Case Studies in Gaming the Income Tax Laws

Tax Breaks

The Top 40% Income Bracket Pays 106% of the Income

Tax, The Lowest 40% Bracket Pays -9%% (Negative).

"Rich" People Gaming the Income Tax Laws: Col. X and

his Wife and Mega-Roth IRAs

"Poor" People

Gaming the Income Tax Laws: Juanita and Her Daughter Laura

Wealth Tax

Ten ways to fight inequality without Piketty's Wealth

Tax

Effective Tax Rates are Lower Than Most People

Believe

Obama’s inequality argument just utterly collapsed

The Phony Lifetime Disabilities Gaming by Tens

of Millions of People Who are Not Disabled

How Can Scandinavians Tax So Much?,

Proposed Solutions

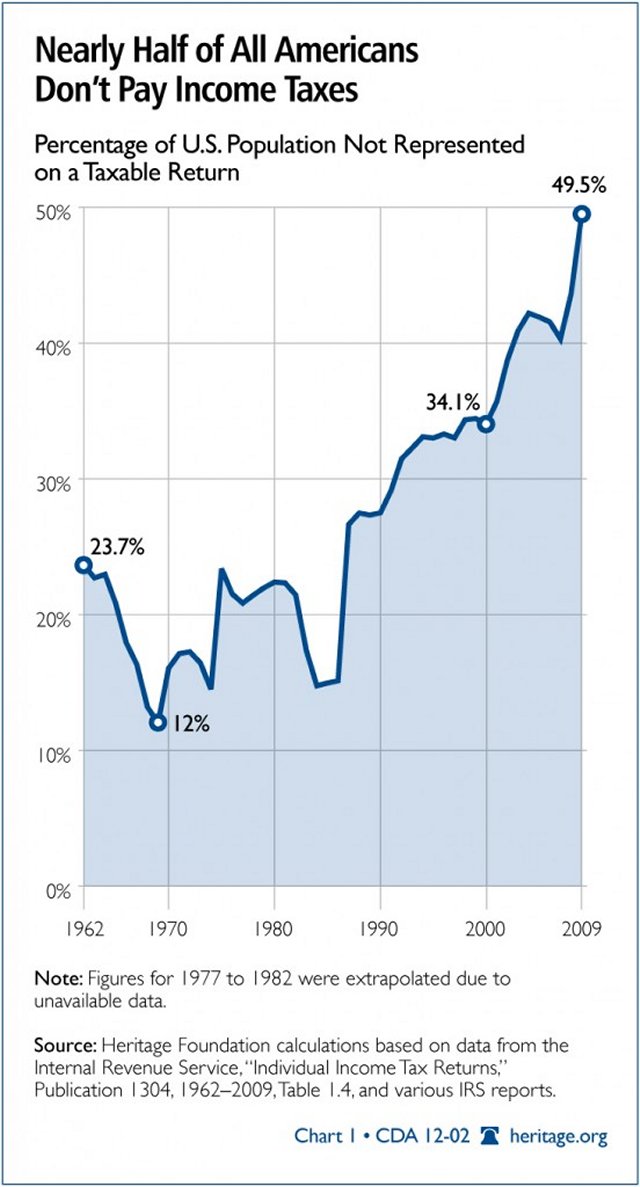

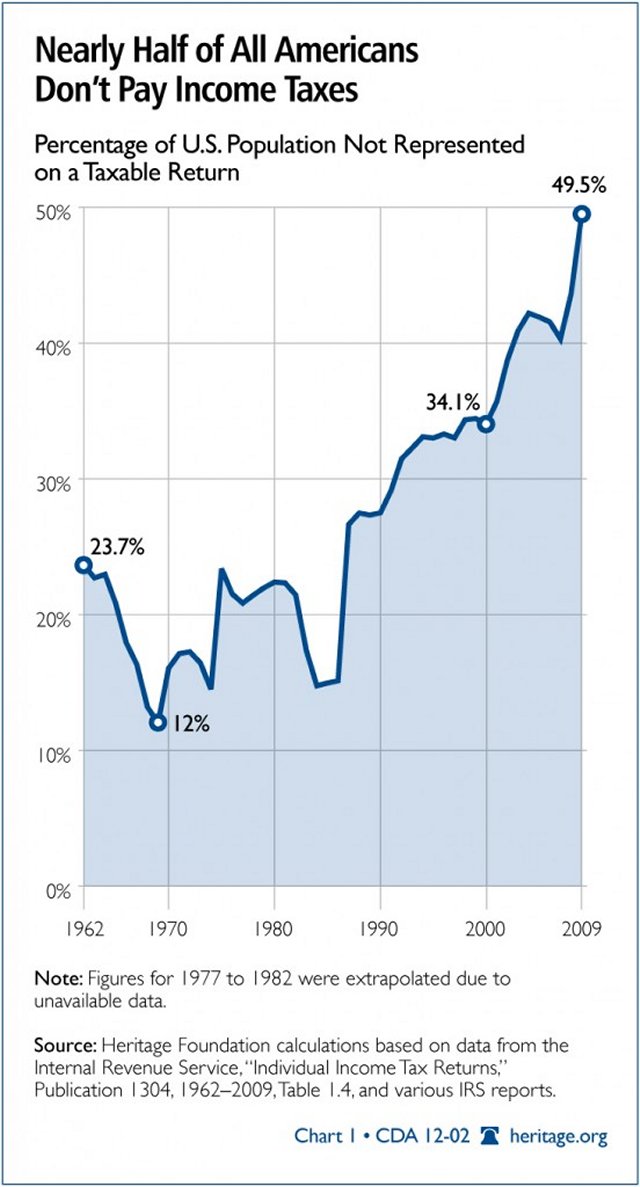

This is recommended as a celebration cocktail for the 49.5% of U.S. taxpayers

who pay no income taxes:

"Next Time You're At the Bar, Order an Income Tax Cocktail," by Adrienne

Gonzalez (Jr. Deputy Accountant), Going Concern, March 20, 2012 ---

http://goingconcern.com/post/next-time-youre-bar-order-income-tax-cocktail

"Why Some Multinationals Pay Such Low Taxes," by Justin Fox, Harvard

Business Review Blog, March 26, 2012 ---

Click Here

http://blogs.hbr.org/fox/2012/03/why-some-multinationals-pay-su.html?referral=00563&cm_mmc=email-_-newsletter-_-daily_alert-_-alert_date&utm_source=newsletter_daily_alert&utm_medium=email&utm_campaign=alert_date

U.S. National Debt

Clock ---

http://www.usdebtclock.org/

Also see

http://www.brillig.com/debt_clock/

Academic Versus Political Reporting of Research: Percentage Columns

Versus Per Capita Columns ---

http://www.cs.trinity.edu/~rjensen/temp/TaxAirlineSeatCase.htm

by Bob Jensen, April 3, 201

Moocher Hall of Fame ---

https://danieljmitchell.wordpress.com/the-moocher-hall-of-fame/

Question

Should we keep increasing the government spending deficit and the national debt

every year ad infinitum?

Answers

Although in these down economic times, the liberal's Keynesian hero and Nobel

Prize economist, Paul Krugman, thinks recovery is stalled because the government

is not massively increasing spending deficits. But he's not willing to commit

himself to never reducing deficits or never paying down some of the national

debt. Hence, he really does not answer the above question ---

http://www.nytimes.com/2012/01/02/opinion/krugman-nobody-understands-debt.html

So let's turn to a respected law professor who advocates increasing the

government spending deficit and the national debt every year ad infinitum?

"Why We Should Never Pay Down the National Debt (even partly)," by

Neil H. Buchanan George Washington University Law School), SSRN, 2012 ---

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2101811

Abstract:

Calls either to balance the federal budget on an annual basis, or to pay

down all or part of the national debt, are based on little more than

uninformed intuitions that there is something inherently bad about borrowing

money. We should not only ignore calls to balance the budget or to pay down

the national debt, but we should engage in a responsible plan to increase

the national debt each year. Only by issuing debt to lubricate the financial

system, and to support the economy’s healthy growth, can we guarantee a

prosperous future for current and future citizens of the United States.

Student Assignment

Since many of the most liberal economists are not quite

willing to assert that "we should never pay down the national debt," what

questionable and unmentioned assumptions have been made by Neil H. Buchanan

that need to be addressed?

Are some of these assumptions unrealistic in any world

other than a utopian world?

