even the oldest banker cannot possibly

remember can afford a perspective my dad would have appreciated: with my

view from the Dodge Dart, the minute he rang the doorbell, when both debtor

and creditor prepared their stories.

Scott Reynolds Nelson is a professor of history at the College of

William and Mary. His book A Nation of Deadbeats: An Uncommon History of

America's Financial Disasters has just been published by Alfred A. Knopf.

Video

"Debt: The First 5,000 Years," by Paul Kedrosky , Kedrosky.com, September

10, 2011 ---

Click Here

http://paul.kedrosky.com/archives/2011/09/debt-the-first-5000-years.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+InfectiousGreed+%28Paul+Kedrosky%27s+Infectious+Greed%29

Debt versus Equity ---

http://www.trinity.edu/rjensen/Theory02.htm#FAS150

The booked National

Debt in August 2012 went over $16 trillion ---

U.S. National Debt Clock ---

http://www.usdebtclock.org/

Also see

http://www.brillig.com/debt_clock/

The unbooked entitlements have a present value between $80 and $100 trillion.

But who's counting?

Pending Collapse of the United States ---

http://www.trinity.edu/rjensen/Entitlements.htm

Should we never pay down (even partly) the U.S. National Debt or

Spending Deficit? ---

http://www.cs.trinity.edu/~rjensen/temp/NationalDeficit-Debt.htm

Bob Jensen's threads on accounting history ---

http://www.trinity.edu/rjensen/Theory01.htm#AccountingHistory