The closest mountain range is the Kinsman Range about 10 miles east of our cottage

The American Dream versus the Danish Dream

Bob Jensen

at

Trinity University

American Dream, Denmark Dream, China Dream, and Nations Ranked on Happiness

Why don't people like markets or professors?

End of the Henderson's American Dream

The Nordic countries are reinventing their model of capitalism

The New American Dream --- Welfare

"Preserving the American Dream," Center for Innovation, Stanford

University Graduate School of Business, April 26, 2013 ---

http://csi.gsb.stanford.edu/preserving-american-dream

Find the Picture of a Celebrity's Home

U.S. National Debt

Clock ---

http://www.usdebtclock.org/

Also see

http://www.brillig.com/debt_clock/

Question

Should we keep increasing the government spending deficit and the national debt

every year ad infinitum?

Answers

Although in these down economic times, the liberal's Keynesian hero and Nobel

Prize economist, Paul Krugman, thinks recovery is stalled because the government

is not massively increasing spending deficits. But he's not willing to commit

himself to never reducing deficits or never paying down some of the national

debt. Hence, he really does not answer the above question ---

http://www.nytimes.com/2012/01/02/opinion/krugman-nobody-understands-debt.html

So let's turn to a respected law professor who advocates increasing the government spending deficit and the national debt every year ad infinitum?

"Why We Should Never Pay Down the National Debt (even partly)," by

Neil H. Buchanan George Washington University Law School), SSRN, 2012 ---

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2101811

Abstract:

Calls either to balance the federal budget on an annual basis, or to pay down all or part of the national debt, are based on little more than uninformed intuitions that there is something inherently bad about borrowing money. We should not only ignore calls to balance the budget or to pay down the national debt, but we should engage in a responsible plan to increase the national debt each year. Only by issuing debt to lubricate the financial system, and to support the economy’s healthy growth, can we guarantee a prosperous future for current and future citizens of the United States.

Student Assignment

Since many of the most liberal economists are not quite willing to assert that "we should never pay down the national debt," what questionable and unmentioned assumptions have been made by Neil H. Buchanan that need to be addressed?

Are some of these assumptions unrealistic in any world other than a utopian world?

Bob Jensen's Answers ---

http://www.cs.trinity.edu/~rjensen/temp/NationalDeficit-Debt.htm

Could it be that tax revisionists in Denmark

are beginning to anticipate (by reducing tax rates)

value added from something like an American Dream being introduced in Denmark?

The American Dream

"15 Billionaires Who Were Once Dirt Poor," by Vivian Giang, Business

Insider, July 1, 2014 ---

http://www.businessinsider.com/billionaires-who-came-from-nothing-2013-12?op=1#ixzz36JysNgcM

Jensen Comment

Note that they are not all white and not all males.

The Humble First Jobs Of 15 Highly Successful People ---

http://www.businessinsider.com/humble-first-jobs-of-successful-people-2014-7

Bob Jensen's threads on The American Dream ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

The China Dream

The Rise of China's Billionaire Tiger Women ---

http://www.thedailybeast.com/videos/2012/03/05/behind-the-rise-of-china-s-billionaire-women.html

2013 Happiest Nations of the World ---

http://247wallst.com/special-report/2013/11/07/the-happiest-countries-in-the-world-4/2/

Jensen Comment

I've been though this before in a debate with Jim Peters and won't repeat myself

again except to say that all the Top 10 other than Canada hare not at all

diverse and have relatively small populations with strict barriers to

immigration. This is not a good testimonial that diversity leads to national

happiness. The Ethnic Fractionalization Index is as follows for selected nations

shown below with the least fractionalized nations having the highest numbers

---

http://en.wikipedia.org/wiki/List_of_countries_ranked_by_ethnic_and_cultural_diversity_level

002 Tanzania (high ethnic diversity)

060 Canada (Happiness Rank 08)

063 Switzerland (Happiness Rank 01)

071 Mexico (Happiness Rank 10)

085 USA

087 Iceland (Happiness Rank 03)

128 Sweden (Happiness Rank 04)

142 Finland (Happiness Rank 09)

144 Denmark (Happiness Rank 05)

145 Austria (Happiness Rank 07)

146 Norway (Happiness Rank 02)

148 Germany

151 Netherlands (Happiness Rank 06)

157 Japan

158 South Korea

159 North Korea (lowest ethnic diversity)

Canada enjoys an enormous land mass relative to its population and is a nation that sells immigration to highest bidders in many instances. Canada also is the largest exporter of oil, timber, and maple syrup to the USA and lives under the umbrella of the USA military and advanced medical research.

Switzerland and Iceland ethic diversity surprises to me, although neither Switzerland nor Iceland is noted to have ethic diversity based upon skin color. The same can be said for Mexico.

The odd thing is that Mexico is among the Top 10 happiest nations in the world. Under these circumstances I would think that people trying to wade south in the Rio Grande would obstruct all those trying to wade north. Why isn't Mexico building a high wall on its northern border?

My guess is that if you randomly offered an immigration lottery ro 10,000 randomly chosen people in Africa, India, and other parts of Asia that the USA would have the highest probability of being chosen by those lottery winners. Why don't they want to go to happier countries?

My threads on happiness and The American Dream (with a special section on

Denmark) are at

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

What happens when you develop a genuinely

almost nearly perfect society in which there is nothing left to achieve, nothing

to kick against, or work?

"Actually, the Danish don't have the secret to happiness," Michael Booth,

The Atlantic, January 31, 2015

The American Dream Versus the Danish Dream ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm#AmericanDream

Jensen Comment

The Atlantic article below is too long but is accompanied by great photographs

Moral of Story

Maybe the best way to be happy is to set expectations low. Reminds me of the

Bloomington High School girls basketball team that recently lost 161-2. Think of

how happy this team will be next year when they only lose 98-12 ---

http://losangeles.cbslocal.com/2015/01/16/girls-basketball-coach-suspended-after-defeating-opponent-161-2/

What happens when you develop a genuinely

almost nearly perfect society in which there is nothing left to achieve, nothing

to kick against, or work?

"Actually, the Danish don't have the secret to happiness," Michael Booth,

The Atlantic, January 31, 2015 ---

http://www.businessinsider.com/actually-the-danish-dont-have-the-secret-to-happiness-2015-1

Jensen Comment

Cars are very, very expensive in Denmark. Maybe they would be happier if they

did not have to ride bicycles all the time and could save up enough money to own

and operate cars.

Denmark's Welfare State is On the Rocks In

Spite of (or because of) High Taxes

"Scandinavia�s Weakest Nation Finds Welfare Habits Too Costly," by Peter

Levring, Bloomberg, August 30, 2013 ---

http://www.bloomberg.com/news/2013-08-30/scandinavia-s-weakest-nation-finding-welfare-habits-unaffordable.html

Marginal Tax Cuts in Denmark --- http://www.asb.dk/en/aboutus/newsfromasb/newsarchive/article/artikel/feature_article_what_can_we_expect_from_the_spring_tax_reform-1/

The media regularly feature stories about how Danes are unwilling to work extra hours, even if taxes are lowered. The Danish Economic Council and the Danish Ministry of Finance say the opposite is true, while the public debate swings in both directions.

By Associate Professor Anders Frederiksen, Department of Marketing and Statistics, Aarhus School of Business, University of Aarhus

(This article was published in the Danish daily Berlingske Tidende on Monday 16 November 2009.)

This spring will see the implementation of a comprehensive tax reform that will reduce the marginal tax rate for most people in Denmark. We are becoming quite well versed in concepts such as financial 'carrots' and 'hammocks', and we have been inundated with all manner of studies of the willingness of the Danish people to work more if taxes are cut. Most of these studies find that the Danes are willing to work more, but there are always some that present the opposite conclusion; and the media has a tendency to call more attention to the latter. Perhaps it makes for a better story when people contradict the Economic Council and the Ministry of Finance.