Bob Jensen's Answers ---

http://www.cs.trinity.edu/~rjensen/temp/NationalDeficit-Debt.htm

InfoGraphic on How the Tax Burden Has Changed ---

http://www.nytimes.com/interactive/2012/11/30/us/tax-burden.html

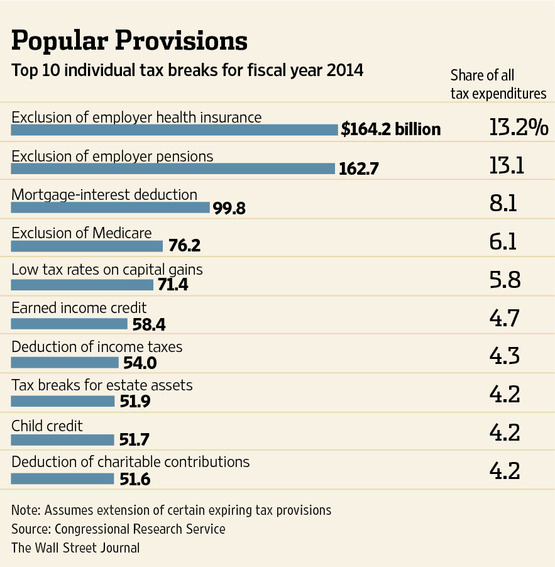

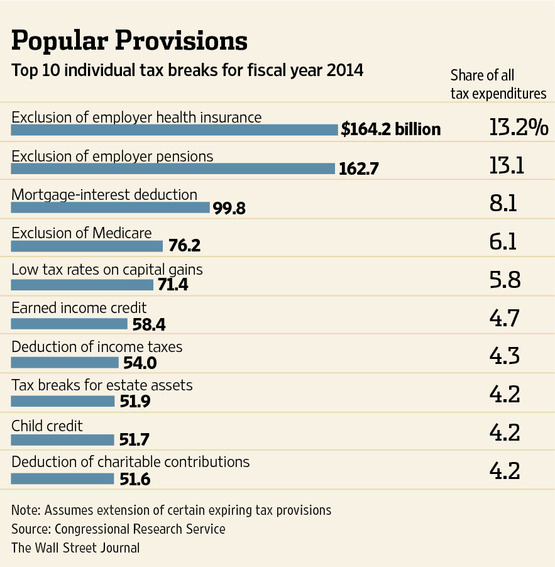

From The Wall Street Journal Accounting Weekly Review on March 30,

2012

Tax Breaks Exceed $1 Trillion: Report

by: John D. McKinnon

Mar 24, 2012

Click here to view the full article on WSJ.com

Click here to view the video on WSJ.com ![WSJ Video]()

TOPICS: Tax Laws, Tax Reform, Taxation

SUMMARY: The article reports on a "...new report by the

non-partisan Congressional Research Service [which] underscores how

far-reaching..." are many of the most costly tax provisions in the U.S. tax

code. As highlighted in the related video, these items are likely to become

a focused issue in this election year. "House Republicans proposed in their

new budget this week to reduce or eliminate an unspecified array of tax

breaks in order to offset the costs of lowering top tax rates for both

corporations and individuals to 25% from the current 35%." President Obama

proposed reducing the top corporate tax rate only, from 35% to 28%, with

corresponding proposals to eliminate certain corporate tax breaks, such as

deductibility of the cost of corporate jets and tax treatment of foreign

earnings.

CLASSROOM APPLICATION: The article is useful to summarize the types

of items considered to be "tax breaks," and the current, election-year

proposals to simplify the U.S. tax code.

QUESTIONS:

1. (Introductory) Who produced the report on which this article is

based? How do you think the information was obtained?

2. (Introductory) Why is this report useful in considering ways to

overhaul the U.S. tax code?

3. (Advanced) What kinds of items are characterized as "tax breaks"

in the document on which this article reports?

4. (Advanced) Specifically describe the tax treatment of each of

the items listed in the graphic entitled "Popular Provisions." Who benefits

from each of these items?

5. (Advanced) Based on your answer to question 2, explain why

"House Republicans dismissed the report's significance saying it only

confirms that overhauling the tax code will be politically challenging."

Reviewed By: Judy Beckman, University of Rhode Island

"Tax Breaks Exceed $1 Trillion: Report," by: John D. McKinnon, The Wall

Street Journal, March 24, 2012 ---

http://online.wsj.com/article/SB10001424052702303812904577299923495453562.html?mod=djem_jiewr_AC_domainid

A congressional report detailing the value of major

tax breaks shows they amount to more than $1 trillion a year—roughly the

size of the annual federal budget deficit—and benefit wide swaths of the

population.

The figures could be useful to lawmakers of both

parties and President Barack Obama, who are looking for ways to shrink

future deficits and offset the anticipated cost of overhauling the

much-criticized U.S. tax code, an effort likely to include tax-rate cuts.

Both parties are looking to trim or eliminate tax breaks to achieve those

goals.

Mr. Obama has suggested eliminating breaks for

corporate jets and oil and gas companies to reduce deficits. He also has

raised the possibility of reducing tax breaks for U.S. multinationals that

ship jobs overseas, as a way to offset the cost of lowering the corporate

tax rate to 28% from the current 35%. Research Report

House Republicans proposed in their new budget this

week to reduce or eliminate an unspecified array of tax breaks in order to

offset the costs of lowering top tax rates for both corporations and

individuals to 25% from the current 35%.

The new report, by the nonpartisan Congressional

Research Service, underscores how far-reaching many of the tax breaks are,

which makes changing them a politically daunting task.

They include the exclusion from taxable income for

employer-provided health insurance, the biggest break, at $164.2 billion a

year in 2014; the exclusion for employer-provided pensions, the

second-biggest, at $162.7 billion; and the exclusions for Medicare and

Social Security benefits.

Other big breaks include the mortgage-interest

deduction, third-largest; taxing capital-gains income at lower rates than

other income; the earned-income credit for the working poor; and deductions

for state and local taxes.

The report, citing political opposition, technical

challenges and other reasons, said that "it may prove difficult to gain more

than $100 billion to $150 billion in additional tax revenues" by eliminating

tax breaks. That likely would leave little for reducing tax rates, perhaps

only enough for one or two percentage points in the top individual rate,

while maintaining the same level of revenue, the report said.

Continued in article

Jensen Comment

I'm suspicious that this greatly underestimates the so-called "tax breaks" by

not mentioning exclusions from revenue. For example, hundreds of billions of

interest revenue from municipal bonds are excluded from taxable revenue

(federal). Many types of life insurance payments are tax exempt. Clerics get

some generous exemptions for housing allowances. And there are capital gains

exemptions in Roth IRAs and scores of other exclusions.

Blue is Blue

From the TaxProf Blog on March 6, 2013

The Fiscal Times:

The Ten Worst States for U.S. Taxes:

-

New York

-

New Jersey

-

California

-

Vermont

-

Rhode Island

-

Minnesota

-

North Carolina

-

Wisconsin

-

Iowa

-

Maryland

The left of liberal governor of Vermont claims that his state's welfare

generosity motivates Vermonters not to seek employment (at least the kind that

does not pay cash under the table in the underground economy) ---

http://www.cs.trinity.edu/~rjensen/temp/Political/PoliticalQuotationsCommentaries.htm#VermontWelfare

Case Studies in Gaming the Income Tax Laws ---

http://www.cs.trinity.edu/~rjensen/temp/TaxNoTax.htm

From CFO.com Morning Ledger on March 14, 2013

Regulators ramp up payroll audits.

Regulators are cracking down on small businesses and other employers who

misclassify workers as independent contractors to avoid paying payroll taxes

and other expenses, the Journal’s

Angus Loten and Emily Maltby write.

Some employers are turning to contractors to avoid hitting the federal

health-care law’s 50-employee threshold for health insurance. And the

crackdown is partly aimed at boosting tax revenue. The U.S. Treasury

estimates that forcing employers to properly classify their workers—while

tightening so-called “safe harbor” rules that provide them with leeway in

determining who is and isn’t an employee—would yield $8.71 billion in added

tax revenue over the next decade.

Jensen Comment

Another incentive for outsourcing certain types of work is to outsource risk

of fines and bad publicity resulting from employing undocumented workers. A

company, including a highly respected university, can get very bad publicity

when the news media discloses a practice of hiring undocumented workers. For

that reason those organizations will hire such things as building cleaning

services from local businesses that are very small and less concerned about bad

publicity. A friend of mine in a very respected large company in San Antonio

said in all his years working as a security guard for that company he never met

a janitor (male or female) who spoke one word of English.

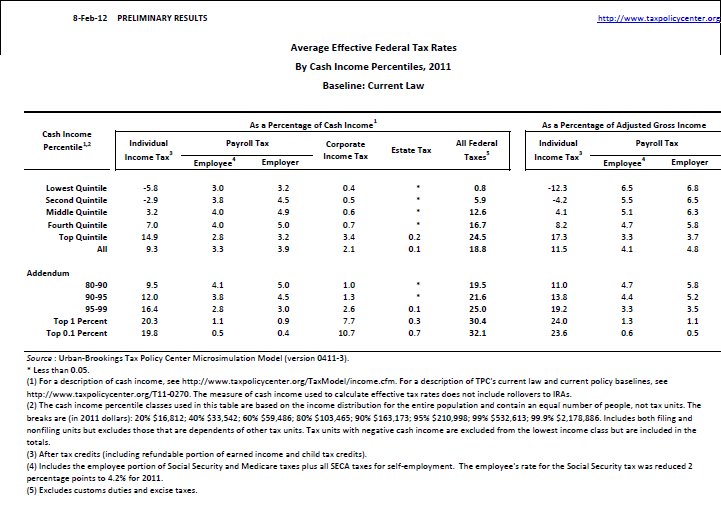

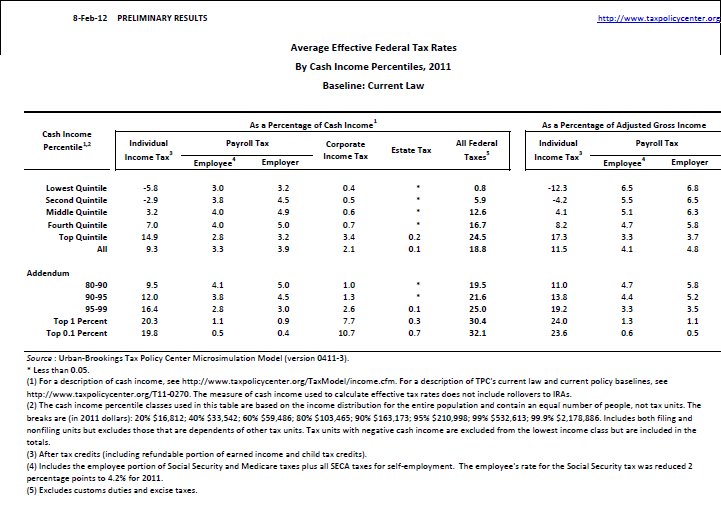

"CBO: The Distribution of Household Income and Federal Taxes, 2008 and

2009," Congressional Budget Office ---

http://www.cbo.gov/sites/default/files/cbofiles/attachments/43373-06-11-HouseholdIncomeandFedTaxes.pdf

Thank you Paul Caron for the heads up.

For most income groups, the 2009 average federal

tax rate was the lowest observed in the 1979–2009 period. ... For the lowest

income group, the average rate fell from 7.5% in 1979 to 1.0% in 2009. ...

Households in the middle three income quintiles saw their average tax rate

fall by 7.1 percentage points over 30 years, from 19.1% in 1979 to 12.0% in

2009. ... The average tax rate for households in the 81st to 99th

percentiles of the income distribution also reached a low point in 2009,

about 4 percentage points below its 1979 level. ... In contrast, in 2009 the

average tax rate for households in the top 1% of the before-tax income

distribution was above its low point, reached in the early 1980s. ... The

tax rate ... rose somewhat from 2007 to 2009, as sharp declines in capital

gains income caused a larger portion of the income of that group to be

subject to the ordinary income tax rates. The decline in after-tax income

between 2007 and 2009 was much larger at the top of the income distribution

than further down the distribution.

Let's soak'em for 100% so we can live off the fat of the land

"CBO: The wealthly pay 70 percent of taxes," by Stephen Dinan, The

Washington Times, July 10, 2012 ---

http://www.washingtontimes.com/news/2012/jul/10/cbo-rich-pay-outsized-share-taxes/

Wealthy Americans earn about 50 percent of all

income but pay nearly 70 percent of the federal tax burden, according to the

latest analysis Tuesday by the Congressional Budget Office — though the

agency said the very richest have seen their share of taxes fall the last

few years.

CBO looked at 2007 through 2009 and found the

bottom 20 percent of American earners paid just three-tenths of a percent of

the total tax burden, while the richest 20 percent paid 67.9 percent of

taxes.

The top 1 percent, who President Obama has made a

target during the presidential campaign, earns 13.4 percent of all pre-tax

income, but paid 22.3 percent of taxes in 2009, CBO said. But that share was

down 4.4 percentage points from 2007, CBO said in a finding likely to

bolster Mr. Obama’s calls for them to pay more by letting the Bush-era tax

cuts expire.

The big losers over the last few years were the

rest of the well-off, especially those in the top fifth, who saw their tax

burdens go up.

“Specifically, between 2007 and 2009, the share of

taxes paid fell for the bottom three income quintiles, was close to flat for

the fourth quintile, but rose for the highest quintile,” CBO said. “Within

the top quintile, however, the shift was uneven; the share paid by the top

percentile fell, and the share paid by the rest of the top quintile rose.”

The tax fight has risen to the top of this year’s

presidential campaign, with Mr. Obama calling for the wealthy to pay more

money both to lower the deficit and fund his new spending promises. He wants

households making $250,000 or more a year to see their rates return to

Clinton-era levels, though he has proposed a one-year extension of the rest

of the Bush-era rates.

Republicans have countered that they want a

one-year extension of all current rates in order to have breathing space to

tackle a broader overhaul of the tax code.

CBO, the nonpartisan agency that serves as

Congress’ official scorekeeper, said the current tax code is progressive

chiefly because of the income-tax structure. On average, the lowest 40

percent of earners actually get money back through the income-tax code

because of refundable tax credits.

Overall, the federal tax rates in 2008 and 2009 —

at 18 percent and 17.4 percent — were the lowest in the last three decades,

suggesting at least part of the reason the federal government has run record

deficits in recent years.

In terms of actual earnings, the top 1 percent

suffered the most in the recession, with their average earnings dropping

from $1.9 million to $1.2 million. The lowest 20 percent saw their incomes

drop from $23,900 to $23,500 during that time.

A Slide Show from the Tax Foundation (Click the arrows on the right side of

the screen)

"Putting a Face on America's Tax Returns: A Chartbook September 24, 2012,"

by Scott A. Hodge William McBride, Tax Foundation, September 24, 2012

http://taxfoundation.org/slideshow/putting-face-americas-tax-returns

Thank you Caleb Newquist for the heads up.

You can get the above content in PDF format at

http://taxfoundation.org/sites/taxfoundation.org/files/docs/putting_a_face_on_americas_tax_returns_a_chartbook.pdf

Jensen Comment

This slide show focuses heavily on inequality.

From The Washington Post regarding a recent Congressional Budget

Office Report on Who is Shouldering the Tax Burden

. . .

The CBO study released this week provides ample evidence that the richest

Americans are paying their “fair share” of federal taxes. In fact,

the richest 20% of Americans by income aren’t just paying a share of federal

taxes that would be considered “fair” — it goes way beyond “fair” — they’re

shouldering almost 100% of the entire federal tax burden of transfer

payments and all other non-financed government spending. What’s probably not

so fair is that the bottom 60% isn’t just getting off with a small tax

burden or no tax burden – the bottom 60% are net recipients of transfer

payments from the top 20% to the tune of about $10,000 per household in

2011. So maybe what the CBO report shows is that we should be asking whether

or not the bottom 60% are paying their fair share when they’re not

paying anything – they’re net recipients of transfer payments that come from

“the richest” 20% of American households. When the top 20% of US households

are financing almost 100% of the transfer payments to the bottom 60% and

financing almost the entire non-financed operating budget of the federal

government, I’d say “the rich” are paying beyond their fair share of the

total tax burden, and we might want to start asking if the bottom 60% of

“net recipient” households are really paying their fair share.

Washington Post Wonkblog, Tax

Rates Are Finally on the Rise for the Top 1 Percent, CBO Says:

November 17, 2014

Congressional Budget Office (CBO)

The Top 40% Income Bracket Pays 106% of the Income Tax, The Lowest 40%

Bracket Pays -9%% (Negative).

CNBC. December 11, 2013 ---

http://www.cnbc.com/id/101264757

Jensen Comment

This is a bit misleading in terms of bracket definitions. The income taxes paid

or received in the above brackets are highly skewed such that the highest income

taxpayers are paying a larger share in the top bracket and the lower income tax

receivers in the low bracket are receiving a larger share of the negative cash

flows.

Thomas J. Sargent's NYT Profile ---

http://www.nytimes.com/2011/10/30/your-money/thomas-sargent-nobel-winner-rejects-philosophical-slogans.html?_r=0

"The Greatest Graduation Speech Ever Given Is This Bullet-Point List Of 12

Economic Concepts" ---

http://www.businessinsider.com/thomas-sargent-shortest-graduation-speech-2014-4#ixzz2zFBwd9Yb

Students from the class of 2014 have begun graduating.

To mark the occasion,

economist and blogger Craig Newmark and

AEI's Mark Perry dug up a speech given by Nobel

economist Thomas Sargent to graduates of Cal-Berkeley in 2007.

It's only 335 words long, but

it's really great. It breaks down the 12 economic concepts that every

graduate should know.

Check it out:

Economics is organized

common sense. Here is a short list of valuable lessons that our beautiful

subject teaches.

1. Many things that are

desirable are not feasible.

2. Individuals and

communities face trade-offs.

3. Other people have

more information about their abilities, their efforts, and their preferences

than you do.

4. Everyone responds to

incentives, including people you want to help. That is why social safety

nets don’t always end up working as intended.

5. There are tradeoffs

between equality and efficiency.

6. In an equilibrium of

a game or an economy, people are satisfied with their choices. That is why

it is difficult for well-meaning outsiders to change things for better or

worse.

7. In the future, you

too will respond to incentives. That is why there are some promises that

you’d like to make but can’t. No one will believe those promises because

they know that later it will not be in your interest to deliver. The lesson

here is this: before you make a promise, think about whether you will want

to keep it if and when your circumstances change. This is how you earn a

reputation.

8. Governments and

voters respond to incentives too. That is why governments sometimes default

on loans and other promises that they have made.

9. It is feasible for

one generation to shift costs to subsequent ones. That is what national

government debts and the U.S. social security system do (but not the social

security system of Singapore).

10. When a government

spends, its citizens eventually pay, either today or tomorrow, either

through explicit taxes or implicit ones like inflation.

11. Most people want

other people to pay for public goods and government transfers (especially

transfers to themselves).

12. Because market

prices aggregate traders’ information, it is difficult to forecast stock

prices and interest rates and exchange rates.

Jensen Comments

Some outstanding commencement speeches may have been more inspirational and

motivational However, this one appeals to me in terms of separating economic

realism from hopeless and sometimes costly dreams such as the dream that if we

ignore entitlements our grandchildren will still be better off even if we don't

make sacrifices ourselves today for those entitlements. Translated into

Jenseneconomics this means that we cannot and should not allow half the

taxpayers in the USA to pay no taxes. The rich just do not have enough money to

sustain the poor and most of the middle class who pay little or no income tax

toward Federal and state budgets even if they do pay some other taxes.