Longer workdays

Let's nail the point home once and for all: the supply of labour in society will increase if the marginal tax rate (the tax on the last krone earned) is cut. This outcome is so certain that not a single economist contradicts it. But that is where the consensus ends, and opinions on the scope of this effect differ greatly, because the change in the supply of labour that will follow a cut in the marginal tax rate is generally considered relatively small � a conclusion that has also been confirmed by Danish research. This means that if the marginal tax rate is lowered by, e.g. 1 per cent, a good estimate is that the supply of labour will increase by 0.05 per cent for men and 0.15 per cent for women. In other words, after a marginal tax rate cut of 10 per cent, an average woman working full time will be willing to work approx. 30 minutes more a week.Uneven effect

But exactly who can we expect to work longer hours? The spring tax reform will abolish the middle-bracket tax, shift the tax basis for the top-bracket tax and reduce the bottom-bracket tax rate. This will increase the incentive for nearly every worker in Denmark to work more, although the consequences for the supply of labour depend on the level of income. Workers with a bottom-bracket tax as their marginal tax will experience a moderate reduction in taxes, and thus we can only expect a moderate increase in the supply of labour within this group. In contrast, people who are no longer charged top-bracket tax and who also experience the reduction in the bottom-bracket tax as well as the abolishment of the middle-bracket tax will have a significantly reduced marginal tax rate, and this will have a major impact on their willingness to work more. Thus, one of the consequences of the tax reform is an increase in the supply of labour among those workers earning around DKK 400,000.New study

But what do the Danish people say when asked whether they would work more if taxes were cut? To obtain a better understanding of this key question, we asked the members of the unemployment insurance fund FTF-A what they would be willing to do if the top-bracket tax were abolished? Their response was clear � they would work more. More precisely, 17 per cent responded that they would work more, while 77 per cent responded that they would not change their working hours and only 6 percent believed that they would reduce their working hours. Thus, these responses confirm the findings found in the specialist literature.Overtime or another job?

The spring tax reform will increase the supply of labour, but how is that possible when everyone works 37-hour-a-week jobs? The idea of inflexible working hours is actually a misconception. According to our study, the majority of the unemployment insurance fund members who responded that they would work more would do more overtime, while nearly a third would increase the supply of labour by taking an additional job. A small share would exchange their part-time job for a full-time job. And those who are not in employment would spend more time looking for work. In other words, you and I may not see any possibilities for earning extra money, but there is a large group of people who would see these possibilities and would be willing to make an extra effort if the incentive were greater.Less attractive to moonlight

One thing is the supply of labour, but what other consequences will the tax reform have? Unintended consequences of taxation, such as the existence of a black labour market, will also be affected by the reform. The specialist literature documents that the supply of labour in the informal labour market (especially for men) will be significantly affected by the pay that can be brought home from the regular labour market. We also know from previous studies that a large share of the population moonlights � a finding that is also confirmed by FTF-A's members, where approximately 10 per cent say they moonlight. If the top-bracket tax were abolished, 18 per cent of those who moonlight would reduce the amount of work they do on the black labour market, while only 1 per cent would go against that trend and moonlight more. In short, lower taxes also contribute to a more honest labour market.Pamper pension savings

The tax reform will also have interesting consequences for the financial sector, the retail sector and other areas of society with an interest in the economic priorities of Danes who have more money in their pockets. We know that the retail sector will experience a boost resulting from the increase in disposable income, but not all the money will go towards extra consumption. Some of it will also be put into savings, but what kind? The high marginal tax rate in Denmark has turned increasing pension payments into something of a national pastime in an effort to avoid and postpone paying taxes. If the top-bracket tax were abolished, this hobby would become less interesting, even though the higher disposable income would make it possible to increase savings. The responses from FTF-A's members show that 20 per cent of people with pension savings would increase their payments if the top-bracket tax were abolished, while only 8 per cent would decrease payments to their pension savings. This illustrates that the tax reform will not only have consequences for the labour market, but for many other sectors as well. For instance, people will spend more money in shops, and the financial sector can expect to experience an increase in demand for pension-related products.

Expensive in the beginning

Naturally, the many positive effects of the tax reform described here do not stand alone, and the observant reader is probably wondering whether there are any negative consequences of the tax reform. One problem is that the reform will not be self-financing in the short term. Consequently, the state will have less money in its coffers as a result of lower taxes next year, even taking into account the fact that a number of people will work more. However, this does not mean that the tax reform cannot be self-financing in the medium or long term. The changed behaviour patterns that we will see in the Danish people as a result of the lower tax on work will contribute to this. For example, higher pay after taxes will encourage young people to exploit their potential better, e.g. by obtaining a higher education, which will contribute in the long term to better pay conditions and growth in the economy.

How skewed can Denmark be?

One of the more negative consequences of the tax reform stems from the fact that the tax cut primarily affects the upper levels of the income distribution, leading to greater inequality in society. While the question of how much inequality can be tolerated is a political issue, it is naturally an important aspect that should be considered. But with that said, Danish society generally has a very high level of equality compared to other countries.

Jensen Comment

Could it be that tax revisionists in Denmark are beginning to anticipate value

added from something like an American Dream being introduced in Denmark?

Does the American Dream add more good than harm?

The current Sunset Hill House Hotel just down the road from

our cottage in the White Mountains of New Hampshire

The closest mountain range is the Kinsman Range about 10 miles east of our

cottage

American Dream ---

http://en.wikipedia.org/wiki/American_Dream

Often the goal of an American Dream is not so much betterment of your own life

as it is betterment of the lives of your children and grandchildren.

The Hendersons featured in this article have two of their own girls plus a girl

and boy that they adopted in China.

A Message from Jim Peters on the AECM

A couple of years ago, 60 minutes interview a bunch of Danish citizens because the Danes had once again topped the international surveys as the happiest people on earth. Americans, as with most international measures, were somewhere in the middle of the pack. The Dane's advice to Americans was to dump the American Dream because it caused more harm than good. The core of the American Dream seems to be equating wealth to happiness and setting off on a constant quest for more wealth. The Danes advice was to focus more on non-economic sources of happiness and learn to appreciate what you have.

Obviously, all this is an anathema to Americans and some of the reaction to the Dane's comments included epithets like "losers" and "hippies." But, the fact is that they are happier than Americans.

Jim

A Reply from Bob Jensen

Oddly, much of what you say about Denmark applies even more so to the higher welfare state of Norway which has much more state-owned oil revenues as an OPEC power player and a much higher ranking education and health care than Denmark.

It seems to me that the variables you praise that supposedly lead to happiness do not ipso facto do so in other welfare nations like Norway. My guess is that the concept of "happiness" is just too complicated to be meaningfully ranked. The poor Australians don't even get ranked --- must be miserable Down Under.

Norway only comes in at Rank 19 on happiness. The United States comes in at Rank 23 ---

http://www.jiangsu.net/forum/viewtopic.php?f=2&t=2256

1st - Denmark

2nd - Switzerland

3rd - Austria

4th - Iceland

5th - The Bahamas

6th - Finland

7th - Sweden

8th - Bhutan

9th- Brunei Darussalam

10th - Canada

11th - Ireland

12th - Luxembourg

13th - Costa Rica

14th - Malta

15th - The Netherlands

16th - Antigua and Barduba

17th - Malaysia

18th - New Zealand

19th - Norway

20th - the Seychelles

23rd - USA

35th - Germany

41st - UK

62nd - France

82nd - China

90th - Japan

125th - India

167th - Russia

177th - Zimbabwe

178th - Burundi

Jensen Comment

I take issue with Jim's quoted phrase that the American Dream in

America "caused more harm than good." In my

opinion, most of what we have that is good in America was built in one way or

another on somebody's American Dream, a somebody willing to take financial and

even physical risks, work tirelessly to build or rebuild something (possibly

making creative innovations along the way), and pass the fruits of

entrepreneurial labor on so that other Americans can find jobs and other

Americans can enjoy the goods and services provided by the American Dreams of

others.