"Rich" People Gaming the Income Tax Laws:

Col. X and his Wife

Perhaps I am less sympathetic than most of you because I suspect that tens of

millions of people are gaming the system to avoid income taxes even though they

are not really so poor when the Great Scorer adds up their annual incomes. There

are really two types of tax gamers. One type is a so-called "taxpayer" who files

an income tax return but games the tax code to pay little or no income tax. The

other gamer is supposedly so poor that it's not necessary to file a tax return

and be classified as a "taxpayer."

I will tell you about two families I know in San Antonio. First note that San

Antonio is heavily populated with retired military families who have extensive

social networks and take advantage of the various Army and Air Force bases in

the area. Among other things, these bases provide free medical services, free

prescription drugs, low cost base exchange (BX) department stores that don't

charge any sales tax, base golf courses, base social clubs, and even free base

cemeteries for husbands and wives.

The American Dream: A Free

Ride

Nearly Half of All Americans Don’t Pay Income Taxes

http://blog.heritage.org/2012/02/19/chart-of-the-week-nearly-half-of-all-americans-dont-pay-income-taxes/

Why don't they grant an Oscar to the state with the biggest tax breaks for

Hollywood film makers?

http://professional.wsj.com/article/SB10001424127887324880504578298080119811240.html?mod=WSJ_Opinion_LEADTop&mg=reno64-wsj#articleTabs%3Darticle

. . .

Actually, nowadays an

Eva Longoria who flipped burgers would probably qualify for the Earned

Income Tax Credit and get a check from the government rather than pay taxes.

It's the movie set where she works these days that may well be getting the

tax break.

With campaign season

over, you're not likely to hear stars bringing up taxes at this weekend's

Academy Awards show. But the tax man ought to come out and take a bow

anyway. Of the nine "Best Picture" nominees in 2012, for example, five were

filmed on location in states where the production company received financial

incentives. ...

Such state incentives

are widespread, and often substantial, but they don't do much to attract

jobs. About $1.5 billion in tax credits and exemptions, grants, waived fees

and other financial inducements went to the film industry in 2010, according

to data analyzed by the Center on Budget and Policy Priorities [State

Film Subsidies: Not Much Bang For Too Many Bucks].

Politicians like to offer this largess because they get photo-ops with

celebrities, but the economic payoff is minuscule. George Mason University's

Adam Thierer has called this "a

growing cronyism fiasco" and noted that the number

of states involved skyrocketed to 45 in 2009 from five in 2002.

Col. X and his wife were our exceptional friends (more like family) when we lived in

San Antonio. Erika and I went to dinner-card parties at least once each week with

this couple and eight other couples that were retired from the military. On

frequent occasions these parties expanded to 20-30 couples at parties on San

Antonio's military bases and

in area country clubs. Throughout most of our 24 years in San Antonio, the major

military bases were Lackland AFB, Ft. Sam Houston Army Medical Command (Brooke

Army Medical Center), Randolph AFB, Brooks AFB , and the huge Kelly AFB

(much of Kelly is now owned and operated by the City of San Antonio).

Col X is a former Air Force physician. He's now retired.

I know some about the personal finances of Col. X and his wife because I

helped them file their tax return each year while I was their close circle of

friends. They receive about $90,000 in tax

exempt bond interest annually. In addition they have about $75,000 in other

retirement income that includes some really complicated depreciation

pass-through amounts from low income housing investments. I never understood

these investments. But that did not matter since Col. X's brokerage firm

provided me with explicit instructions about how to feed all this information

into Turbo Tax.

The bottom line is that during our years in San Antonio Col. X and his wife received well over $150,000 per

year in retirement and paid almost no income tax. They lived in a $600,000 house

with a four-car garage that housed two big Lincoln automobiles. They never

seemed to begrudge losing thousands of dollars in monthly trips with friends to

the Golden Nugget Hotel and Casino in downtown Las Vegas. But they adopted a

strategy to only pay a

pittance in income tax even though they lived on a full military pension

with totally free medical services from the Brooke Army Medical Hospital on Fort

Sam Houston, free prescription drugs, BX shopping, and other base privileges

paid for by the military. When they die they will be buried, one on top of the

other, by an honor guard at the Fort Sam Houston Military Cemetery.

I might add that during World War 2, Col. X was a B17 navigator who went on

dangerous missions in North Africa, Italy, and eventually Germany. He recalls

bombing the hell our of a ball bearing factory in

Regensburg

a few years before

Erika,

as a five-year old child, was smuggled across the Czech. border into

Regensburg shortly after the war.

After World War 2 the Air Force paid the tuition for Col. X to attend the

Johns Hopkins University Medical School. He also retained his active duty pay as

a Captain in the Air Force while attending medical school. Afterwards he was

assigned to both the Brooke Army Medical Center at Ft. Sam and the Wilford Hall

Medical Center at Kelly AFB. Subsequent to retiring from the Air Force he went

into private practice in San Antonio.

Question

Among the 46% (some say 49.5%) of taxpayers not paying any taxes, is it mostly

the outliers (extremely rich and extremely poor) who pay no income taxes?

Answer

Well, only in part. Most (89%) of those so-called "taxpayers" making less than

$20,000 pay no taxes. A few like college students who are still claimed as

dependents on the tax returns of their parents may pay a slight amount of income

tax on part-time earnings.

Most of those making more than $100,000 pay some income taxes. Bloomberg

reports that 98% of those that pay no income taxes have less than $100,000 in

earnings. Most are availing themselves of recent tax breaks such as energy

credits, tax breaks from employer contributions to medical insurance, increased

tax breaks for dependents, and deferred tax breaks such as breaks professors get

for employer contributions to TIAA-CREF.

Watch the April 3, 2012 Bloomberg Video ---

http://www.bloomberg.com/video/89503501/

Also see

"Comparing the top and the bottom income earners: Distribution of income and

taxes in the United States," by Govind S. Iyera, Peggy Jimeneza, and Philip M.J.

Reckers, Journal of Accounting and Public Policy, March–April 2012, Pages

226–234 ---

http://www.sciencedirect.com/science/article/pii/S027842541200004X

Thank you Steve Sutton for the heads up.

Why, according to the OECD, is the US system so

progressive? Not because the rich face unusually high average tax rates, but

because middle-income US households face unusually low tax rates--an important

point which de Rugy mentions and Chait ignores.

Note that the Excel file includes payroll taxes as well as income taxes

---

(Here are the IRS data,

excel file.)

"U.S. Taxes Really Are Unusually Progressive," by Clive Crook, The

Atlantic, February 10, 2012 ---

http://www.theatlantic.com/business/archive/2012/02/us-taxes-really-are-unusually-progressive/252917/

If you ask me, Jonathan Chait, a writer I respect,

has made an ass of himself in a fight he picked with Veronique de Rugy over

taxes and progressivity. She offended him by saying that

America's income taxes are more progressive than

those of other rich countries. Chait assailed her "completely idiotic"

reasoning, called her an "inequality

denier", "a ubiquitous right-wing misinformation

recirculator" and

asked if it was really any wonder he cast insults

now and then at such "lesser lights of the intellectual world". (Paul

Krugman said he sympathises. With Chait, obviously. The only danger here is

in being too forgiving,

Krugman advises. Chait may think the de Rugys of

this world are only lazy and incompetent, but we know them to be liars as

well.)

Just one problem. On the topic in question, De Rugy

is right and Chait is wrong.

Income taxes in America are more

progressive than in other rich countries--according to an authoritiative

official study which, to my knowledge, has not been contradicted. The OECD's

report "Growing

Unequal", on poverty and inequality in industrial

countries, includes a table that provides two measures of income tax

progressivity in 2005. This is evidently the source of de Rugy's numbers.

Here they are in an

excel file. According to one measure, America's

income taxes were the most progressive of the 24 countries in the sample,

except for Ireland. According to the other, they were the most progressive

full stop. (A more recent OECD report, "Divided

We Stand", uses different data, a smaller sample

of countries and a different measure of progressivity: the results are

similar.)

Before you ask, this ranking takes account of

employee-side payroll tax as well as the federal income tax.

Chait first objected to de Rugy's claim about

progressivity because he thought she was inferring it from the fact that the

US collects the biggest share of income taxes--45 percent of the total, col

B1 in the table--from the top income decile. That would be a false

inference, as Chait says, because it could be true of a country with a very

unequal income distribution even if its taxes were not especially

progressive. But look at the table. There was no need for de Rugy to draw

any such inference, let alone try to mislead readers. All she needed to

do--and all, I'm sure, she did--was glance over to the last column, which

actually gives the measure of progressivity, showing the US to have the

highest score.

The measure of progressivity is hard to explain, so

I can see why de Rugy quoted the tax share instead. But she could have

chosen a much more dramatic number if she was seeking merely to bamboozle

her readers. Exclude payroll tax, and the top 1 percent of taxpayers, not

the top 10 percent, have lately accounted for nearly 40 percent of income

tax receipts, the top 5 percent for nearly 60 percent, and the top decile

for roughly 70 percent. (Here are the IRS data,

excel file.)

For the reason I just gave, this does not prove

that the US tax system is more progressive than anybody else's--but it

surely has some relevance to the question, "Are the rich paying their fair

share of income tax?" If this isn't fair, what would be?