An Illustration of the American Dream

In this essay, I will provide one case illustration regarding what is now the

Sunset Hill House Hotel in Sugar Hill, New Hampshire. The present-day Sunset

Hill House Hotel is a restoration of a former resort's old Annex ---

http://www.sunsethillhouse.com/

Also see

http://www.trinity.edu/rjensen/tidbits/2008/tidbits080824.htm

Lon and Nancy Henderson were two U.S. Army Officers who met for the first

time in Somalia and were later married. After retiring from the U.S. Army they

pooled their savings and borrowed millions of dollars to save a dilapidated

building called The Annex that was one of many buildings standing after the

historic Sunset Hill House Resort was torn down in 1973 ---

http://www.trinity.edu/rjensen/tidbits/CottageHistory/Hotel/Brochure/Brochure1900.htm

In the supposedly happiest nation on earth where education, health care, and many other goods and services are free due to equalization of income and wealth based on tax laws (that confiscate 77% of high incomes), I was wondering if any Danish couple would've borrowed millions of dollars to save a dilapidated building and commenced to each work tirelessly for 70 or more hours per week to run a hotel seven days a week for 52 weeks each year.

Would a Lon and Nancy Henderson in Denmark cheerfully awake at 4:00 a.m. every morning of every week to cook a full breakfast for each of the hotel guests intending to hike or ski or golf in the White Mountains?

Would a Lon and Nancy Henderson in Denmark spend the better part of every winter season day and evening, including week end days and evenings, painting and wall papering rooms of the hotel?

Would Lon Henderson in Denmark crawl on his belly at considerable physical risk crawl on his belly day-after-day to jack up the sagging floor of the golf club house?

Would Lon Henderson, with the help of his greens keeper Sam Kerr, daily mow over 70 acres of grass on the golf course and hotel grounds?

Would Lon Henderson maintain 40 motorized golf carts in mint condition for golfers?

Would Lon and Nancy Henderson in Denmark willingly go deeper into debt after two major fires in this hotel, each of which caused over $100,000 in damage?

Without an American Dream would Lon and Nancy Henderson be happy working and sacrificing like this for perhaps 20 more years of their lives?

This is our Subaru parked in front of the main hotel

There's another three-story building called The Hill House that houses guests as

well

This is the golf club house that Lon crawled under for several

weeks in a row

This is the view to the west toward the Green Mountains of Vermont

The Hendersons worked hard seven days a week for 52 weeks a year. In many ways they may have a better life now that they no longer own the inn. (see below)

July 4, 2014 Update: The End of the Henderson's American Dream

http://www.trinity.edu/rjensen/tidbits/Lupine/Set04/LupineSet04.htm#DreamEnd

In May 2014 a Bank Foreclosed on the Properties of the Sunset Hill House Hotel,

the Land, and the Golf Course

On June 17, 2014 here was an auction that failed to get bids in the neighborhood

of $2 million hoped for by the bank

The bank then refused all bids and is still trying to sell the hotel and

contents and land and the golf course

(actually the golf course land is restricted to being only a golf course or a

forest)

The far the bank is maintaining the closed golf course

The Henderson's spent quite a lot of money on a new heating system and 15

solar panels for hot water

Marginal Tax Cuts in Denmark --- http://www.asb.dk/en/aboutus/newsfromasb/newsarchive/article/artikel/feature_article_what_can_we_expect_from_the_spring_tax_reform-1/

The media regularly feature stories about how Danes are unwilling to work extra hours, even if taxes are lowered. The Danish Economic Council and the Danish Ministry of Finance say the opposite is true, while the public debate swings in both directions.

By Associate Professor Anders Frederiksen, Department of Marketing and Statistics, Aarhus School of Business, University of Aarhus

(This article was published in the Danish daily Berlingske Tidende on Monday 16 November 2009.)

This spring will see the implementation of a comprehensive tax reform that will reduce the marginal tax rate for most people in Denmark. We are becoming quite well versed in concepts such as financial 'carrots' and 'hammocks', and we have been inundated with all manner of studies of the willingness of the Danish people to work more if taxes are cut. Most of these studies find that the Danes are willing to work more, but there are always some that present the opposite conclusion; and the media has a tendency to call more attention to the latter. Perhaps it makes for a better story when people contradict the Economic Council and the Ministry of Finance.

Longer workdays

Let's nail the point home once and for all: the supply of labour in society will increase if the marginal tax rate (the tax on the last krone earned) is cut. This outcome is so certain that not a single economist contradicts it. But that is where the consensus ends, and opinions on the scope of this effect differ greatly, because the change in the supply of labour that will follow a cut in the marginal tax rate is generally considered relatively small – a conclusion that has also been confirmed by Danish research. This means that if the marginal tax rate is lowered by, e.g. 1 per cent, a good estimate is that the supply of labour will increase by 0.05 per cent for men and 0.15 per cent for women. In other words, after a marginal tax rate cut of 10 per cent, an average woman working full time will be willing to work approx. 30 minutes more a week.Uneven effect

But exactly who can we expect to work longer hours? The spring tax reform will abolish the middle-bracket tax, shift the tax basis for the top-bracket tax and reduce the bottom-bracket tax rate. This will increase the incentive for nearly every worker in Denmark to work more, although the consequences for the supply of labour depend on the level of income. Workers with a bottom-bracket tax as their marginal tax will experience a moderate reduction in taxes, and thus we can only expect a moderate increase in the supply of labour within this group. In contrast, people who are no longer charged top-bracket tax and who also experience the reduction in the bottom-bracket tax as well as the abolishment of the middle-bracket tax will have a significantly reduced marginal tax rate, and this will have a major impact on their willingness to work more. Thus, one of the consequences of the tax reform is an increase in the supply of labour among those workers earning around DKK 400,000.New study

But what do the Danish people say when asked whether they would work more if taxes were cut? To obtain a better understanding of this key question, we asked the members of the unemployment insurance fund FTF-A what they would be willing to do if the top-bracket tax were abolished? Their response was clear – they would work more. More precisely, 17 per cent responded that they would work more, while 77 per cent responded that they would not change their working hours and only 6 percent believed that they would reduce their working hours. Thus, these responses confirm the findings found in the specialist literature.Overtime or another job?

The spring tax reform will increase the supply of labour, but how is that possible when everyone works 37-hour-a-week jobs? The idea of inflexible working hours is actually a misconception. According to our study, the majority of the unemployment insurance fund members who responded that they would work more would do more overtime, while nearly a third would increase the supply of labour by taking an additional job. A small share would exchange their part-time job for a full-time job. And those who are not in employment would spend more time looking for work. In other words, you and I may not see any possibilities for earning extra money, but there is a large group of people who would see these possibilities and would be willing to make an extra effort if the incentive were greater.Less attractive to moonlight

One thing is the supply of labour, but what other consequences will the tax reform have? Unintended consequences of taxation, such as the existence of a black labour market, will also be affected by the reform. The specialist literature documents that the supply of labour in the informal labour market (especially for men) will be significantly affected by the pay that can be brought home from the regular labour market. We also know from previous studies that a large share of the population moonlights – a finding that is also confirmed by FTF-A's members, where approximately 10 per cent say they moonlight. If the top-bracket tax were abolished, 18 per cent of those who moonlight would reduce the amount of work they do on the black labour market, while only 1 per cent would go against that trend and moonlight more. In short, lower taxes also contribute to a more honest labour market.Pamper pension savings

The tax reform will also have interesting consequences for the financial sector, the retail sector and other areas of society with an interest in the economic priorities of Danes who have more money in their pockets. We know that the retail sector will experience a boost resulting from the increase in disposable income, but not all the money will go towards extra consumption. Some of it will also be put into savings, but what kind? The high marginal tax rate in Denmark has turned increasing pension payments into something of a national pastime in an effort to avoid and postpone paying taxes. If the top-bracket tax were abolished, this hobby would become less interesting, even though the higher disposable income would make it possible to increase savings. The responses from FTF-A's members show that 20 per cent of people with pension savings would increase their payments if the top-bracket tax were abolished, while only 8 per cent would decrease payments to their pension savings. This illustrates that the tax reform will not only have consequences for the labour market, but for many other sectors as well. For instance, people will spend more money in shops, and the financial sector can expect to experience an increase in demand for pension-related products.

Expensive in the beginning

Naturally, the many positive effects of the tax reform described here do not stand alone, and the observant reader is probably wondering whether there are any negative consequences of the tax reform. One problem is that the reform will not be self-financing in the short term. Consequently, the state will have less money in its coffers as a result of lower taxes next year, even taking into account the fact that a number of people will work more. However, this does not mean that the tax reform cannot be self-financing in the medium or long term. The changed behaviour patterns that we will see in the Danish people as a result of the lower tax on work will contribute to this. For example, higher pay after taxes will encourage young people to exploit their potential better, e.g. by obtaining a higher education, which will contribute in the long term to better pay conditions and growth in the economy.

How skewed can Denmark be?

One of the more negative consequences of the tax reform stems from the fact that the tax cut primarily affects the upper levels of the income distribution, leading to greater inequality in society. While the question of how much inequality can be tolerated is a political issue, it is naturally an important aspect that should be considered. But with that said, Danish society generally has a very high level of equality compared to other countries.

Jensen Comment

Could it be that tax revisionists in Denmark are beginning to anticipate value

added from something like an American Dream being introduced in Denmark?

Hi Ramesh,

If income and wealth equality is such a stimulant to economic growth and

prosperity why haven't nations other than Cuba and North Korea seriously

experimented with making everybody equal in income and wealth?

Why, for example, haven't Japan, South Korea, Norway, Finland, India, and now

China seen the egalitarian light?

Seems like an economic prosperity solution that Marx, Engels, and Mao

brilliantly advocated in previous centuries.

More importantly, Ramesh, can you offer us a clue as to why the following

countries, in an effort to stimulate economic growth, decreased

rather than increased the taxes paid by their most wealthy citizens? Why on

earth would Finland, Norway, Denmark, India, Iran, and the others do such a

thing that is counter to the expert that you linked us to in this thread?

Isn't this an effort to increase the economy with less equality?

Liberals/progressives just will not provide me with an answer to this question.

I imagine you will also not answer this question about the economic stupidity

versus brilliance of so many nations when they decrease taxes to their most

wealthy citizens?

Respectfully,

Bob Jensen

Denmark's Welfare State is On the Rocks In Spite of (or because of) High

Taxes

"Scandinavia’s Weakest Nation Finds Welfare Habits Too Costly," by Peter

Levring, Bloomberg, August 30, 2013 ---

http://www.bloomberg.com/news/2013-08-30/scandinavia-s-weakest-nation-finding-welfare-habits-unaffordable.html

TED Video by Richard Wilkinson: The Situation of Inequality

Jensen Preliminary Comment

I'm always in favor in academic settings in trying to show all sides of an

issue, the issue in this case being equality of income, opportunity, health

care, diet, etc.

Firstly, I should state my biases. I'm rooted in The American Dream that people of all ages should have all-important opportunities for training and education, which is why I strongly favor tax supported schools, colleges, and free open sharing of knowledge. In the U.S. we've seen a decline in opportunity with great variations safety and education in schools say in South Chicago versus those in South Dakota. Inequality in opportunity in education is appalling to me.

Secondly, I'm in favor of universal health care (much like the Canadian Model

and not at all like the Obamacare Model) ---

http://www.trinity.edu/rjensen/Health.htm

I note, however, that America's vast investments in health have not all been

wasted. The entire world has benefited from the U.S. advances in pharmacology,

medical technology, and other discoveries. More people come to the U.S. for

complicated medical treatments than vice versa. But there are gaps in terms of

access where the poorest and the richest people have better access than some of

the people caught in the middle who cannot afford good health insurance.

I could go on about my liberal (progressive) biases in many areas, but it may be better for you to watch the following very moving video about inequality around the world.

TED Video by Richard Wilkinson: The Situation of Inequality ---

http://thesituationist.wordpress.com/2012/06/09/the-situation-of-inequality-2/

Jensen Comment

Some might conclude that this video is just the opposite of what I've been

urging about The American Dream ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

I agree with much (actually most) of this video.

There are some comments in the video that I most certainly must register

disagreement.

For example, Wilkinson at one point asserts: "If you want The American

Dream go to Denmark."

In the context of universal educational opportunity in the 21st Century this

sadly correct.

However, in other contexts this is not correct. The Denmark Dream of free

education, health care, retirement pensions, etc. has in retrospect had impacts

that run counter to the American Dream. The American Dream inspires ambition,

whereas the Denmark Dream destroys ambition --- Danes are provided for

cradle-to-grave with equality no matter how hard you work. Studies show that

Danes usually aren't interested in overtime work opportunities. They don't have

to save for their children or their old age.

Danes have less incentive to invent and innovate since the tax structure

takes most of the rewards for success to the government. They are less likely to

do such things as go heavily into mortgage debt and invest their savings in a

risky investment that takes 16 or more hours a day of hard labor to bring to

long-term fruition when the mortgages are paid off ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

What is the most misleading to me in Wilconsin's video is that simply redistributing the wealth in America to make us more like Denmark would bring about dramatic improvements in all the problems of inequality that he addresses. However, he simply avoids more complicated questions. For example, Denmark does not have millions of very poor and uneducated people from other parts of the world sneaking into and squatting for the long-term in Denmark. Denmark does not have anywhere near the crime issues with drugs and gangs that are raising havoc in U.S. schools, medical clinics, families, neighborhoods, and prisons. For example, putting the highest paid and best teachers in urban schools in our largest schools is not going to solve the problem of neighborhood gangs, fear, intimidation, extortion, rape, prostitution, and murder that interferes with equal opportunity education in America. I think Wilkinson knows all these problems but selectively does not want to poison his conclusion that redistribution of wealth is the magic bullet of society.

The Scandinavian countries, Japan, and South Korea all are countries of low

diversity and minimal immigration. They do not experience many of the problems

(as well as benefits) that comes from diversity. Where they've experimented with

slight amounts of immigration they've encountered huge problems such as a spike

in rapes in Norway attributed to immigration. The "happiest nations" if the

world have the least legal and illegal immigration ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

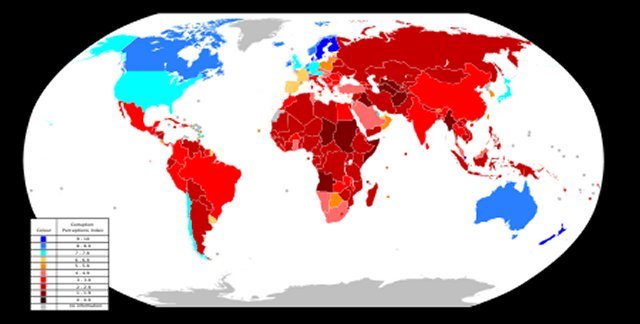

The underlying theme of the Wilconson video is that increasing the top marginal tax rates to achieve inequality will have nothing but good outcomes for developed countries (he makes an exception for undeveloped countries). But this does not explain why even his most favored equality-bent countries like Scandinavia and Japan discovered that very high marginal tax rates were dysfunctional to their economies:

Data that Wilconson does not show is that nations benefitting (in his eyes)

from high top marginal tax rates have actually been lowering this rates and

creating greater inequality in their nations. Wilconson makes no attempt to

explain why all these nations are lowering their top marginal tax rates ---

http://www.cs.trinity.edu/~rjensen/temp/TaxNoTax.htm

Marginal Tax Rate Declines in the Rest of the World ---

http://www.econlib.org/library/Enc/MarginalTaxRates.html

| *. Hong Kong’s maximum tax (the “standard rate”) has normally been 15 percent, effectively capping the marginal rate at high income levels (in exchange for no personal exemptions). | |||

| **. The highest U.S. tax rate of 39.6 percent after 1993 was reduced to 38.6 percent in 2002 and to 35 percent in 2003. | |||