When Chait, with all the authority of a leading

light of the intellectual world, says "Rich Americans pay a bigger share of

the tax burden because they earn a bigger share of the income, not because

the U.S. tax code is more progressive," he is making the same kind of sloppy

bias-driven error he falsely accuses de Rugy of making. (I'll refrain from

wondering whether he made the mistake deliberately.) According to the OECD,

rich Americans bear a bigger share of the tax burden because they earn a

bigger share of the income and because the US income tax

system is more progressive.

There's a lot more to say on this subject.

Is measuring progressivity straightforward? No.

It's difficult, because the underlying data are very complicated and hard to

compare across countries. Another problem: expressing progressivity across

the whole income range as a single number, so that one can say A is more or

less progressive than B, can be misleading. Unfortunately, we all want to be

able to say, A is more or less progressive than B.

Why, according to the OECD, is the US system so

progressive? Not because the rich face unusually high average tax rates, but

because middle-income US households face unusually low tax rates--an

important point which de Rugy mentions and Chait ignores.

How does the picture change if you take indirect

taxation into account? That would make the US system look even more

progressive, because the US doesn't rely on a flat consumption tax like most

other governments.

Continued in article

Most developed nations, other than the U.S., provide relief on double

taxation

"Corporate Dividend and Capital Gains Taxation: A Comparison of the United

States to Other Developed Nations," by Ernst & Young (Drs. Robert Carroll

and Gerald Prante), February 2012 ---

http://images.politico.com/global/2012/02/120208_asidividend.html

Individual Retirement Account (IRA) ---

http://en.wikipedia.org/wiki/Individual_retirement_account

There are several types of IRA:

-

Traditional IRA – contributions are often

tax-deductible (often simplified as “money is deposited before tax” or

“contributions are made with pre-tax assets”), all transactions and

earnings within the IRA have no tax impact, and withdrawals at

retirement are taxed as income (except for those portions of the

withdrawal corresponding to contributions that were not deducted).

Depending upon the nature of the contribution, a traditional IRA may be

referred to as a “deductible IRA” or a “non-deductible IRA.” It was

introduced with the Tax Reform Act (TRA) of 1986.

-

Roth IRA – contributions are made with

after-tax assets, all transactions within the IRA have no tax impact,

and withdrawals are usually tax-free. Named for Senator

William V. Roth, Jr.. The Roth IRA was

introduced as part of the Taxpayer Relief Act of 1997.

-

SEP IRA – a provision that allows an employer

(typically a small business or self-employed individual) to make

retirement plan contributions into a Traditional IRA established in the

employee’s name, instead of to a pension fund in the company's name.

-

SIMPLE IRA – a Savings Incentive Match Plan

for Employees that requires employer matching contributions to the plan

whenever an employee makes a contribution. The plan is similar to a

401(k) plan, but with lower contribution

limits and simpler (and thus less costly) administration. Although it is

termed an IRA, it is treated separately.

-

Self-Directed IRA – a self-directed IRA that

permits the account holder to make investments on behalf of the

retirement plan.

There are two other subtypes of IRA, named Rollover

IRA and Conduit IRA, that are viewed by some as obsolete under current tax

law (their functions have been subsumed by the Traditional IRA); but this

tax law is set to expire unless extended. However, some individuals still

maintain these arrangements in order to keep track of the source of these

assets. One key reason is that some qualified plans will accept rollovers

from IRAs only if they are conduit/rollover IRAs.

What was formerly known as an Educational IRA is

now called a

Coverdell Education Savings Account.

Starting with the

Economic Growth and Tax Relief Reconciliation Act of 2001

(EGTRRA), many of the restrictions of what type of funds could be rolled

into an IRA and what type of plans IRA funds could be rolled into were

significantly relaxed. Additional acts have further relaxed similar

restrictions. Essentially, most retirement plans can be rolled into an IRA

after meeting certain criteria, and most retirement plans can accept funds

from an IRA. An example of an exception is a non-governmental

457 plan which cannot

be rolled into anything but another non-governmental 457 plan.

The tax treatment of the above types of IRAs except

for Roth IRAs are substantially similar, particularly for rules regarding

distributions. SEP IRAs and SIMPLE IRAs also have additional rules similar

to those for qualified plans governing how contributions can and must be

made and what employees are qualified to participate.

"Should You Contribute to a Non-Deductible IRA?" by Laura Adams,

Money Girl, February 12, 2013 ---

http://moneygirl.quickanddirtytips.com/what-is-a-non-deductible-ira.aspx

Bob Jensen's personal finance helpers ---

http://www.trinity.edu/rjensen/Bookbob1.htm#InvestmentHelpers

Roth IRA ---

http://en.wikipedia.org/wiki/Roth_IRA

Jensen Warning

Deborah Jacobs may have overstated the case for a Roth IRA. Ordinary folks

should not choose a Roth IRA without expert tax advice

Mega-Roths

Remarkably, despite warnings of future large revenue losses, Congress has put

no cap on the amount that can accumulate in a Roth IRA. Still, the Yelp

shares in Levchin’s Roth do raise a legal issue. Tax rules bar you from

investing your IRA or Roth IRA in a business you control—such a “prohibited

transaction” can render the IRA immediately taxable and possibly subject to

penalties.

Deborah L. Jacobs (see

below)

"How Facebook Billionaires Dodge Mega-Millions In Taxes," by Deborah

L. Jacobs, Forbes, March 20, 2012 ---

http://www.forbes.com/sites/deborahljacobs/2012/03/20/how-facebook-billionaires-dodge-mega-millions-in-taxes/

In 2010 Max R. Levchin, chairman of social review

site

Yelp, sold 3.1 million shares of Yelp held in his

Roth individual retirement account. Most of the $10.1 million he received

was profit. But Levchin, a 36-year-old serial entrepreneur who started

PayPal with billionaire

Peter Thiel

in 1998, won’t ever have to pay a penny of income tax

on those gains. That’s because all earnings in a Roth IRA are tax free so

long as its owner waits until age 59 1/2 to take money out.

Moreover, Securities & Exchange Commission filings

show Levchin still has 3.9 million shares of Yelp, now trading near $22, in

his Roth. So it appears his tax-free “retirement” kitty is worth at least

$95 million—and maybe a lot more. We don’t know, for example, if Levchin’s

Roth owned stock in social app company Slide, which he started in 2004 and

sold to

Google

for $182 million in 2010. If Levchin doesn’t spend his

mega-Roth in retirement, he can leave it to his kids or grandkids, who can,

under current law, stretch out income-tax-free growth and withdrawals for

decades.

Levchin isn’t the only tech titan who’s got a

shrewd tax advisor. Buried in recent SEC filings for Facebook,

Zynga and

LinkedIn are other examples of legal moves the

ultrarich use to shield big dollars from the taxman. These techniques are

available to the merely well-off, too, but they produce the most dramatic

savings when executed early in a hot company’s—or hot entrepreneur’s—life.

How early? Facebook billionaire cofounders

Mark Zuckerberg and

Dustin Moskovitz are both 27, unmarried and have

no children we know of. Yet back in 2008 they both set up grantor retained

annuity trusts (GRATs) that we estimate will allow them to transfer a total

of at least $185 million of wealth to future offspring or others, gift tax

free. That compares to a supposed gift-tax exemption of just $1 million in

2008 and $5.12 million today.

Both the Obama Administration and congressional

Democrats have proposed new limits on GRATs. Meanwhile, you may want to copy

the social tech wizards, if you have high-growth investments to shelter.

Mega-Roths

Remarkably, despite warnings of future large

revenue losses, Congress has put no cap on the amount that can accumulate in

a Roth IRA. Still, the Yelp shares in Levchin’s Roth do raise a legal issue.

Tax rules bar you from investing your IRA or Roth IRA in a business you

control—such a “prohibited transaction” can render the IRA immediately

taxable and possibly subject to penalties.

It’s clear that if you own a small business, your

IRA or Roth IRA can’t invest in it. But what if you are chairman or CEO of a

private firm with many investors and buy its shares for your Roth? SEC

filings show that in 2001, while CEO of PayPal, tech investor Thiel bought

1.7 million shares of that company for 30 cents a share through his Roth. In

2002 eBay bought out PayPal for $19 a share—an apparent $31.5 million

tax-free profit for Thiel. It also appears from a letter we discovered in a

federal court case that some of Thiel’s early investment in Facebook was

also through his Roth IRA. He now sits on Facebook’s board.

Is this kosher? FORBES has been told reward-seeking

informants are filing claims with the IRS Whistleblower Office, flagging

such transactions as improper. But IRA expert Noel Ice says it’s a gray

area, with little IRS or court guidance. Buying closely held stock for an

IRA is probably okay, he says, so long as the IRA’s owner doesn’t have—when

all his investments are combined—voting control of that company. Levchin,

Thiel and the IRS wouldn’t comment.

The lesson for ordinary folks? Put investments with

the highest growth potential in your Roth. Note: If you do want to put

nonpublicly traded stock in an IRA or a Roth IRA, you’ll generally need to

use a special custodian who handles “self-directed” IRAs. (The big brokers,

banks and mutual fund companies that hold most IRAs generally limit

investments to publicly traded stock, bonds, mutual funds and bank CDs.)

Levchin and Thiel have used

San

Francisco-based Pensco Trust Co. to hold their

Roth IRAs.