| 1979 | 1990 | 2002 | |

| Argentina | 45 | 30 | 35 |

| Australia | 62 | 48 | 47 |

| Austria | 62 | 50 | 50 |

| Belgium | 76 | 55 | 52 |

| Bolivia | 48 | 10 | 13 |

| Botswana | 75 | 50 | 25 |

| Brazil | 55 | 25 | 28 |

| Canada (Ontario) | 58 | 47 | 46 |

| Chile | 60 | 50 | 43 |

| Colombia | 56 | 30 | 35 |

| Denmark | 73 | 68 | 59 |

| Egypt | 80 | 65 | 40 |

| Finland | 71 | 43 | 37 |

| France | 60 | 52 | 50 |

| Germany | 56 | 53 | 49 |

| Greece | 60 | 50 | 40 |

| Guatemala | 40 | 34 | 31 |

| Hong Kong | 25* | 25 | 16 |

| Hungary | 60 | 50 | 40 |

| India | 60 | 50 | 30 |

| Indonesia | 50 | 35 | 35 |

| Iran | 90 | 75 | 35 |

| Ireland | 65 | 56 | 42 |

| Israel | 66 | 48 | 50 |

| Italy | 72 | 50 | 52 |

| Jamaica | 58 | 33 | 25 |

| Japan | 75 | 50 | 50 |

| South Korea | 89 | 50 | 36 |

| Malaysia | 60 | 45 | 28 |

| Mauritius | 50 | 35 | 25 |

| Mexico | 55 | 35 | 40 |

| Netherlands | 72 | 60 | 52 |

| New Zealand | 60 | 33 | 39 |

| Norway | 75 | 54 | 48 |

| Pakistan | 55 | 45 | 35 |

| Philippines | 70 | 35 | 32 |

| Portugal | 84 | 40 | 40 |

| Puerto Rico | 79 | 43 | 33 |

| Russia | NA | 60 | 13 |

| Singapore | 55 | 33 | 26 |

| Spain | 66 | 56 | 48 |

| Sweden | 87 | 65 | 56 |

| Thailand | 60 | 55 | 37 |

| Trinidad and Tobago | 70 | 35 | 35 |

| Turkey | 75 | 50 | 45 |

| United Kingdom | 83 | 40 | 40 |

| United States | 70 | 33 | 39** |

| Source: PricewaterhouseCoopers; International Bureau of Fiscal Documentation. | |||

My conclusion is that Wilconson's TED video is very thought provoking and has changed my thinking on a lot of things. But as a magic bullet for issues threatening sustainability of the United States his implied solutions are superficial and misleading. The U.S. is an immensely more complicated than Denmark. Denmark solutions in the U.S. might very well indeed spell complete disaster by destroying ambition, savings, risk taking (business loans), and innovations.

All the sophomores of the world will buy into Wilconson's TED video hook, line, and sinker. Hopefully, their teachers and professors have more good sense. We need more ambition and innovation in the world rather than the complacency of the Denmark Dream not suited for mass immigrations and cultural diversity conflicts. We need to face the reality that most of the people of the world are still greedy and tribal and conflicted with differing religions. For them the answers are so simple.

Could it be that the rest of the world finds value added something like America's Dream?

Welfare States Don't Come Cheap

"U.S. Taxes and Government Benefits in an International Context," by

Bruce Bartlett, TaxProf Blog, December 26, 2012 ---

http://taxprof.typepad.com/files/137tn1429.pdf

Bruce Bartlett reviews new international data on taxes and healthcare spending as a share of GDP in OECD countries and suggests that Americans' antipathy to taxes may be a function of the modest benefits they receive from government in contrast to those in high-tax countries.

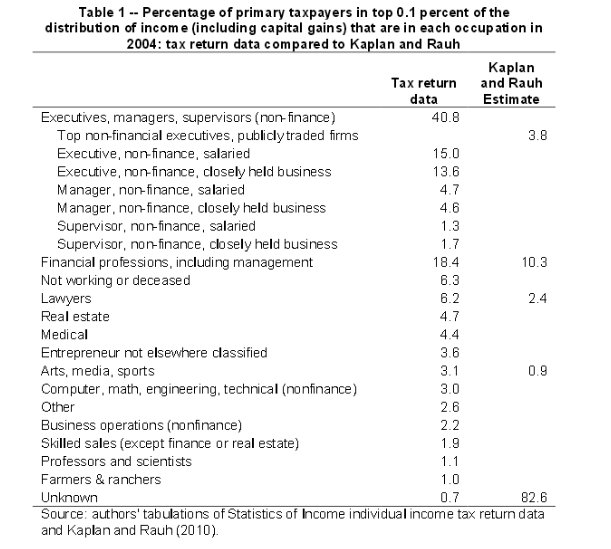

Table 1. Total Tax Revenue, 2010

Country Percent of GDP

Denmark 47.6

Sweden 45.5

Belgium 43.5

Italy 42.9

Norway 42.9

France 42.9

Finland 42.5

Austria 42.0

Netherlands 38.7

Hungary 37.9

Slovenia 37.5

Luxembourg 37.1

Germany 36.1

Iceland 35.2

United Kingdom 34.9

Czech Republic 34.2

Estonia 34.2

OECD average 33.8

Israel 32.4

Spain 32.3

Poland 31.7

New Zealand 31.5

Portugal 31.3

Canada 31.0

Greece 30.9

Slovakia 28.3

Switzerland 28.1

Ireland 27.6

Japan 27.6

Turkey 25.7

Australia 25.6

Korea 25.1

United States 24.8

Chile 19.6

Mexico 18.8

Source

: OECD.

Jensen Comment

Comparing nations on this index is difficult, particularly due to how health

care is provided.

Nations like Denmark that are high in egalitarian living have difficulty

motivating workers to work overtime and invest savings in risky ventures. This

is partly the reason all the highest ranked nations above reduced top tax rates

from what they were in the 1970s ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

Happy or not, the Danes have some of the same unhappiness (on a smaller

scale) as we have in the United States.

Danes must be a bit unhappy about being ranked the lowest of the Scandinavian

countries in terms of education. Denmark also ranks lower in education than the

United States, Poland, Estonia, France, Ireland, South Korea, and some other

nations ---

http://www.guardian.co.uk/news/datablog/2010/dec/07/world-education-rankings-maths-science-reading

Denmark comes in at Rank 34 in health care behind Italy, Greece, Morocco, Chile,

Canada, and its Scandinavian neighbors. The United States is at Rank 37 ---

http://www.photius.com/rankings/healthranks.html

Perhaps Denmark is "happy" because it turns a blind eye to many of its serious

troubles. Or perhaps Danes just try harder at keeping up happiness appearances.

Nurses strike over wages in Denmark, the divorce rate is somewhat high, crime is

on the rise, and immigrants in Denmark find barriers to social integration.

http://www.ms.dk/sw116735.asp

The bliss in Denmark (even more so in Norway) has been greatly upset by recent

multiculturalism ---

http://www.danielpipes.org/450/something-rotten-in-denmark

This article and its controversial author, however, are probably too off topic

to pursue in a thread on the AECM. The point is, however, that happiness and

multiculturalism do not always go hand in hand. Denmark and Norway may have been

more "happy" in the past when they were less multicultural. There are reports

that many blond women are dying their hair to make them less vulnerable to

rapes.

Perhaps Denmark is "happy" because it turns a blind eye to many of its serious

troubles. Or perhaps Danes just try harder at keeping up happiness appearances.

Respectfully,

Bob Jensen

None of the Scandinavian countries did well in the hard work rankings, nor did

high GDP per capita nations that are OPEC nations. This does not surprise me.

However, Iceland made it in the Top 10. This is somewhat a surprise. South

Korea tops the list --- which hardly comes as a surprise to me.

What's most surprising, however, is how many of the so-called "failing" European

nations are considered to be the "hardest working" versus how many of the most

successful European nations are not found to be the "hardest working" nations.

For example, in the Top 10 hardest working nations are Greece, Spain, and Italy.

Not in the Top 10 are Germany, France, or any of the Scandinavian countries.

I don't want to imply that egalitarianism destroys the work ethic, or that the

work ethic is always the road to happiness and feelings of accomplishment. The

results for Greece, Spain, Italy, Mexico, and some of the other "hardest

working" countries are somewhat confusing to me. If I were to investigate, I

would try to dig deeper into whether an "hour of work" can really be compared

between some countries. For example, in the U.S. there's a difference between

the 10 guys leaning on shovels above a trench and the two guys down below with

the perspiration-soaked shirts.

"KRUGMAN: Sweden Has The Answers To Our Taxation Problems,"

by Kamelia

Angelova, Business Insider, February 12, 2013 ---

http://www.businessinsider.com/paul-krugman-on-taxes-2013-2

The above link is a video of Paul Krugman being interviewed. He seems to be holding an earlier Sweden as having some type of taxation and welfare spending program that's an ideal without mentioning that the current Sweden and other Nordic nations are trying to change all that by:

Either Professor Krugman is ignorant of the changes taking place in Sweden (which I doubt) or he's selectively trying to mislead his audience. He should be more careful in selectively choosing examples he promotes as ideals. This is not, in my viewpoint, the type of selectivity we want in our Academy.

"The Secret To Sweden's Brilliant Economic Comeback,"

by Michael Moran, Business Insider, April 13, 2013 ---

http://www.businessinsider.com/what-we-can-learn-from-swedens-inequality-lessons-2013-4

As recently as the early 1990s, the idea that Sweden could be a model of anything except socialism gone awry would have been laughable.Sweden's debt-to-GDP was staggering when compared to other advanced industrial nations, topping 70 percent in 1992 and headed ever upward. Nearly 60 percent of all economic activity was generated by either government or government-owned enterprises. Meanwhile, the full employment mantra of its socialist model was coming apart at the seams as government simply could not borrow or print enough money to bridge the gap. The Swedish jobless rate shot from less than 2 percent in 1988 to more than 10 percent in 1993.

Even renowned global brands — Saab, Volvo and Electrolux — were failing. By 1993, Sweden’s banks were effectively bankrupt.

But Sweden today barely resembles its former self. As the Economist magazine wrote last year, “The streets of Stockholm are awash in the blood of sacred cows.”

A century of pursuing political neutrality and aggressive egalitarian socialism has more recently been leavened by economic reforms and market liberalizations, lighting a fire under the economy. After a modest dip during 2008, the economy has outperformed the US and even Germany since.

Most importantly, the growth has not led to the kind of spike in income inequality that accompanied growth spurts in many other western countries since the 1980s. Sweden’s reforms caused inequality of income to grow over the past 20 years. As measured by the Gini coefficient, the world’s standard measure of household equality, Sweden went from a .21 to a .25 – still the best in the developed world. For the US, the numbers are staggering. From a Gini rating of .31 in 1975, the current ranking (adjusted for taxes and benefits) is .38.

How did Sweden do it? The answer is a mix of carefully introduced competitive pressures on services previously run by government, from schools to health to pensions, and an intelligent and forceful response to a banking crisis in the early 1990s that had a lot in common with the one that followed the collapse of Lehman Brothers.

There was no "radical shock" akin to the market reforms applied to the states of the former Warsaw Pact in Europe after 1989. Rather, Sweden embarked on a gradual recalibration of government spending, a lowering of top tax rates — to "only" 57 percent at the top — without a kind of offloading of social responsibility that characterized earlier market reform efforts in Thatcher's Britain or Reagan's America. The result is a country and a Nordic region, given that its neighbors have followed suit, that no longer resembles the socialist "Third Way" economy of the late 1970s.

Not just Sweden, but also Denmark, Finland and Norway are thriving, and it turns out its quirky mix of social democracy, communitarianism and advanced capitalism has produced the most socially mobile, consistently robust and fiscally sound nations in the world. While some of its old state champions have been sold — Saab to a Dutch firm, Volvo to China — new powerhouses like IKEA and H&M have mixed corporate responsibility with an intense focus on cost controls — and high profits.

Sweden’s banks, flat on their back in 1993, are now rated by the European Union’s chief banking regulator as the strongest on the continent.

While there are many lessons from Sweden’s experience applicable in the West, there also is an apples and oranges problem.

For one thing, Sweden is a relatively small economy at $500 billion in GDP, compared to the $15.7 trillion in US annual output. It’s also a much more homogeneous society. A recent spike in immigration from the Middle East and Eastern Europe notwithstanding, most Swedes are, well, Swedish.

The large influx of immigrants into the US that began in the late 1980s certainly did much to prevent fiscal problems; by raising the US birth rate, for instance, immigrants have prevented the current debate about Social Security from being a question of collapse and merely one of finding a way to make it more sustainable; and a few founded world-beating companies, like Russian immigrant Sergey Brin at Google or Taiwan-born Jerry Yang of Yahoo, adding billions to US GDP.

But immigration on such a scale attracts people at both the top and bottom of the skills pool, meaning that some will go on to found S&P 500 firms or win Nobel Prizes, while many other lag in educational achievement and earnings. Taken together, this phenomenon naturally pushes up inequality rankings.

Sweden also has handled the age of globalized finance very differently and indeed, it might be argued, a lot more intelligently.

Back in 1992, Sweden suffered its own real estate bubble-fueled banking crisis. Facing the same kind of domino-effect collapse on a smaller scale, Swedish regulators demanded banks write down losses, provide major relief to underwater homeowners and issue warrants — in effect, voting rights on their boards of directors — the government. Once the bad debts were sold back onto the market, Swedish taxpayers rather than bank shareholders were the primary beneficiaries, and taxpayers made more when the government exited from its stake in the banks later in the 1990s.

Reflecting on the Swedish crisis in 2008, as the US and UK were trying to structure their own bailouts, Urban Backstrom, a senior Swedish finance ministry official at the time, warned that a guiding principle was that the “public will not support a plan if you leave the former shareholders with anything.” By and large, the American version, TARP, left shareholders, including bank executives, completely intact — to this day a source of serious criticism of former US Treasury Secretary Tim Geithner and his team.

While the Swedish government insisted that banks pay a proper tab for their drinking binge, it simultaneously opened up other markets which had been over regulated, selling state shares in major enterprises, introducing school vouchers and private, rather than state-run pension programs. The country also broke the state’s hold on its central bank (with the US Federal Reserve as a model).

“These decisive economic liberalizations, and not socialism, are what laid the foundations for Sweden's success over the last 15 years,” says Jonny Munkhammar, a member of parliament for Sweden’s center-right Moderate Party who wrote a book about the Swedish reforms.

Could the United States emulate even some of this? The question is complex and shot through with the competing ideological dogmas that each party bring to the table. Indeed, it might be said that there is something from both sides to loathe in the modern Swedish model. For the American Left, the idea that market liberalization is a significant part of the Swedish story shatters a simplistic devotion to redistributive policy. For the American Right, Sweden’s heavy handed devotion to regulation and a top tax rate of 57 percent for multimillionaires would be a hard pill to swallow.

Then again, national insolvency and an ever rising gap between rich and poor in America are two nasty pills in their own right. The Swedish option is starting to look pretty good.

Continued in article

Jensen Comment

Sweden's tax rates cover expenditures for nationwide health care and education.

If we added what Americans pay separately for health care and college education

wouldn't our tax rate be higher than that of Sweden?

Comparing the U.S. and Sweden is complicated by differences in size, ethnicity, immigration (legal and illegal) and the massive drug underworld in the United States that is destroying the largest cities in the USA. Similarly Sweden did not choose to become the police force of the world.

Among the smart things Sweden did is resist becoming part of the disastrous Eurozone.

Special Report in The Economist magazine that the liberal television

stations and newspapers are keeping secret

"Northern lights: The Nordic countries are reinventing their model of

capitalism," by Adrian Wooldridge, The Economist, February 2, 2013,

pp. 1-6 ---

http://www.economist.com/news/special-report/21570840-nordic-countries-are-reinventing-their-model-capitalism-says-adrian

THIRTY YEARS AGO Margaret Thatcher turned Britain into the world’s leading centre of “thinking the unthinkable”. Today that distinction has passed to Sweden. The streets of Stockholm are awash with the blood of sacred cows. The think-tanks are brimful of new ideas. The erstwhile champion of the “third way” is now pursuing a far more interesting brand of politics.

Sweden has reduced public spending as a proportion of GDP from 67% in 1993 to 49% today. It could soon have a smaller state than Britain. It has also cut the top marginal tax rate by 27 percentage points since 1983, to 57%, and scrapped a mare’s nest of taxes on property, gifts, wealth and inheritance. This year it is cutting the corporate-tax rate from 26.3% to 22%.

Sweden has also donned the golden straitjacket of fiscal orthodoxy with its pledge to produce a fiscal surplus over the economic cycle. Its public debt fell from 70% of GDP in 1993 to 37% in 2010, and its budget moved from an 11% deficit to a surplus of 0.3% over the same period. This allowed a country with a small, open economy to recover quickly from the financial storm of 2007-08. Sweden has also put its pension system on a sound foundation, replacing a defined-benefit system with a defined-contribution one and making automatic adjustments for longer life expectancy.