The Facebook GRATs

Thanks to a 2000 Tax Court decision involving a

member of the billionaire Walton clan, which founded Wal-Mart, it’s now

possible to transfer large amounts of wealth to heirs gift tax free using a

grantor retained annuity trust. The person who wants to transfer wealth (the

grantor) puts shares into the irrevocable trust and retains the right to

receive an annual payment back from the trust for a period of time—say, 2

to 15 years. If the grantor survives that period, any property left in the

trust when the annual payments end passes to family members.

The key is this: In calculating how much value will

be left at the end—and thus how big a gift the grantor is making—the IRS

doesn’t look at the performance of the actual stock in the trust. Instead,

it assumes the trust assets are earning a paltry government-determined

interest rate. With a zeroed-out, or “Walton” GRAT, the grantor receives an

annuity that leaves nothing for heirs—if assets grow only at the IRS’ lowly

interest rate. If they grow faster, the excess goes to heirs gift tax free.

(If assets don’t grow, the grantor is no worse off, because the annuity can

be paid by returning some shares each year to the grantor.)

Continued in article

Hi Ramesh,

If income and wealth equality is such a stimulant to economic growth and

prosperity why haven't nations other than Cuba and North Korea seriously

experimented with making everybody equal in income and wealth?

Why, for example, haven't Japan, South Korea, Norway, Finland, India, and now

China seen the egalitarian light?

Seems like an economic prosperity solution that Marx, Engels, and Mao

brilliantly advocated in previous centuries.

More importantly, Ramesh, can you offer us a clue as to why the following

countries, in an effort to stimulate economic growth, decreased

rather than increased the taxes paid by their most wealthy citizens? Why on

earth would Finland, Norway, Denmark, India, Iran, and the others do such a

thing that is counter to the expert that you linked us to in this thread?

Isn't this an effort to increase the economy with less equality?

Liberals/progressives just will not provide me with an answer to this question.

I imagine you will also not answer this question about the economic stupidity

versus brilliance of so many nations when they decrease taxes to their most

wealthy citizens?

Marginal Tax Rate Declines in the Rest of the World ---

http://www.econlib.org/library/Enc/MarginalTaxRates.html

Table 1 Maximum Marginal Tax Rates on

Individual Income

|

*. Hong Kong’s maximum tax (the “standard rate”) has

normally been 15 percent, effectively capping the marginal rate

at high income levels (in exchange for no personal exemptions). |

|

**. The highest U.S. tax rate of 39.6 percent after 1993 was

reduced to 38.6 percent in 2002 and to 35 percent in 2003. |

|

| |

1979 |

1990 |

2002 |

| Argentina |

45 |

30 |

35 |

| Australia |

62 |

48 |

47 |

| Austria |

62 |

50 |

50 |

| Belgium |

76 |

55 |

52 |

| Bolivia |

48 |

10 |

13 |

| Botswana |

75 |

50 |

25 |

| Brazil |

55 |

25 |

28 |

| Canada (Ontario) |

58 |

47 |

46 |

| Chile |

60 |

50 |

43 |

| Colombia |

56 |

30 |

35 |

| Denmark |

73 |

68 |

59 |

| Egypt |

80 |

65 |

40 |

| Finland |

71 |

43 |

37 |

| France |

60 |

52 |

50 |

| Germany |

56 |

53 |

49 |

| Greece |

60 |

50 |

40 |

| Guatemala |

40 |

34 |

31 |

| Hong Kong |

25* |

25 |

16 |

| Hungary |

60 |

50 |

40 |

| India |

60 |

50 |

30 |

| Indonesia |

50 |

35 |

35 |

| Iran |

90 |

75 |

35 |

| Ireland |

65 |

56 |

42 |

| Israel |

66 |

48 |

50 |

| Italy |

72 |

50 |

52 |

| Jamaica |

58 |

33 |

25 |

| Japan |

75 |

50 |

50 |

| South Korea |

89 |

50 |

36 |

| Malaysia |

60 |

45 |

28 |

| Mauritius |

50 |

35 |

25 |

| Mexico |

55 |

35 |

40 |

| Netherlands |

72 |

60 |

52 |

| New Zealand |

60 |

33 |

39 |

| Norway |

75 |

54 |

48 |

| Pakistan |

55 |

45 |

35 |

| Philippines |

70 |

35 |

32 |

| Portugal |

84 |

40 |

40 |

| Puerto Rico |

79 |

43 |

33 |

| Russia |

NA |

60 |

13 |

| Singapore |

55 |

33 |

26 |

| Spain |

66 |

56 |

48 |

| Sweden |

87 |

65 |

56 |

| Thailand |

60 |

55 |

37 |

| Trinidad and Tobago |

70 |

35 |

35 |

| Turkey |

75 |

50 |

45 |

| United Kingdom |

83 |

40 |

40 |

| United States |

70 |

33 |

39** |

|

| Source: PricewaterhouseCoopers;

International Bureau of Fiscal Documentation. |

Respectfully,

Bob Jensen

Note that PwC does Romney's tax returns and most likely is his main source

regarding global tax planning.

"In Superrich, Clues to What Might Be in Romney’s Returns," by James B.

Steward, The New York Times, August 10. 2012 ---

http://www.nytimes.com/2012/08/11/business/in-the-superrich-clues-to-romneys-tax-returns-common-sense.html?_r=3&ref=business

On the face of it, Senator Harry Reid’s explosive

but flimsily sourced claim that Mitt Romney paid no income tax seems

preposterous. Mr. Romney has denied it, and without his returns no one can

say for sure. But for someone who makes millions of dollars a year, would it

even be possible?

Evidently it is.

It so happens that this summer the Internal Revenue

Service released data from the 400 individual income tax returns reporting

the highest adjusted gross income. This elite ultrarich group earned on

average $202 million in 2009, the latest year available. And buried in the

data is the startling disclosure that six of the 400 paid no federal income

tax.

The I.R.S. has never before disclosed that last

fact.

Not even Mr. Romney, with reported 2010 income of

$21.7 million, qualifies for membership in this select group of 400. But the

data provides a window into the financial lives and tax rates of the

superrich. Since the I.R.S. doesn’t release data for the tiny percentage of

Americans at Mr. Romney’s income level, the 400 are the closest proxy.

And that data demonstrates that many of the

ultrarich can and do reduce their tax liability to very low levels, even

zero. Besides the six who paid no federal income tax, the I.R.S. reported

that 27 paid from zero to 10 percent of their adjusted gross incomes and

another 89 paid between 10 and 15 percent, which is close to the 13.9

percent rate that Mr. Romney disclosed that he paid in 2010. (At the other

end of the spectrum, 82 paid 30 to 35 percent. None paid more than 35

percent.) So more than a quarter of the people earning an average of over

$200 million in 2009 paid less than 15 percent of their adjusted gross

income in taxes.

How do they do it?

The data show that the ultrarich typically pay low

tax rates every year, but 2009 was a special case. In 2008, people with

large stock portfolios and other less liquid assets were disproportionately

hit with large losses on paper. One of the oddities of the tax code is that

capital gains taxes are discretionary, since they must be paid only when

gains are realized. And they can be offset by losses. The silver lining in a

bad year like 2008 for wealthy people is that they can “harvest” losses by

selling assets, then use those losses to offset any gains. They can also

carry forward the losses to offset gains in future years.

There’s ample evidence that happened in 2009 among

the richest taxpayers. Their average income, $202 million, dropped from $270

million in 2008 and was the lowest since 2004. Like Mr. Romney in 2010, for

the richest taxpayers most income comes from capital gains and other

investment income. Their net capital gains (the data doesn’t include gross

gains and losses) dropped by nearly 40 percent, from an average of $154

million in 2008 to $93 million in 2009, which accounts for nearly all of

their drop in total income. Even with these lower gains, these 400

taxpayers, a minuscule fraction of the population at large, still managed to

account for 16 percent of all capital gains. That is the highest percentage

since the data was first released for 1992, when that percentage was less

than 6 percent.

Tax experts I consulted said these results almost

certainly reflected aggressive use of tax-loss carry-forwards from 2008,

since the stock market bottomed in March 2009 and rallied strongly during

the rest of the year.

The superrich also accounted for a disproportionate

amount of dividend income, which averaged over $26 million for the top 400,

or over 6 percent of total dividend income, also a record. Capital gains and

dividends are both taxed at a maximum rate of 15 percent, as opposed to the

maximum rate on earned income of 35 percent, which helps explain why so many

of the superrich pay a relatively low rate. Still, that preferential rate

doesn’t get them anywhere near zero, or even 10 percent.

Edward Kleinbard, professor of law at the Gould

School of Law at the University of Southern California, explained it this

way, “You start with income dominated by tax-preferred income — capital

gains and qualified dividends. That gets you to 15 percent. Then you use

charitable contributions of appreciated securities to reduce ordinary

income. But the charitable contribution deduction is capped at 50 percent of

adjusted gross income. Now you’re way down, but you’re not at zero.”

Continued in article

Jensen Comment

Note that in many instances what we call a "tax savings" is not a net savings.

For example, when a taxpayer has millions of dollars invested in tax-exempt

bonds of towns, cities, counties, states, and schools (the so-called muni-bonds),

those government entities are getting a lower cost of capital (adjusted for

financial risk) than if the federal government took away those tax-exempt

options in tax reforms. For example, the cost of capital for municipalities

would soar much higher if their bonds were suddenly to become taxable on federal

tax returns and, thereby, had to compete with lower risk corporate bonds.

One could argue that it would be better for the government to eliminate tax

exemptions for municipal bonds and then subsidize all of the towns, cities,

counties, states, and school districts, but the trillions in subsidies required

would clobber Federal deficits now over a trillion dollars. And shrewd

high-income taxpayers would simply find other ways avoid taxation.

Even if Congress should enact a flat tax, I'm not in favor of eliminating tax

exemption for bonds of towns, cities, counties, states, and school districts.

That elimination would be too much of a shock to all the Main Streets of

America.

Having said this, I think there are many things that need to be accomplished

in major tax reforms for all levels of AGI.

The American Dream ---

http://www.cs.trinity.edu/~rjensen/SunsetHillHouse/SunsetHillHouseHotel.htm

"Poor" People Gaming the Income Tax Laws:

Juanita and Her Daughter Laura

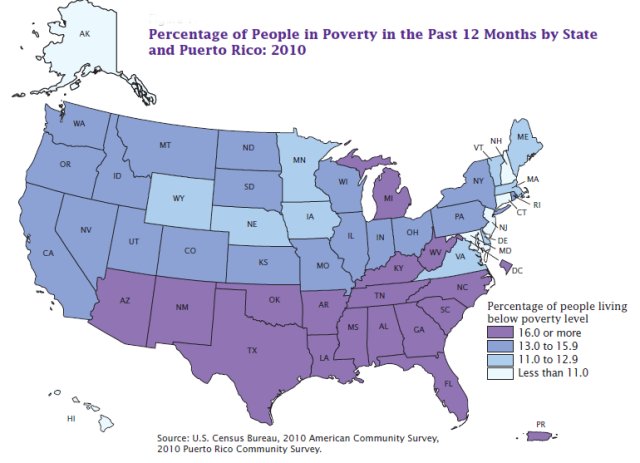

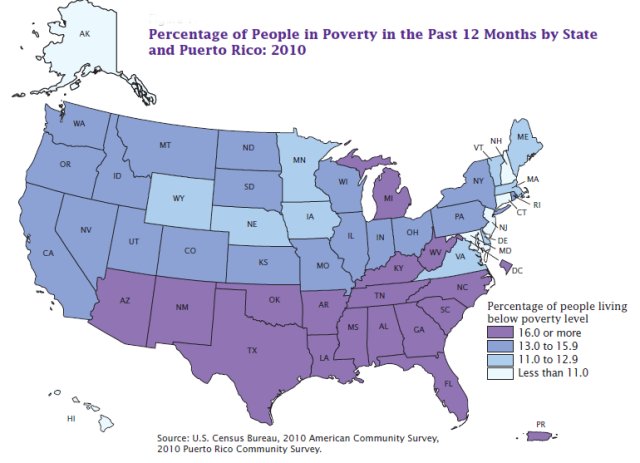

Nationally, the poverty rate increased from 14.3 percent in

the 2009 to 15.3 percent in the 2010

http://www.census.gov/prod/2011pubs/acsbr10-01.pdf

How Poverty is Calculated

http://www.census.gov/hhes/www/poverty/methods/definitions.html

Now we come to the second San Antonio family that games the income tax system. Col. X and

his wife pay about $400 per week for two part-time maids --- a mother and

daughter team. Juanita is not a U.S. citizen although she's lived in San Antonio

for over 40 years. Her daughter Laura is a U.S. citizen and single parent with

five children, welfare, food stamps, and free Medicaid family medical care.

Juanita and Laura also work for several of our other friends. As best I can

tell, they're earning over $50,000 in cash per year that's never been reported

to the government. When combined with welfare, food stamps, and Medicaid

services and drugs, their income is probably equivalent to a family earning over

$100,000 in reported income. And yet Juanita and Laura are considered too "poor" to

even file income tax returns.

We're told that about half the taxpayers-gamers in the United States pay no

income taxes when they file their returns. In addition tens of millions of other

gamers are too "poor" to even file income tax returns.

Yet many of them are cash gaming

the system with tax free unreported cash. This includes the following:

- Day laborers,

- Ghost writers

- Elderly home care companions

- Child care providers

- Chop shop stolen car mechanics

- Engine Mechanics

- Transmission mechanics

- Body repair specialists

- Taxi drivers

- Housekeeping maids

- Drug dealers

- Prostitutes

- Student tutors

- Roofers

- Bricklayers

- Electricians

- Painters

- Fence builders

- Ranch hands

- Crop pickers

- And on and on and on.

Note there are various instances when poor people who do not have to file an

income tax return are advised to do so by the IRS ---

http://www.irs.gov/newsroom/article/0,,id=105097,00.html

"2 in 5 Young Americans Don’t Have Jobs and Aren’t Looking,"

Time Magazine, November 14, 2014 ---

http://time.com/3585786/young-americans-work/?xid=newsletter-brief

93% of Americans

who aren't looking for work say they don't want a job

Nearly 40% of people in the United States ages 16

to 24 don’t have a job, and are fine with it. They say they’re happy not to

be employed and don’t plan to find a job anytime soon, according to a Pew

Research Center

analysis of Bureau of Labor Statistics data.

The figures do not include young people who aren’t

working, but are actively seeking employment. About 10% of Americans aged 20

to 24 and 19% of those aged 16 to 19 are considered

unemployed, which means they are actively seeking

work.

However, most Americans who are of working age and

don’t have jobs are not actively seeking employment. Overall, 93% of the 86

million Americans 16 and older who aren’t looking for work say they don’t

want a job. The total figure is up from a decade ago, and the change is most

stark for young people. Around 30% of young Americans of working age in 2000

said they weren’t looking for work, compared to nearly 40% today. People

over 55 are much more likely not to look for work, the data shows.

Individuals who aren’t looking for work do not

count as unemployed for statistical purposes. The U.S. unemployment hit 5.8%

last month, the

lowest number since 2008

Jensen Comment

I guess they either live on welfare or somebody who loves them to a point where

they don't have to contribute to their own room and board. Most of the time it's

probably parents for the young people who are not yet parents themselves and

qualify for welfare.

To be honest, I don't really trust these statistics due to the

$2+ trillion underground economy. The nerd who fixes computers for cash probably

does not report the income to the IRS and is not truly "unemployed." The same

goes for many of the people who clean houses, work on construction, farms, and

ranches for cash, load and unload furniture trucks for cash, tutor in math and

music for cash, etc. Sadly, tens of thousands are also drug pushers,

prostitutes, stealing cars, or otherwise starting life as career criminals.

"Senate report finds (massive) disability benefits fraud," by Erik

Wasson, The Hill, October 7, 2013 ---

http://thehill.com/blogs/on-the-money/budget/326985-senate-report-finds-disability-benefits-fraud

A Senate committee on Monday wrapped up a two-year

investigation into the nearly insolvent Social Security Disability Insurance

program and alleged weak systemic oversight allowed massive fraud to

perpetrated by a Kentucky lawyer.

The investigation, spearheaded by Sen. Tom Coburn

(R-Okla.), found evidence that lawyer Eric Conn collaborated with

Administrative Law Judge David B. Daugherty, to wrongly award potentially

billions in benefits.

The revelations of fraud and inability of

bureaucrats to address weak oversight comes as the disability fund is set to

run out of money to pay full benefits by 2016. It also comes as the federal

government is partially shutdown and because of that officials from the

Social Security Administration were not available to testify before the

Senate on Monday about the fraud allegations.

“A two-year investigation of his actions representing

claimants applying for Social Security Disability Insurance (“SSDI”) and

Supplemental Security Income (“SSI”) benefits uncovered a raft of improper

practices by the Conn law firm to obtain disability benefits, inappropriate

collusion between Mr. Conn and a Social Security Administrative Law Judge,

and inept agency oversight which enabled the misconduct to continue for

years,” the report concludes.

Coburn said that the fraud was hurting the truly

disabled and the report lists a series of steps the government can take to

prevent fraud.

“Every bogus claim made on behalf of someone who is

not truly disabled robs taxpayers and denies or delays benefits for someone

who is truly disabled. This is an enormous and urgent problem that should

demand our immediate attention,” Coburn said in a release.

The report found that Daugherty, who was sanctioned

and allowed to retire, had awarded an unusually large $2.5 billion in

benefits and had received unexplained cash payments. The judge had provided

the Conn law firm with assistance through lists in obtaining medical

opinions for Conn clients.

The investigation found questionable benefit awards

by Daugherty based on evidence by doctors who had suspect medical

credentials, and determined that Conn had destroyed a massive amount of

evidence once he came under congressional investigation.

The Democratic chairman of the panel said the

investigation was troubling.

“While we don't have any evidence that this is more

than an isolated case, one example of inappropriate actions of this nature

is one too many,” Sen. Tom Carper (D-Del.) said. “ I am encouraged that the

Social Security Administration has already acknowledged many of the issues

raised by the investigation, and I understand that it has begun to implement

stronger reviews and other solutions.”

Bob Jensen's threads on entitlements disasters ---

http://www.trinity.edu/rjensen/Entitlements.htm

U.S. Census Report: Only a small percentage of

impoverished adults actually say it's because they can't find employment.