Most daringly, it has introduced a universal system of school vouchers and invited private schools to compete with public ones. Private companies also vie with each other to provide state-funded health services and care for the elderly. Anders Aslund, a Swedish economist who lives in America, hopes that Sweden is pioneering “a new conservative model”; Brian Palmer, an American anthropologist who lives in Sweden, worries that it is turning into “the United States of Swedeamerica”.

There can be no doubt that Sweden’s quiet revolution has brought about a dramatic change in its economic performance. The two decades from 1970 were a period of decline: the country was demoted from being the world’s fourth-richest in 1970 to 14th-richest in 1993, when the average Swede was poorer than the average Briton or Italian. The two decades from 1990 were a period of recovery: GDP growth between 1993 and 2010 averaged 2.7% a year and productivity 2.1% a year, compared with 1.9% and 1% respectively for the main 15 EU countries.

For most of the 20th century Sweden prided itself on offering what Marquis Childs called, in his 1936 book of that title, a “Middle Way” between capitalism and socialism. Global companies such as Volvo and Ericsson generated wealth while enlightened bureaucrats built the Folkhemmet or “People’s Home”. As the decades rolled by, the middle way veered left. The government kept growing: public spending as a share of GDP nearly doubled from 1960 to 1980 and peaked at 67% in 1993. Taxes kept rising. The Social Democrats (who ruled Sweden for 44 uninterrupted years from 1932 to 1976 and for 21 out of the 24 years from 1982 to 2006) kept squeezing business. “The era of neo-capitalism is drawing to an end,” said Olof Palme, the party’s leader, in 1974. “It is some kind of socialism that is the key to the future.”

The other Nordic countries have been moving in the same direction, if more slowly. Denmark has one of the most liberal labour markets in Europe. It also allows parents to send children to private schools at public expense and make up the difference in cost with their own money. Finland is harnessing the skills of venture capitalists and angel investors to promote innovation and entrepreneurship. Oil-rich Norway is a partial exception to this pattern, but even there the government is preparing for its post-oil future.

This is not to say that the Nordics are shredding their old model. They continue to pride themselves on the generosity of their welfare states. About 30% of their labour force works in the public sector, twice the average in the Organisation for Economic Development and Co-operation, a rich-country think-tank. They continue to believe in combining open economies with public investment in human capital. But the new Nordic model begins with the individual rather than the state. It begins with fiscal responsibility rather than pump-priming: all four Nordic countries have AAA ratings and debt loads significantly below the euro-zone average. It begins with choice and competition rather than paternalism and planning. The economic-freedom index of the Fraser Institute, a Canadian think-tank, shows Sweden and Finland catching up with the United States (see chart). The leftward lurch has been reversed: rather than extending the state into the market, the Nordics are extending the market into the state.

Why are the Nordic countries doing this? The obvious answer is that they have reached the limits of big government. “The welfare state we have is excellent in most ways,” says Gunnar Viby Mogensen, a Danish historian. “We only have this little problem. We can’t afford it.” The economic storms that shook all the Nordic countries in the early 1990s provided a foretaste of what would happen if they failed to get their affairs in order.

There are two less obvious reasons. The old Nordic model depended on the ability of a cadre of big companies to generate enough money to support the state, but these companies are being slimmed by global competition. The old model also depended on people’s willingness to accept direction from above, but Nordic populations are becoming more demanding.

Small is powerful

The Nordic countries have a collective population of only 26m. Finland is the only one of them that is a member of both the European Union and the euro area. Sweden is in the EU but outside the euro and has a freely floating currency. Denmark, too, is in the EU and outside the euro area but pegs its currency to the euro. Norway has remained outside the EU.

But there are compelling reasons for paying attention to these small countries on the edge of Europe. The first is that they have reached the future first. They are grappling with problems that other countries too will have to deal with in due course, such as what to do when you reach the limits of big government and how to organise society when almost all women work. And the Nordics are coming up with highly innovative solutions that reject the tired orthodoxies of left and right.

The second reason to pay attention is that the new Nordic model is proving strikingly successful. The Nordics dominate indices of competitiveness as well as of well-being. Their high scores in both types of league table mark a big change since the 1980s when welfare took precedence over competitiveness.

The Nordics do particularly well in two areas where competitiveness and welfare can reinforce each other most powerfully: innovation and social inclusion. BCG, as the Boston Consulting Group calls itself, gives all of them high scores on its e-intensity index, which measures the internet’s impact on business and society. Booz & Company, another consultancy, points out that big companies often test-market new products on Nordic consumers because of their willingness to try new things. The Nordic countries led the world in introducing the mobile network in the 1980s and the GSM standard in the 1990s. Today they are ahead in the transition to both e-government and the cashless economy. Locals boast that they pay their taxes by SMS. This correspondent gave up changing sterling into local currencies because everything from taxi rides to cups of coffee can be paid for by card.

The Nordics also have a strong record of drawing on the talents of their entire populations, with the possible exception of their immigrants. They have the world’s highest rates of social mobility: in a comparison of social mobility in eight advanced countries by Jo Blanden, Paul Gregg and Stephen Machin, of the London School of Economics, they occupied the first four places. America and Britain came last. The Nordics also have exceptionally high rates of female labour-force participation: in Denmark not far off as many women go out to work (72%) as men (79%).

Flies in the ointment

This special report will examine the way the Nordic governments are updating their version of capitalism to deal with a more difficult world. It will note that in doing so they have unleashed a huge amount of creativity and become world leaders in reform. Nordic entrepreneurs are feeling their oats in a way not seen since the early 20th century. Nordic writers and artists—and indeed Nordic chefs and game designers—are enjoying a creative renaissance.

The report will also add caveats. The growing diversity of Nordic societies is generating social tensions, most horrifically in Norway, where Anders Breivik killed 77 people in a racially motivated attack in 2011, but also on a more mundane level every day. Sweden is finding it particularly hard to integrate its large population of refugees.

The Nordic model is still a work in progress. The three forces that have obliged the Nordic countries to revamp it—limited resources, rampant globalisation and growing diversity—are gathering momentum

Continued in article

Note that on Page 5 there's also a section entitled "More for Less" devoted to Welfare Capitalism.

Jensen Comment

It appears that among the Nordics only Norway will continue to afford socialism,

but this is because oil-rich Norway is a leading OPEC nation less concerned with

the need for private sector growth.

There are of course serious obstacles to applying the new Nordic capitalism to the USA. Firstly, the USA is not bound by the Arctic Ocean on the north and the North Sea on the south that greatly discourages illegal immigration and narcotics. Secondly, the Nordic countries have difficult languages that are not studied to a significant degree in other nations. For example, I'm told that if you weren't raised in Finland you can never understand the language. Thirdly, there's no existing infrastructure to absorb and aid illegal immigrants in Scandinavia. Scandinavians like my grandparents, Ole, Sven, and Lena emigrated from these hard and cold countries rather than immigrating to these lands.

Scandinavians have avoided the crippling costs of building up powerful military forces and have not tried to become the police force of the world.

Scandinavians also avoided the horrors in importing millions of slaves and the centuries of social costs and degradations that followed. Nor did they have to go to war, to a serious degree, with indigenous peoples to take over the land by trickery and force.

February 13, 2013 reply from David Johnstone

Dear Bob, even if tax rates in Sweden have come down, the top marginal rates are still very high in Sweden relative to where they are now in the US (and once were in the US) and surely that makes a very big difference to taxes collected, socially and in other ways. I just watched a program on TV here, showing how previously comfortably albeit not extremely well-off off families in the US were living in cars and barely feeding/clothing/warming themselves, and I must say that this, like the frequency of gun ownership, seems like another planet and species to life in Australia. I have not tried to think it through, or read all the arguments, but it seems to me that people who want to get rich and create businesses and wealth will still have that drive even if at the top end they pay higher tax rates (as they used to in the US). Once these rates are set much lower and spoilt people get used to them and “believe” they are “right”, then it is very hard behaviourally to go back. Similarly with letting people own guns galore.

February 14, 2013 reply from Bob Jensen

Hi David,

It was Krugman's comparisons of the U.S. and Swedish tax rates that started this thread.