"Why The Poor Don't Work, According To The Poor," by Jordan Weissmann,

The Atlantic, September 23, 2013 ---

http://www.theatlantic.com/business/archive/2013/09/why-the-poor-dont-work-according-to-the-poor/279900/

Conservative Republicans have officially made it

their mission to end food stamps as we know them. Such was evident last

week, when the House GOP

voted to cut the Supplemental Nutrition Assistance

Program, as food stamps are now known, by $39 billion over a decade and

begin bulking up its work requirements,

along the lines of welfare reform in the 1990s.

Whether you believe this a good or humane idea

probably boils down to your take on a single question: why don't the poor,

who make up the overwhelming majority of food stamp recipients

(nearly 50 million of them), go to work? In 2012, more

than 26 million 18-to-64-year-old adults lived under the poverty line; about

15 million of them didn't have a job during the year. Is the economy to

blame? Or are personal choices at fault?

If you're a liberal, your answer is probably pretty

cut and dry, and these days likely involves the word

"recession." But conservatives tend to take a different view. They

argue that whereas unemployment among middle class families rises and falls

with the health of the job market, poverty is shaped and fueled mostly by

cultural forces, that the poor could work if they wanted, and that the

safety net lulls them into indolence. One of their key data points on this

front comes from the Census. Each year, the

bureau asks jobless Americans why it is they've

been out of work. And traditionally, a only a small percentage of

impoverished adults actually say it's because they can't find employment,

a point that New York University professor Lawrence Mead, one of the

intellectual architects of welfare reform, made to Congress in

recent testimony.

In 2007, for instance, 6.4 percent of adults who

lived under the poverty line and didn't work in the past year said it was

because they couldn't find a job. As of 2012, it had more than doubled,

leaving it at a still-small 13.5 percent. By comparison, more than a quarter

said they stayed home for family reasons and more than 30 percent cited a

disability.

Continued in article

Jensen Comment

What the article overlooks is that millions of people who are described as "not

working" really are working in the underground economy where cash wages are tax

free to maids, farm workers, construction workers, care providers, pool

cleaners, roofers, etc.

It's also hard to determine underground compensation relative to the minimum

wage because so many such workers contract by the job rather than by the hour

for housekeeping, lawn services, etc. For example, my lawn worker in New

Hampshire (one person only) that charges me $100 per job has expenses for

equipment, fuel, travel, etc. but usually does the job in less than 2.5 hours.

I do that part myself with my tractor and hand mower. In the winter he has a

very profitable ski and sportswear shop.

He only does the front part of my lawn but is

not interested in the back lawn where the ground is not a smooth

Up here the "cash only" housekeepers generally get

paid by the job that nets out to over $35 per hour. One woman wanted over $50

per hour.

USA Today also attributes much of the

economic recovery to the $2-trillion underground economy.

Unemployment is not what it seems.

Pretending to be a shoeless and homeless bum is good business

"Bum given boots by kind-hearted cop is back to begging barefoot Panhandler

has '30 pairs of shoes'," by M.L. Nestel, Kevin Fasick, and Bob Fredericks,

The New York Post, March 26, 2016 ---

http://www.nypost.com/p/news/local/manhattan/kind_cop_bum_goes_from_gift_to_grift_93SD0wxjPPCxm7lzZ8vlwM

Jensen Comment

Reminds me of the time I followed a fashionably-dressed beautiful woman with two

small children through a payment line at a supermarket in San Antonio. She paid

for her groceries with food stamps and then a man helped her load the stash into

a shiny new Cadillac Escadade (starting around at over $60,000). I overheard her

children him "Daddy." My guess is that she had more than 50 pairs of shoes

stored at his magnificent house.

Why do any parents want to get married? The food stamp game can be played

better without getting married.

The New Yorker:

From maids to roofers to drug dealers the underground economy resulted in an

estimated $2 Trillion (with a T) of underreported taxable income in 2012

Unemployment and Welfare Fraud

"The Underground Recovery," by James Surowiecki," The New Yorker,

April 29, 2013 ---

http://www.newyorker.com/talk/financial/2013/04/29/130429ta_talk_surowiecki

When we all finished filing our tax returns last

week, there was a little something missing: two trillion dollars. That’s how

much money Americans may have made in the past year that didn’t get reported

to the I.R.S., according to a recent study by the economist Edgar Feige,

who’s been investigating the so-called underground, or gray, economy for

thirty-five years. It’s a huge number: if the government managed to collect

taxes on all that income, the deficit would be trivial. This unreported

income is being earned, for the most part, not by drug dealers or Mob bosses

but by tens of millions of people with run-of-the-mill jobs—nannies,

barbers, Web-site designers, and construction workers—who are getting paid

off the books. Ordinary Americans have gone underground, and, as the

recovery continues to limp along, they seem to be doing it more and more.

Measuring an unreported economy is obviously

tricky. But look closely and you can see the traces of a booming informal

economy everywhere. As Feige said to me, “The best footprint left in the

sand by this economy that doesn’t want to be observed is the use of cash.”

His studies show that, while economists talk about the advent of a cashless

society, Americans still hold an enormous amount of cold, hard cash—as much

as seven hundred and fifty billion dollars. The percentage of Americans who

don’t use banks is surprisingly high, and on the rise. Off-the-books

activity also helps explain a mystery about the current economy: even though

the percentage of Americans officially working has dropped dramatically, and

even though household income is still well below what it was in 2007,

personal consumption is higher than it was before the recession, and retail

sales have been growing briskly (despite a dip in March). Bernard Baumohl,

an economist at the Economic Outlook Group, estimates that, based on

historical patterns, current retail sales are actually what you’d expect if

the unemployment rate were around five or six per cent, rather than the 7.6

per cent we’re stuck with. The difference, he argues, probably reflects

workers migrating into the shadow economy. “It’s typical that during

recessions people work on the side while collecting unemployment,” Baumohl

told me. “But the severity of the recession and the profound weakness of

this recovery may mean that a lot more people have entered the underground

economy, and have had to stay there longer.”

The increasing importance of the gray economy isn’t

only a reaction to the downturn: studies suggest that the sector has been

growing steadily over the years. In 1992, the I.R.S. estimated that the

government was losing $80 billion a year in income-tax revenue. Its estimate

for 2006 was $385 billion—almost five times as much (and still an

underestimate, according to Feige’s numbers). The U.S. is certainly a long

way from, say, Greece, where tax evasion is a national sport and the shadow

economy accounts for twenty-seven per cent of G.D.P. But the forces pushing

people to work off the books are powerful. Feige points to the growing

distrust of government as one important factor. The desire to avoid

licensing regulations, which force people to jump through elaborate hoops

just to get a job, is another. Most important, perhaps, are changes in the

way we work. As Baumohl put it, “For businesses, the calculus of hiring has

fundamentally changed.” Companies have got used to bringing people on as

needed and then dropping them when the job is over, and they save on

benefits and payroll taxes by treating even full-time employees as

independent contractors. Casual employment often becomes under-the-table

work; the arrangement has become a way of life in the construction industry.

In a recent California survey of three hundred thousand contractors,

two-thirds said they had no direct employees, meaning that they did not need

to pay workers’-compensation insurance or payroll taxes. In other words, for

lots of people off-the-books work is the only job available.

Sudhir Venkatesh, a sociologist at Columbia and the

author of a study of the underground economy, thinks that many workers,

particularly younger ones, have become comfortable with casual work

arrangements. “We have seen the rise of a new generation of people who are

much more used to doing things in a freelance way,” he said. “That makes

them more amenable to unregulated work. And they seem less concerned about

security, which they equate with rigidity.” The growing importance of

services in the economy is also crucial. Tutors, nannies, yoga teachers,

housecleaners, and the like are often paid in cash, which is hard for the

I.R.S. to track. In a 2006 study, the economist Catherine Haskins found that

between eighty and ninety-seven per cent of nannies were paid under the

table.

Continued in article

Labor Hoarding ---

http://en.wikipedia.org/wiki/Underemployment

"Housing has been booming! Construction jobs haven’t. Here’s why," by

Neil Irwin, The Washington Post, March 19, 2013 ---

http://www.washingtonpost.com/blogs/wonkblog/wp/2013/03/19/housing-has-been-booming-construction-jobs-havent-heres-why/

. . .

Key to understanding the sluggish growth in

construction jobs is a concept called “labor hoarding.” That’s what happens

during a recession when companies don’t fire as many workers as the decline

in business would seem to have justified. Firms don’t want to lose all their

quality workers and then be unable to keep up with demand when business

finally turns around, so they keep people on staff even when there is not

enough work to keep them fully busy.

This seems to have happened on a large scale in

construction in the last few years. Kris Dawsey and Hui Shan at Goldman’s

economics research group calculated that the economic value added per

construction worker fell from $80,000 in 2006 to under $60,000 at the end of

2012. That is labor hoarding in a nutshell.

But because construction companies never fired as

many workers as the collapse in their business would have justified, that

means that over the last year, they haven’t needed to hire additional

workers to keep up with the uptick in business.

Continued in article

Jensen Comment

I think an even bigger reason that a housing boom is disappointing for reducing

unemployment is the way housing contractors outsource much of the construction

work to skilled tradesmen who are self-employed and not included in the

employment-unemployment data generated by the government ---

http://www.cs.trinity.edu/~rjensen/temp/TaxNoTax.htm

For example, such things as basement construction, plumbing, electrical

wiring, bricklaying, siding, roofing, landscaping, swimming pool installation,

etc. are outsourced mainly for reasons of not having to pay benefits to

employees and unemployment insurance. The self-employed subcontractors often

hire unskilled and unreported helpers in the underground market where no