In reality it is very hard to compare many macroeconomic measures between nations because they often are not very comparable. Sweden's marginal tax rates are still relatively high because they include paying for nationalized health care and education, including college education. If we had the cost of our health care and education added to the U.S. tax revenues we would be closer to comparability. But there are other enormous problems. In the U.S. we must also add in state taxation to the Federal tax rates to make them more comparable to Sweden. In California, for example, the marginal Federal and State rates before health care costs to 50%,

At the same time, the U.S. tax rates are not comparable with Sweden because of all the tax preferences we build into the system such as tax exemptions of municipal bond interest and deductions medical expenses in excess of 7.5% of AGI, state taxes. mortgage interest, casualty losses, etc. These days there are also enormous credits reducing payments such as the earned income credit, energy credits, etc.

But if economists like Krugman still want to make these international tax rate comparisons in public interviews, I think that it is also important to discuss trends in those tax rates. The tax rates in Nordic countries have been coming down rather dramatically over the decades, and it's important to point this fact out and to examine the reasons why Nordic countries are reducing the size of their governments in favor o building up their private sectors.

Of course there are many other international measures that are not comparable such as unemployment rates, poverty rates (e.g., Gini coefficients), infant mortality, etc.

Even within a nation, statistics are often not comparable over time. For example, inflation rates in the USA used to factor in price changes in food and fuel. Now to make inflation look less severe, the U.S. government no longer includes fuel and food price changes in inflation rates. Dah!

Respectfully,

Bob Jensen

"The Nordic model for unemployment insurance," Sober Look,

January 11, 2013 ---

http://soberlook.com/2013/01/the-nordic-model-for-unemployment.html

Bob Jensen's comparisons of the American versus Denmark dreams ---

http://www.cs.trinity.edu/~rjensen/temp/SunsetHillHouse/SunsetHillHouse.htm

Bob Jensen's threads on why Vermont is trying to increase its unemployment

rate ---

http://www.cs.trinity.edu/~rjensen/temp/Political/PoliticalQuotationsCommentaries.htm#VermontWelfare

Case Studies in

Gaming the Income Tax Laws

http://www.cs.trinity.edu/~rjensen/temp/TaxNoTax.htm

Effective Tax Rates Are Lower Than Most People Believe

"Measuring Effective Tax Rates," by Rachel Johnson Joseph Rosenberg Roberton

Williams, Urban-Brookings Tax Policy Center, February 7, 2012 ---

http://www.taxpolicycenter.org/UploadedPDF/412497-ETR.pdf

The China Dream

Ronald Coase (Nobel Laureate) --- http://en.wikipedia.org/wiki/Ronald_Coase

"How China Made Its Great Leap Forward: Some observers praise its

'state-led capitalism.' But the truth is that leaders, starting with Deng

Xiaoping, loosened Beijing's control," by Ronald Coase and Ning Wang, The

Wall Street Journal, April 6, 2012 ---

http://online.wsj.com/article/SB10001424052702303302504577326132059836456.html#mod=djemEditorialPage_t

China's post-Mao market transformation is one of the most dramatic and momentous events of our time. It has lifted hundreds of millions out of extreme poverty, freed one fifth of humanity from ideological radicalism, revived one of the oldest civilizations, and inspired all of us to explore the benevolence of the market.

Yet capitalism as currently practiced in China suffers a severe failing: the lack of a marketplace for ideas. China's market transformation flourished at the ground level without much help from Beijing—contrary to its leadership's claims. But the free flow of ideas has faltered. Until that changes, China will never reach its full potential.

At Mao Zedong's death in 1976, few, if any, could have foreseen that China, then one of the poorest and most isolated countries in the world, would become a dynamic market economy in just three decades. An added surprise is that all this happened under the auspices of the Chinese Communist Party, which was committed along the way to modernizing socialism.

When China started reforming and opening up, it had little knowledge of the market economy. Mao's grandiose but disastrous policies had gravely impoverished the country materially and intellectually. China had been isolated from the West and cut off from its own traditions. With no blueprint, it had no choice but to work within the ruins of socialism, through tinkering and improvisation. This experimental approach was helped along the way by the resuscitation of the Confucian tradition of "seeking truth from facts."

China's road to capitalism was forged by two movements. One was orchestrated by Beijing; its self-proclaimed goal being to turn China into a "modern, powerful socialist country." The other, more important, one was the gross product of what we like to call "marginal revolutions." It involved a concatenation of grass-roots movements and local initiatives.

While the state-led reform focused on enhancing the incentives of state-owned enterprises, the marginal revolutions brought private entrepreneurship and market forces back to China. Private farming, for example, was secretly engaged in by starving peasants when it was still banned by Beijing. Rural industrialization was spearheaded by township and village enterprises that operated outside state control. Private sectors emerged in cities when self-employment was allowed to cope with rising unemployment. Foreign direct investment and labor markets were first confined to Special Economic Zones.

All these marginal forces had been either harshly oppressed or heavily regulated during Mao's era. Fortunately, post-Mao Chinese leaders—most notably Deng Xiaoping—embraced change. Mao's failure taught them to stay away from ideological hubris and re-embrace pragmatism. Under their leadership, Beijing admitted its lack of experience in reform. Local initiatives were first allowed, and later encouraged, to play a leading role in market-oriented experiments.

Inadvertently, this process led to the relatively thriving market we see in China today. When Beijing still preached socialism, local authorities explored new, market-oriented approaches to revive local economies. While Beijing held tight to political power, it was no longer a central planner. As provinces, cities and counties all competed for economic development, China became a giant laboratory of regional competition.

China's leaders have never given up on socialism, which in their minds calls for public ownership to ensure shared prosperity (even though state-owned enterprises have exacerbated inequality and corrupted politics). They insist on keeping key sectors—including banking, energy, communication and education—under state monopoly. As a result, many characterize the Chinese economy as "state-led capitalism." But it was really the marginal revolutions and regional competition that ushered in China's economic rise.

In the years to come, China will continue to forge its own path, but it needs to address its lack of a marketplace for ideas if it hopes to continue to prosper. An unrestricted flow of ideas is a precondition for the growth of knowledge, the most critical factor in any innovative and sustainable economy. "Made in China" is now found everywhere in the world. But few Western consumers remember any Chinese brand names. The British Industrial Revolution two centuries ago introduced many new products and created new industries. China's industrial revolution is far less innovative.

The active exchange of thoughts and information also offers an indispensable foundation for social harmony. It is not a panacea; nothing can free us once and for all from ignorance and falsehood. But the free flow of ideas engenders repeated criticism and continuous improvement. It also cultivates respect and tolerance, which are effective antidotes to the bigotry and false doctrines that can threaten the foundation of any society.

Continued in article

The China Dream: Rise of the Billionaire Tiger Women from Poverty

"Tigress Tycoons," by Amy Chua, Newsweek Magazine Cover Story, March 12,

2012, pp. 30-39 ---

http://www.thedailybeast.com/newsweek/2012/03/04/amy-chua-profiles-four-female-tycoons-in-china.html

Like a relentless overachiever, China is eagerly collecting superlatives. It�s the world�s fastest-growing major economy. It boasts the world�s biggest hydropower plant, shopping mall, and crocodile farm (home to 100,000 snapping beasts). It�s building the world�s largest airport (the size of Bermuda). And it now has more self-made female billionaires than any other country in the world.

This is not only because China has more females than any other nation. Many of these extraordinary women rose from nothing, despite living in a traditionally patriarchal society. They are a beguiling advertisement for the New China�bold, entrepreneurial, and tradition-breaking.

Four standouts among China�s intriguing new superwomen are Zhang Xin, the factory worker turned glamorous real-estate billionaire, with 3 million followers on Weibo (China�s Twitter); talk-show mogul Yang Lan, a blend of Audrey Hepburn and Oprah Winfrey; restaurant tycoon Zhang Lan, who as a girl slept between a pigsty and a chicken coop; and Peggy Yu Yu, cofounder and CEO of one of China�s biggest online retailers. None of these women inherited her money, and unlike many of the richest Chinese who are reluctant to draw public scrutiny to their path to wealth, they are proud to tell their stories.